Property Valuation Income Approach Formula

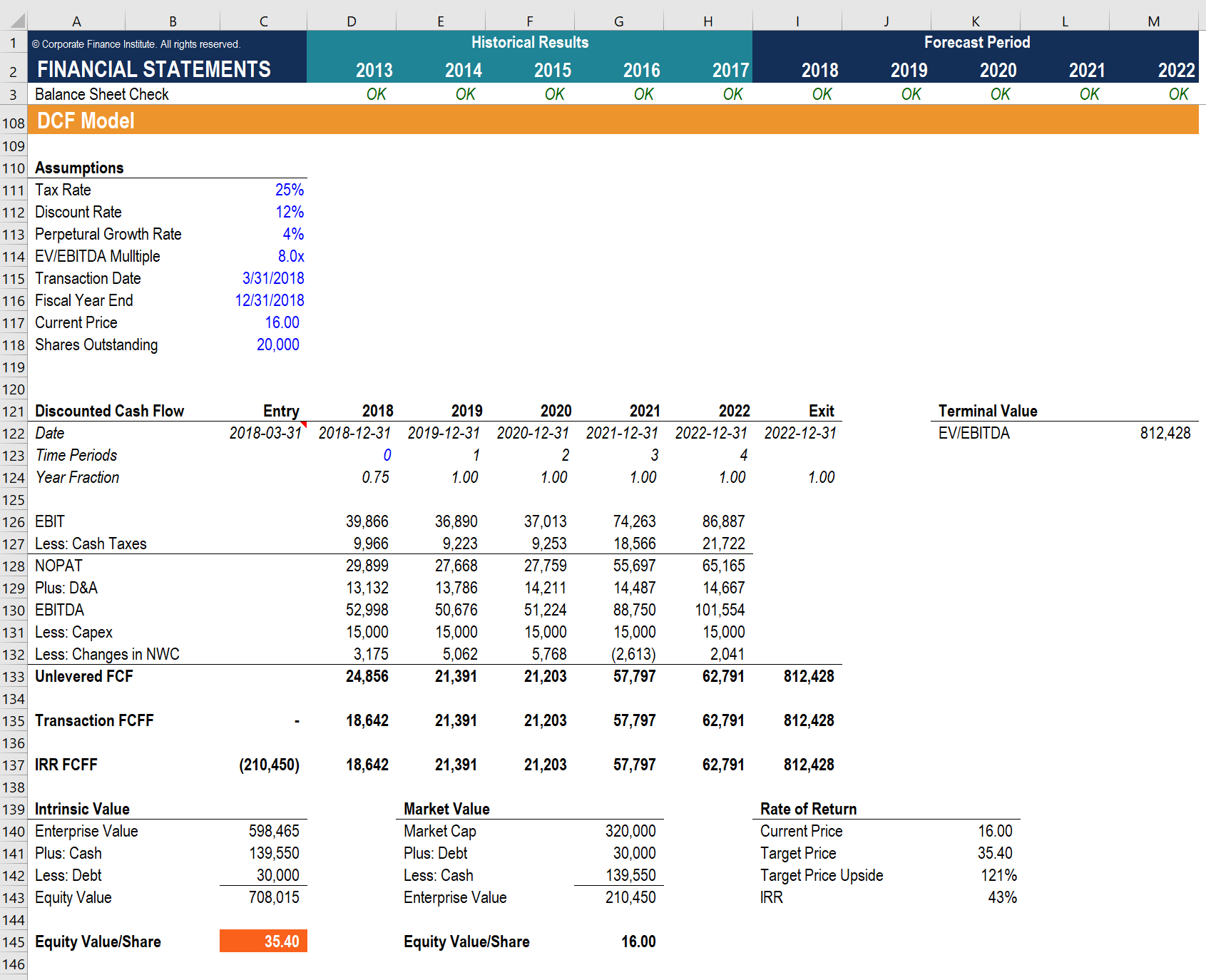

With the income approach a property s value today is the present value of the future cash flows the owner can expect to.

