Definition Of Relative As Per Income Tax Act 1961

Definition of relative u s.

Definition of relative as per income tax act 1961. The term relative definition under various laws is given as under. The term relative as per income tax act 1961 is defined under section 2 41 which says husband wife brother or sister or any lineal ascendant or descendent of that individual. Spouse of the individual. As per section 2 41 of income tax act 1961 unless the context otherwise requires the term relative in relation to an individual means the husband wife brother or sister or any lineal ascendant or descendant of that individual.

Income tax act contains various sections which involve relationship between two individuals. Definition of relative u s. The fact of adoption is irrelevant in the above provision of income tax act 1961. As per section 2 41 of the income tax act 1961 relative in relation to an individual means the husband wife brother or sister or any lineal ascendant or descendant of that individual.

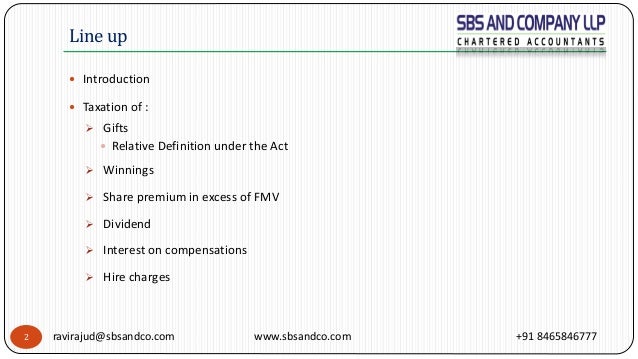

It does not include the illegitimate child. Brother or sister of the spouse of the individual. Link your pan with aadhaar number. 56 of the income tax a.

You may also refer our other articles on the issue at following link. The persons who are considered as relatives are. This section state that an individual can take a deduction of interest paid on loan taken for higher education if that interest is paid for the education of individual himself or for the education of his her relative. Definition of relative needs to be ascertained from the angel of recipient for each and every gift.

Interest or any other proceedings under the central excise act 1944 or chapter v of the finance act 1944 to those persons who pay the declared tax dues. Brother or sister of the individual. Meaning of relative as per section 80e. It was also argued that section 2 15b of the income tax act 1961 defines child in relation to an individual includes a step child and an adopted child of that individual.

For income tax act we need to forget that the relative is a cohesive term. In case of an individual. 56 of the income tax act 1961.