Real Estate Passive Income Tax Rate 2018

Passive losses in excess of passive income are suspended until you 1 have sufficient passive income or gains or 2 sell the property or properties that produced the losses.

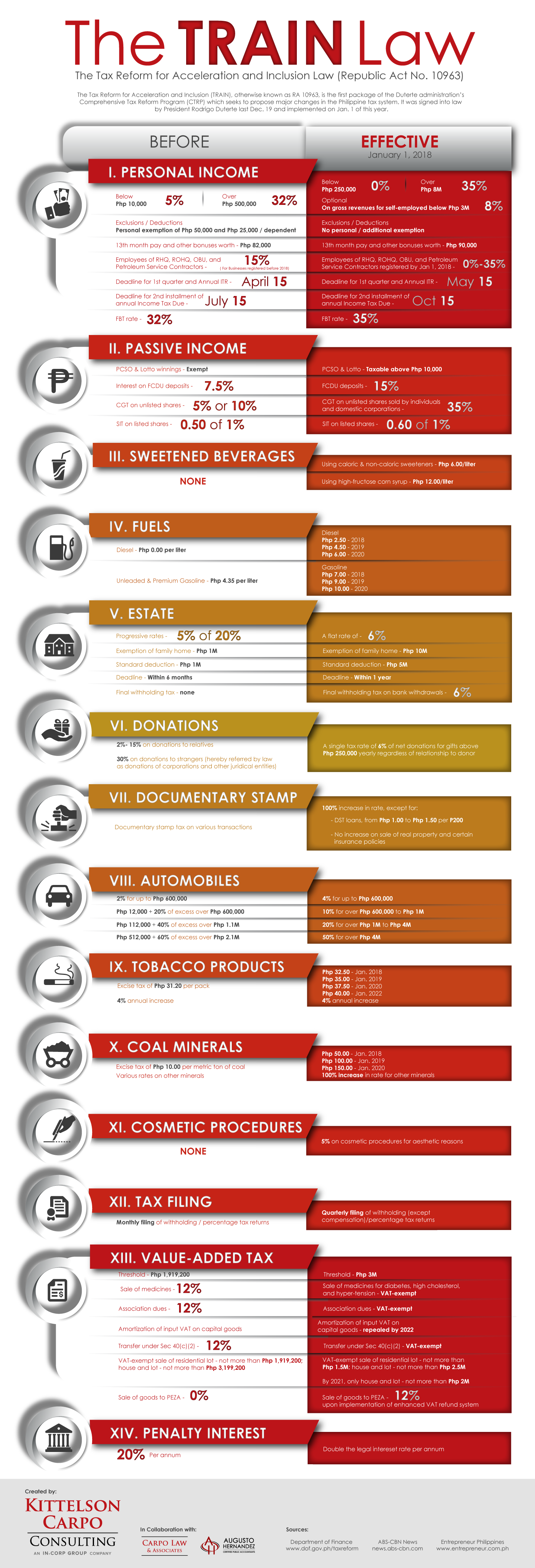

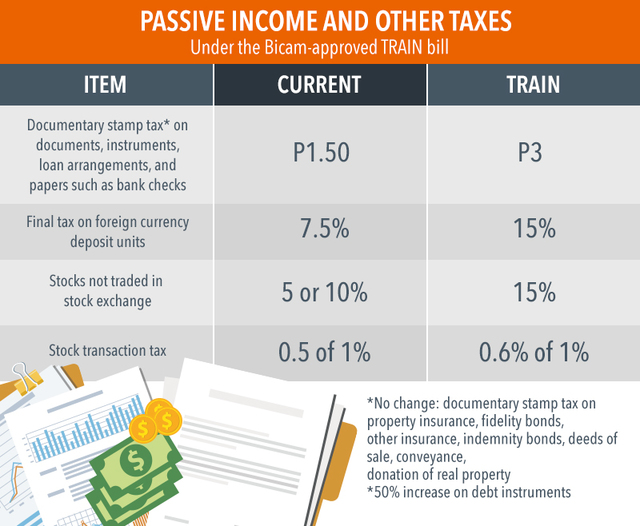

Real estate passive income tax rate 2018. Interests from any currency bank deposit and yield or any other monetary benefit from deposit substitutes and from trust funds and similar arrangements. For tax years beginning in 2018 through 2025 you can t deduct. Passive income tax rate for 2018 for the 2018 tax year the tax brackets have changed for ordinary income. Interest income received by an individual taxpayer except a non resident individual from a depositary bank under the expanded foreign currency deposit system.

Using real estate as a tax. Passive income interest taxable capital gains and certain rents as examples earned by a ccpc is subject to a high corporate income tax rate of approximately 50 a portion of which is accumulated in a notional account called the refundable dividend tax on hand rdtoh. Investors turn to real estate as a way to build long term wealth earn additional income and generate a tax shelter. In other words short term capital gains are taxed at the same rate as your income tax.

Everyone knows how profitable the right passive income property in the ideal location can be but the same properties often coincide with more impressive tax benefits and deductions. Nonetheless it s still a viable form of passive income. Passive income tax rate. Passive income tax benefits for real estate investors.

Under the previous tax regime passive investment income earned by a ccpc was subject to tax at approximately the top personal marginal tax rate. Like reit dividend income income from real estate etfs is taxed as portfolio income using the capital gain tax rate. Passive income broadly refers to money you don t earn from actively engaging in a trade or business. 10 12 22 24 32 35 and 37.

As mentioned previously short term gains apply to assets held for a year or less and are taxed as ordinary income. The current tax rates for short term gains are as follows. This means that any passive income you earn that is taxed as ordinary income like short term capital gains ordinary dividends and interest income will be taxed anywhere from 10 to 37 percent depending on the amount of income. Short term passive income tax rates.

However far too many investors overlook the deductions they can make when it comes time to file their taxes. Refundability of taxes on investment income. To complicate matters further the tcja establishes another hurdle for you to pass beyond the pal rules.