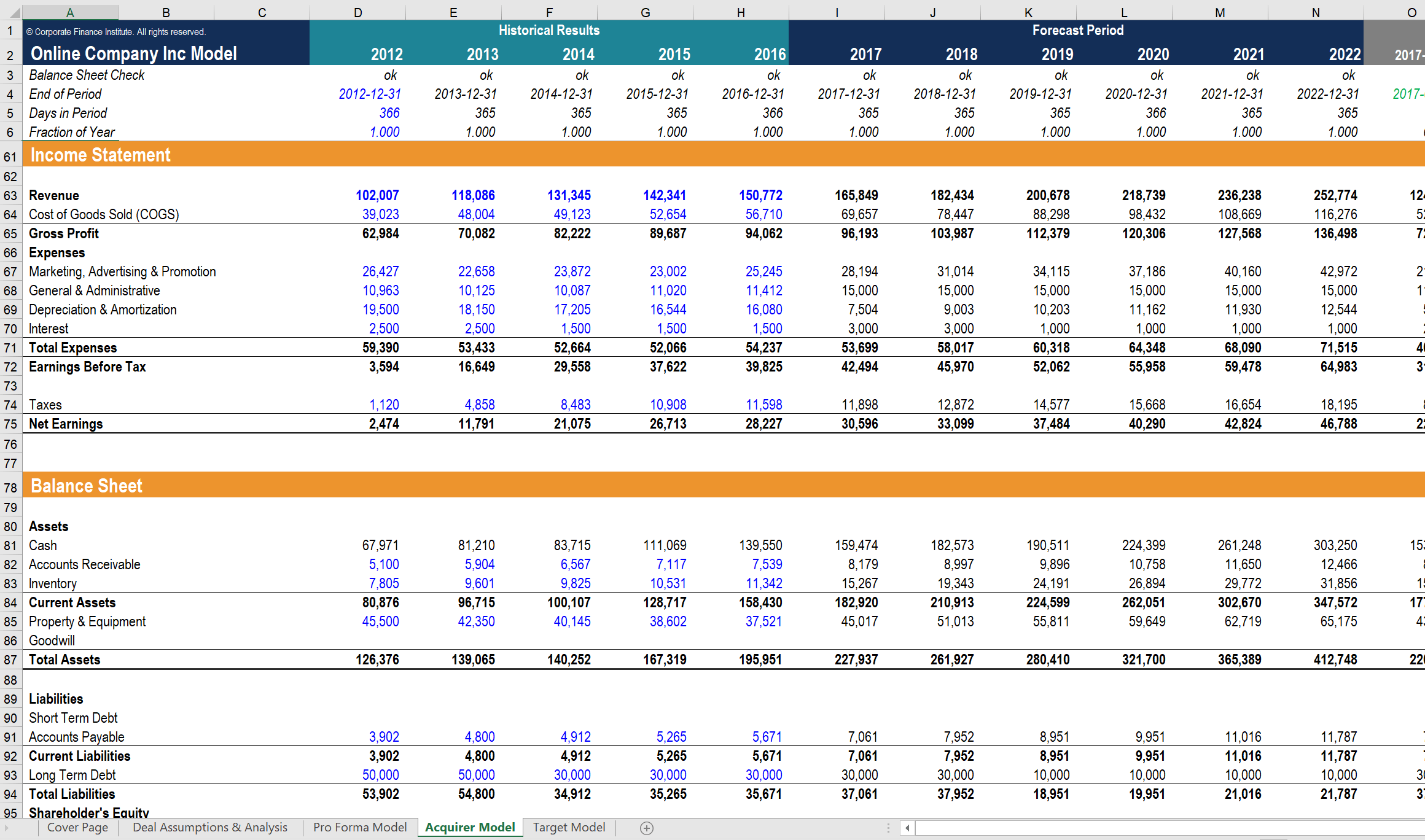

Property valuation income approach formula. In applying this approach two different techniques can be used. This tool is a very flexible and basic excel model that allows you to perform a valuation of a real estate property. The income capitalization approach is one of the three major property valuation methodologies. The net income generated by the property is measured in conjunction with certain other factors to calculate its value on the current market if it were to be sold.

