Capitalization Of Income Approach Formula

As you can see this appraisal approach consists of two main variables.

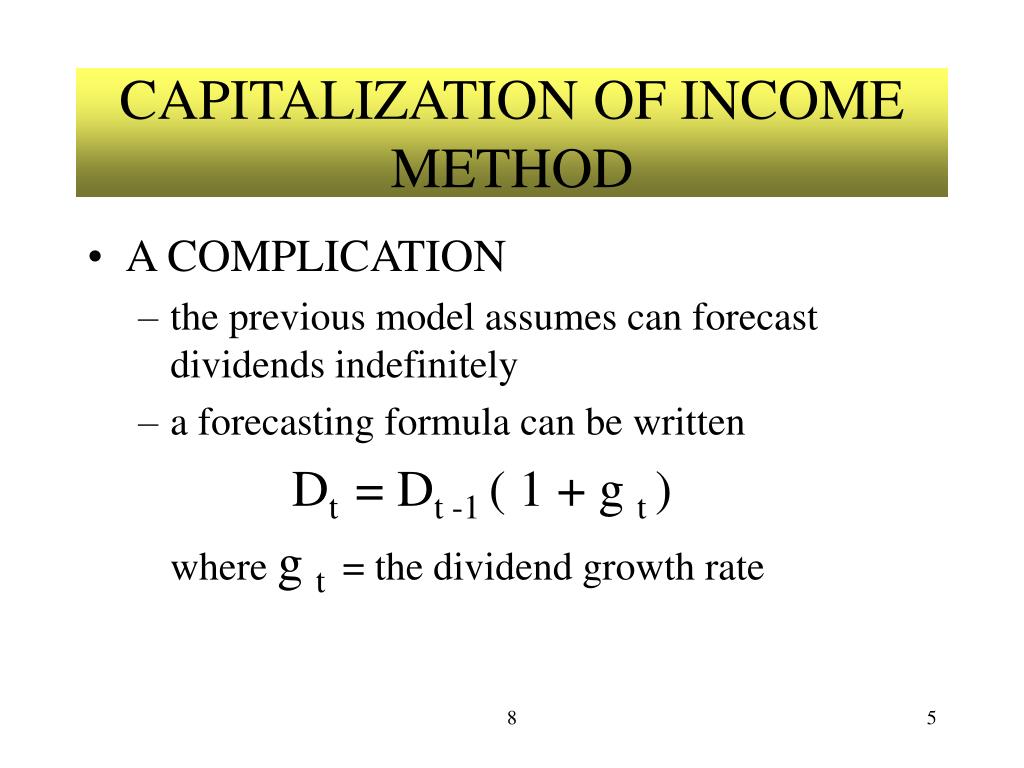

Capitalization of income approach formula. Unlike other appraisal methods the method is easy to use and interpret when there is enough data over time for both income. First the annual gross income of the investment must be. This works because you can simply plug in 0 for the initial investment amount. The capitalization rate can be used to determine the riskiness of an investment opportunity a high capitalization rate implies lower risk while a low capitalization rate implies higher risk.

