Us Federal Income Tax Brackets 2020

These are the rates for taxes due.

Us federal income tax brackets 2020. The income brackets though are adjusted slightly for inflation. Income tax tables and other tax information is sourced from the federal internal revenue service. In tax year 2020 for example a single person with taxable income up to 9 875 paid 10 percent while in 2021 that income bracket rises to 9 950. This page has the latest federal brackets and tax rates plus a federal income tax calculator.

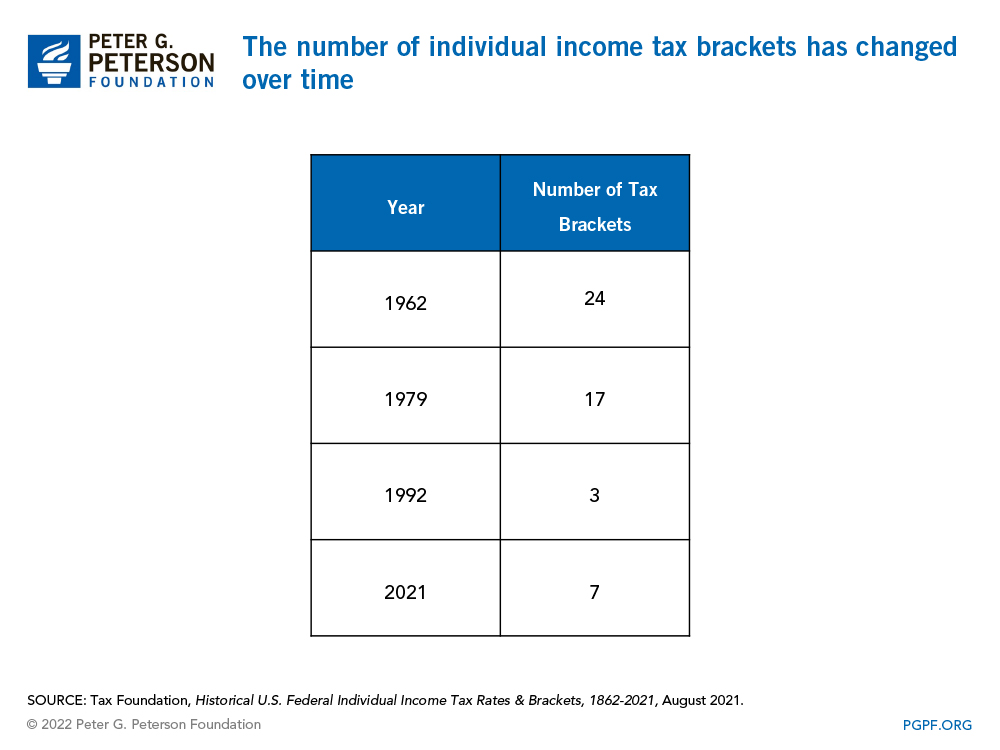

Read on for more about the federal income tax brackets for tax year 2019 due july 15 2020 and tax year 2020 due april 15 2021. 10 12 22 24 32 35 and 37. Your bracket depends on your taxable income and filing status. The new 2018 tax brackets are 10 12 22 24 32 35 and 37.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518 400 and higher for single filers and 622 050 and higher for married couples filing jointly. 2020 individual income tax brackets. There are seven federal tax brackets for the 2020 tax year. 2020 federal income tax brackets and rates in 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1.

The brackets above show the tax rates for 2020 and 2021. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518 400 and higher for single filers and 622 050 and higher for married couples. Use our salary tax calculator to get a full breakdown of your federal and state tax burden given your annual income and. The federal tax brackets are broken down into seven 7 taxable income groups based on your filing status.

Federal 2020 income tax ranges from 10 to 37. The tax rates for 2020 are. 10 12 22 24 32 35 and 37. For tax year 2020 the top tax rate remains 37 for individual single taxpayers with incomes greater than 518 400 622 050 for married couples filing jointly.

The brackets are adjusted each year for inflation. Income tax brackets and rates in 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. The current tax rates 2017 consist of 10 15 25 28 33 35 and 39 6. There are basically two ways to get into a lower.

It s important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the. 10 12 22 24 32 35 and 37. Similarly other brackets for income earned in 2021 have been adjusted upward as well. As of 2016 there are a total of seven tax brackets.

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)