Rental Income Passive Loss Rules

For taxation purposes the irs looks at your annual income in terms of net gain or loss.

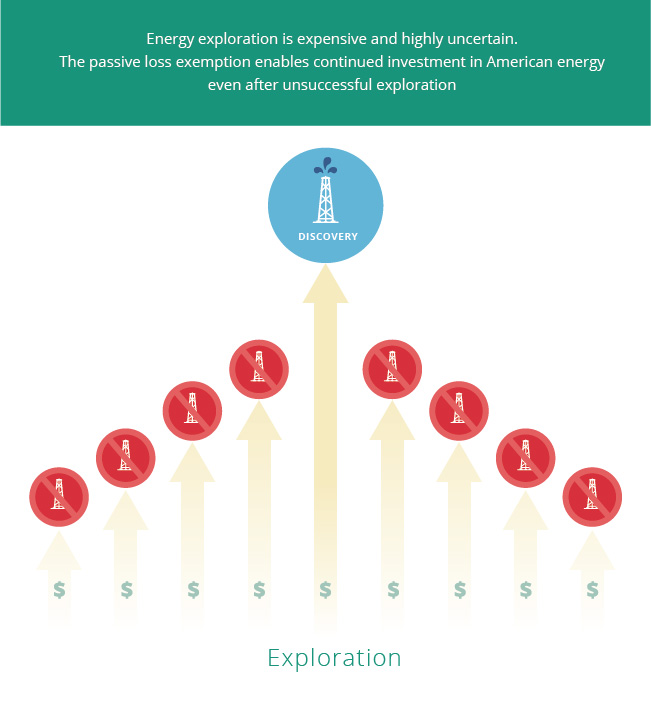

Rental income passive loss rules. The passive activity loss rules are perhaps the largest limiting factor when it comes to deducting rental income losses and they apply to non active rental property investors. In short your rental losses will be useless without offsetting passive income. In general if a taxpayer s aggregate losses from passive activities exceed the taxpayer s aggregate income from passive activities for the taxable year the excess losses may not be deducted against other income for that taxable year. As a result of this combination of income and losses the beechers paid no tax on the rental income paid to them by their corporations this amounted to over 85 000 of tax free income over three years.

The passive activity loss rules. As discussed in my blog post passive loss limitations in rental real estate the irs code generally prohibits taxpayers from deducting passive activity losses against other income including salaries interest dividends and income from nonpassive activities. They would use this lease income ordinarily passive income to offset the losses from their rentals. Exceptions to passive loss rules.

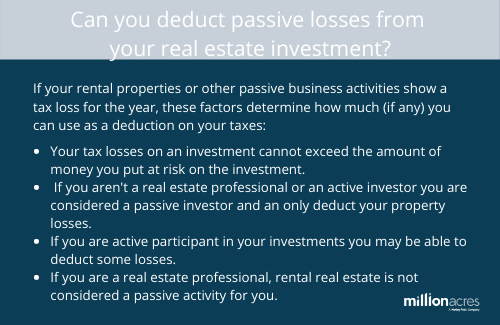

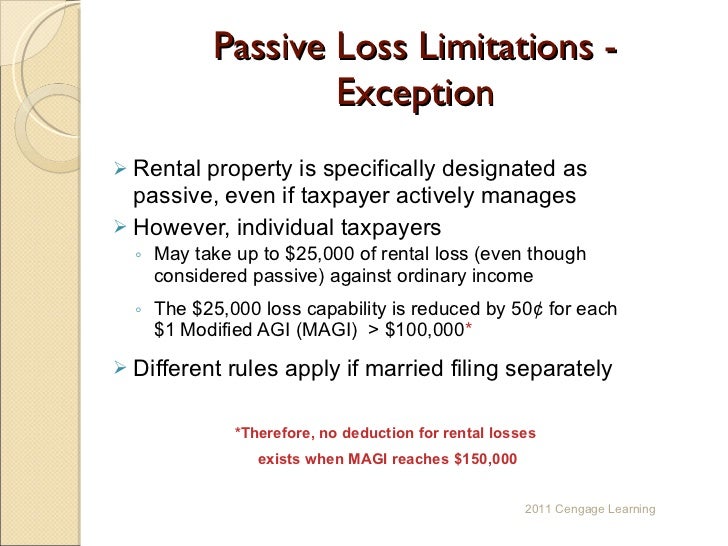

If you aren t a. This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out. Generally a passive activity loss can only be used. If your real estate rental income generates a net loss.

Passive income is generated from property rentals and investments in which you do not participate in the ongoing activities of the business. You or your spouse qualify as a real estate professional or. Passive activity loss rules. There are only two exceptions to the passive loss pal rules.

Using suspended passive losses. Your income is small enough that you can use the 25 000 annual rental loss allowance. However since rental real estate income is considered to be passive in nature there are special rules called the passive activity loss rules that can limit the amount of rental real estate or. Any rental real estate loss allowed because you materially participated in the rental activity as a real estate professional as discussed later under activities that aren t passive activities.

Passive activity loss rules are generally applied at the individual level but they also extend to virtually all businesses and rental activity in various reporting entities except c corporations.