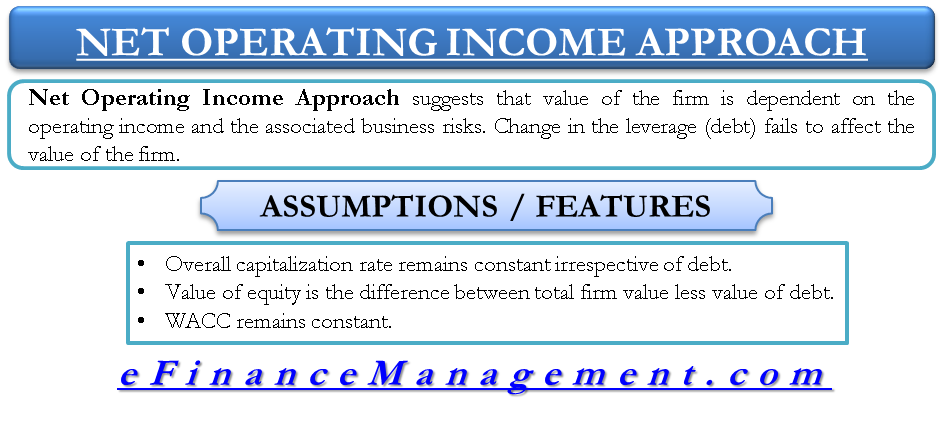

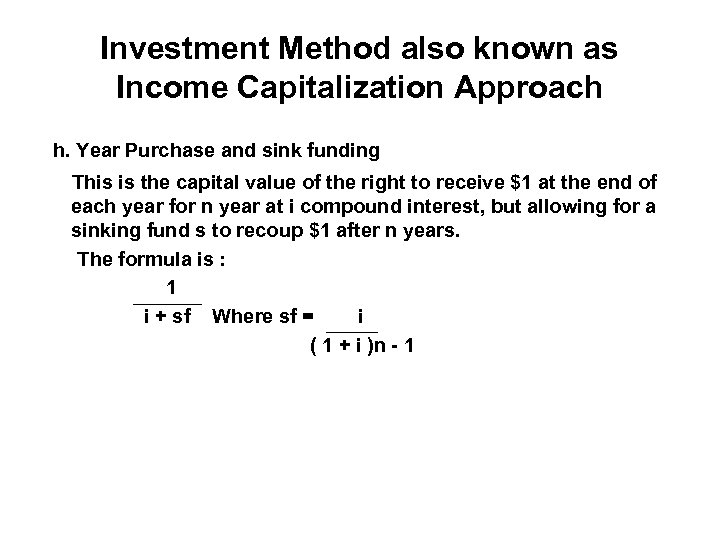

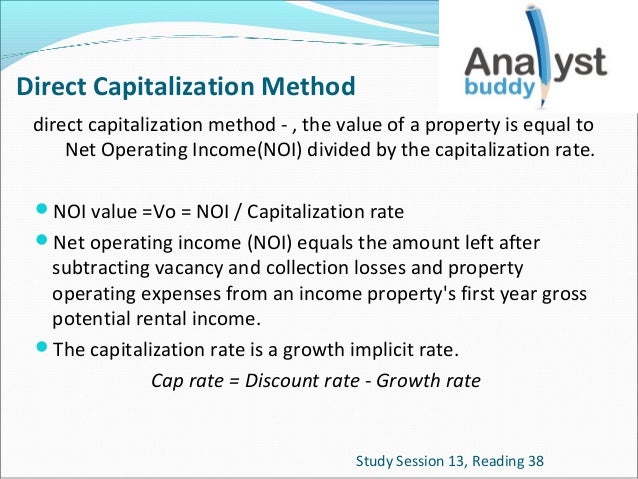

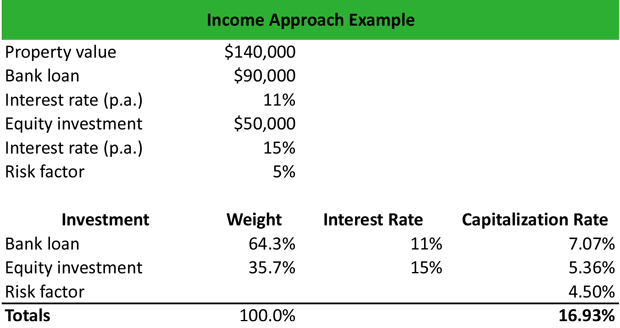

This approach to value is best suited for income generating properties that has adequate market data because it is meant to reflect the behaviors and expectation of participant of typical market. Property market value net operating income noi capitalization rate. The direct capitalization method is achieved by dividing the income generated by the property by its cap rate. Capitalization of earnings method determines the business value using a single measure of the expected business economic benefit as the numerator.

Net operating income i sales price v capitalization rate r this formula is applied using the net operating income and sale price of each comparable that you re analyzing. The income capitalization formula looks like this. Note in this formula the reversal of the irv formula for finding value. A building sells for 200 000.

The income capitalization approach is the approach which is applied to determine the value of an investment or commercial property. The capitalization rate and the net operating income noi. A common income based small business valuation method that establishes the business value by dividing the expected business economic benefit such as the seller s discretionary cash flow by the capitalization rate. The direct capitalization method is a real estate appraisal method that helps in converting income into value.

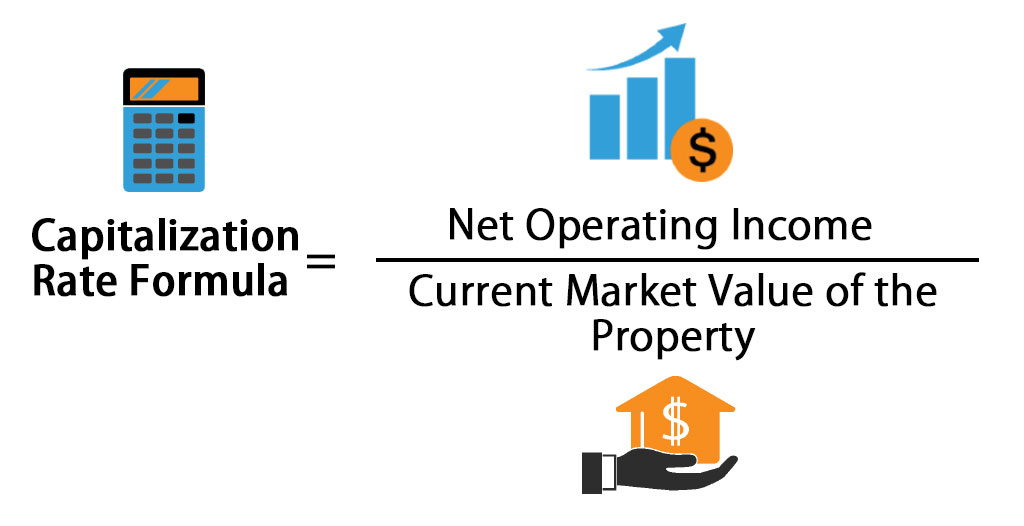

The formula you use is. Although the formula calculates present value pv it should be noted that both excel and popular financial calculators utilize the net present value npv formula to find the present value of uneven cash flows. The income capitalization approach formula. The formula for the capitalization rate is calculated as net operating income divided by the current market value of the asset.

So here s how to calculate each of the.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)