Can Passive Income Offset Active Losses

Can passive losses offset active income.

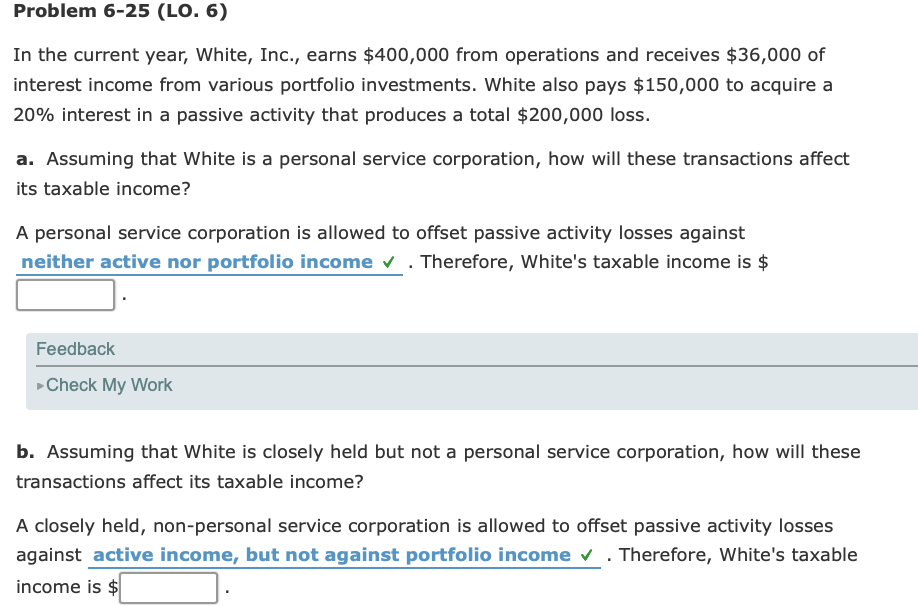

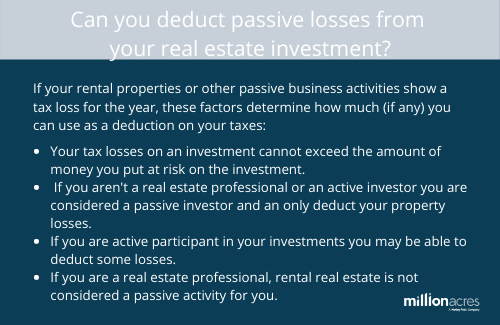

Can passive income offset active losses. To qualify your modified adjusted gross income must not exceed 100 000 for the year. She cannot use these active losses to offset the passive income. You can only use the loss to offset the passive business income. Losses from passive income cannot be used to offset gains from active income.

This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out. If you are an active participant in your rental properties and you have modified adjusted gross income magi of 100 000 or less you can deduct as much as 25 000 in rental real estate losses. The irs taxes active and passive incomes at different rates and under different rules. Unlike active business losses and.

Active incomes are wages tips commissions bonuses or business incomes. You can t use the additional 2 000 to reduce your other taxable income. In this scenario tina can offset the 3 000 passive income with the 2 500 passive loss. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less.

This leaves 500 of passive income that is taxable. So you can t use. The active losses can however be carried forward to offset future active. All you require is an excellent product to offer someone to pay you to sell it and also a location to put your ads.

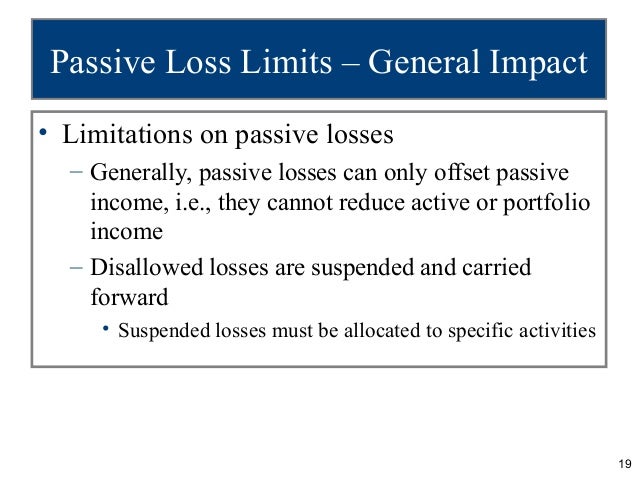

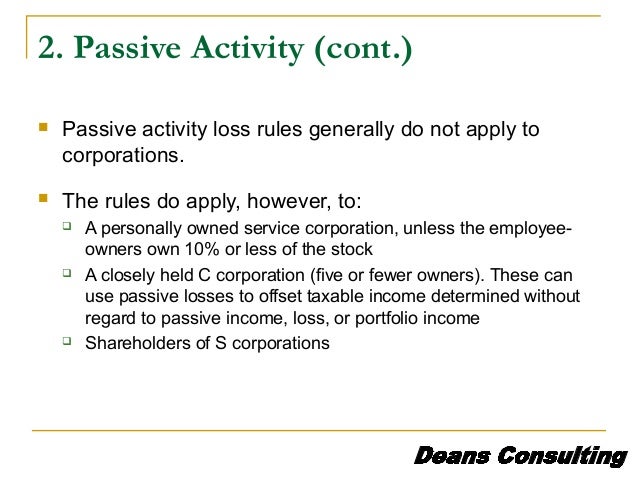

Passive activity loss rules are a set of irs rules stating that passive losses can be used only to offset passive income. You may not offset passive losses against nonpassive income. So if you have a passive loss from a passive activity and nonpassive income from a nonpassive activity such as a sole proprietorship that you own and run you would not be allowed to deduct a loss from the passive activity from a net profit of the sole proprietorship. If you are the owner or landlord of a rental property a special rental loss offset lets you apply up to 25 000 of passive activity losses against your normal income.

Even if you ve never considered being a marketer before you can discover the ad biz faster than possibly any other method of digital marketing that s out there.