Business Valuation Income Approach Formula

Eq 6 5 eq 6 6 or eq 6 7 where cf cash flow k discount rate n time periods time 1 to t.

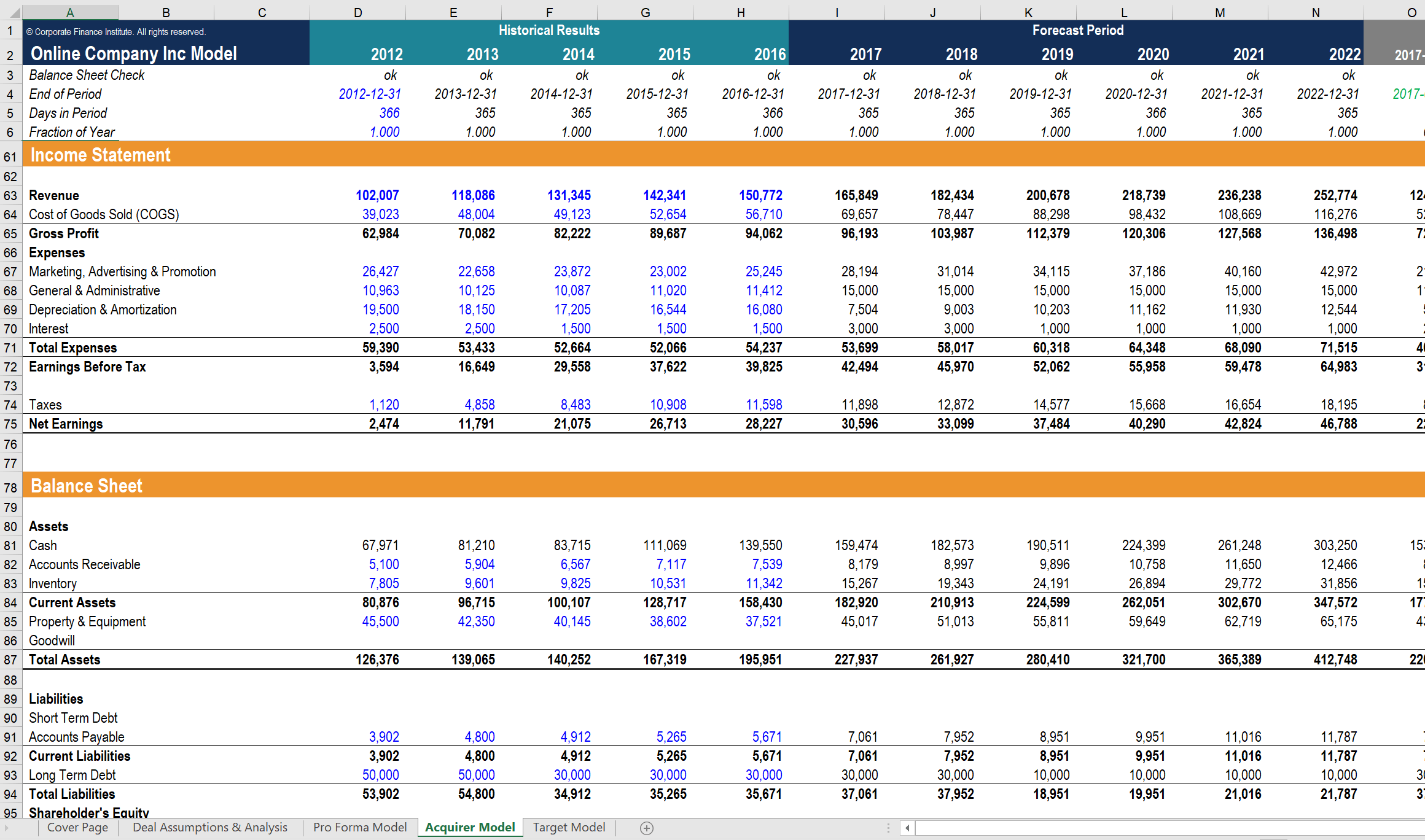

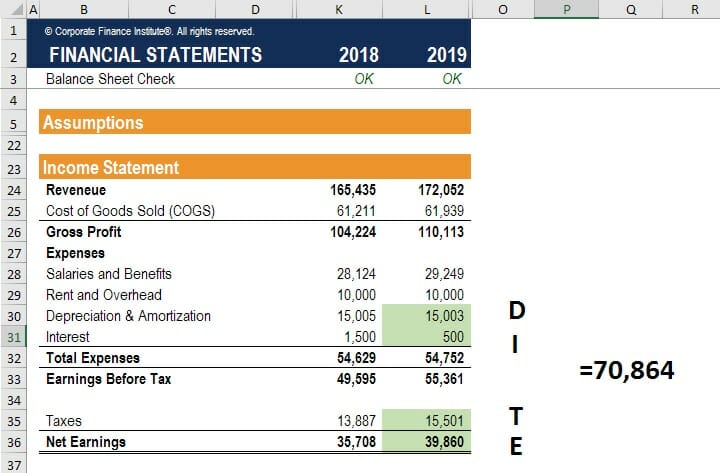

Business valuation income approach formula. The discounted cash flow dcf method is an income oriented approach. Two of the most common business valuation formulas begin with either annual sales or annual profits also known as seller discretionary earnings multiplied by an industry multiple. This is an income valuation approach that determines the value of a business by looking at the current cash flow the annual rate of return and the expected value of the business. The theory behind this method is that the total value of a business is the present value of its projected future earnings plus the present value of the terminal value in this process the expected cash flow of the business.