The multiples derived from comparable transactions are then multiplied with the same feature of the property to arrive at a value estimate i e. 1 the direct income capitalization technique which is quite simpler and 2 the more sophisticated technique that involves the use of the discounted cash flow model. Value per square feet must be multiplied by the property s area in square feet to find value. The above equation is based on the formula for present value of a perpetuity.

Note in this formula the reversal of the irv formula for finding value. Estimates of value via the income approach are highly sensitive to changes in revenue expense and capitalization rates. The formula you use is. The income capitalization approach is primarily used for the.

A initial period of say 5 years for which net cash flows and growth rate for each year can be determined and b period after the initial period for which year by year projection is unreliable. To calculate the noi start by annualizing the property s rental income and subtracting a vacancy. The income approach only works if you have an accurate net operating income for the property. The income approach to property valuation is a useful tool for investors to evaluate income producing real estate.

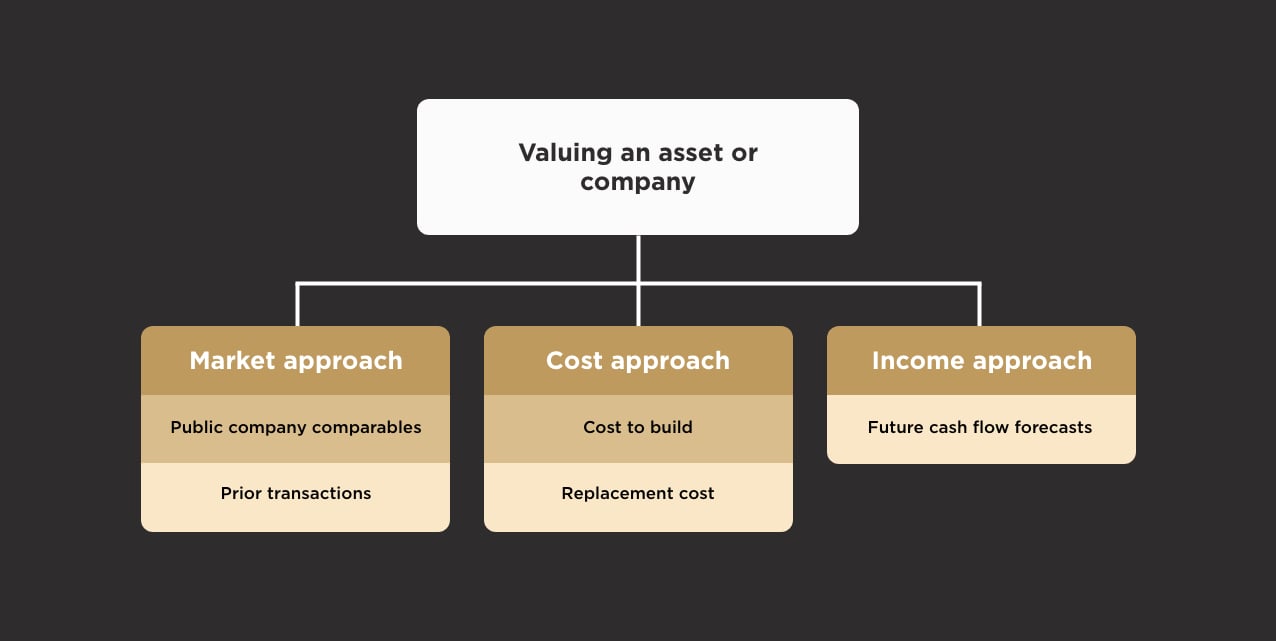

The income approach is an absolute valuation method. The model includes a cost approach and an income approach. The income approach is often given primary emphasis when appraising a commercial real estate used to generate income. We will discuss the three major formulas that comprise the approach.

When a property s intended use is to generate income from rents or leases the income method of appraisal or valuation is most commonly used. A building sells for 200 000. The income approach is a methodology used by appraisers that estimates the market value of a property based on the income of the property. Income approach commercial real estate appraisal.

Another approach called multi stage growth model divides future into two or more stages.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)