Passive Vs Nonpassive Income Irs

Tax deductions for passive vs nonpassive income passive and nonpassive income irs internal revenue service definition is based on how the income received is taxed.

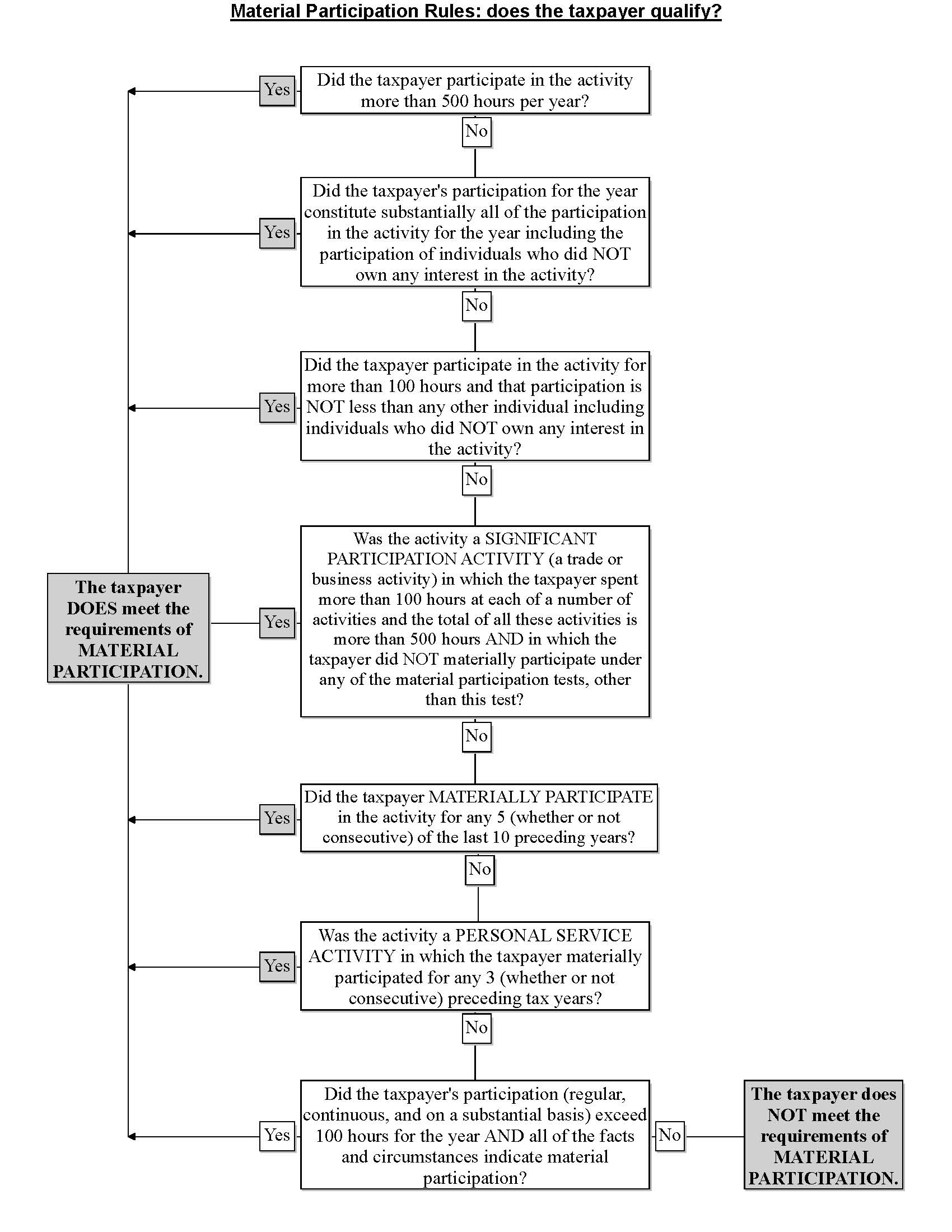

Passive vs nonpassive income irs. The us revenue department in fact has incorporated several tests to identify whether a source of income is passive or nonpassive. Trade or business activities in which the shareholder materially participated for the tax year. Passive vs nonpassive income have a direct correlation to the amount of tax that you pay. Many people are unaware of the tax implications as well as the potential benefits of this alternative.

For tax purposes it is important to note that passive income losses cannot be compared or filed under regular income losses. The taxpayer can be able to get all his tax details on the 26as income tax form. The rate of tax that you pay is often dependent on whether you have passive vs nonpassive income. Passive income generating has gained much popularity in recent times and many individuals use the concept to make an extra income.

Any rental real estate activity in which the shareholder materially participated if the partner met both of the following conditions for the tax year. If you have gross income from an equity financed lending activity the lesser of the net passive income or the equity financed interest income is nonpassive income. Nonpassive income or loss. Passive income losses must be kept separate from other income to ensure the tax amounts are filed correctly with the irs.

You can really take advantage of passive income by being fully aware of your tax liabilities. For the most part when it comes to passive income tax it is usually deducted on passive income. Passive income can be taxed up to 15 which is considerably a lower rate compared to non passive income. Nonpassive income and losses are any income or losses that cannot be classified as passive.

Non passive income and the tax. Included in nonpassive income is any active income such as wages business income or investment income. Activities that are not passive. Hardy s income from mbj as passive and if so whether they could deduct a passive activity loss carryover from previous years.

The tax court had to decide whether the hardys properly reported dr.

/GettyImages-951640954-158bffdec37041f5b772279def9c6d83.jpg)