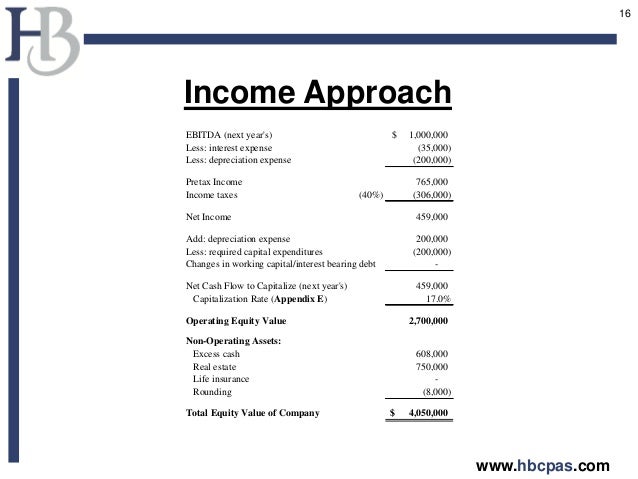

Formulas for putting a value on a business. To do so the expected income and risk must be translated to today. Income based valuation approaches depend on a number of criteria in valuing a firm such as a capitalization rate risk related discount factors and the projection of future cash flows. Discounted cash flow dcf method.

Discounted cash flow method formula the discounted cash flow dcf method is the second kind of income approach that many companies use for their business valuation. Louis presents a summary of valuation methods such as income approach and discounted cash flow dcf model. Opportunity cost if you have received 1000 today then you could have invested the money in something profitable and get a good return every year. There are two ways you can do this translation.

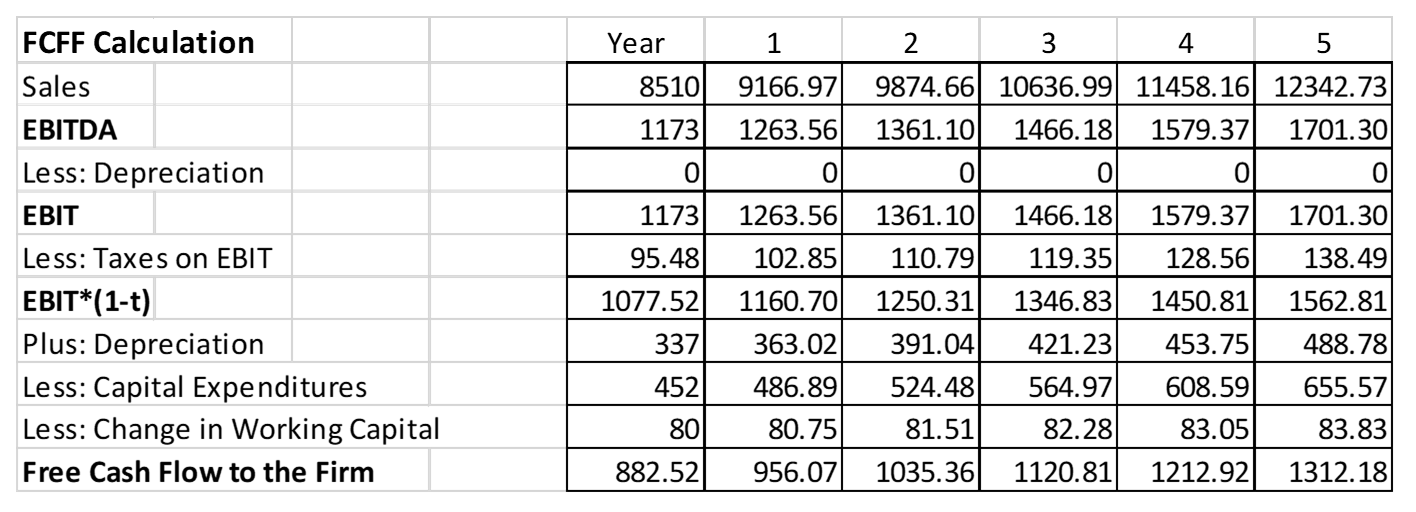

Future earnings cash flows are determined by projecting the business s earnings cash flows and adjusting them for changes in growth rate cost structure and taxes etc. Both methods are great starting points to accurately value your business. Looking at the asset value of a business can be complicated as the numbers on the balance sheet may not accurately reflect the actual value of things like building and equipment after depreciation or land value if the business is more than a few years old. Itsdiscounted cash flow basic formula can be seen in equation 6 5.

This present value figure is the basis for a sale price. Create a forecast of the expected cash flows of the business for at least the next five years and then derive the present value of those cash flows. In income approach of business valuation a business is valued at the present value of its future earnings or cash flows. The real power of the income valuation is that it lets you calculate business value in the present.

Business valuation income approach 103 a discounted cash flow is a multi year or period calculation of value.

.gif/_jcr_content/renditions/cq5dam.thumbnail.460.258.png)