Definition Of Relative In Income Tax Act

Spouse of the individual.

Definition of relative in income tax act. Income tax act 1961. Brother or sister of individual or of spouse. The persons who are considered as relatives are. In the case of pendurthi chandrasekhar v.

If stepchild and adopted child is child then it is not. In this article we will discuss the meaning of relative as provided under different sections of the income tax act 1961. The tax department thought so. In case of an individual.

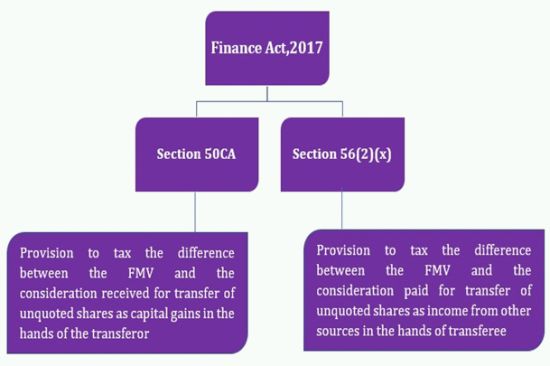

Gift received from a relative is not taxable in hands of the recipient under section 56 of income tax act. Brother or sister of the individual. Dcit 2018 ts 5466 hc 2018 andhra pradesh o the high court held that an occasion is not necessary to accept a gift from a relative. The definition is explained further in section 56 2 vii under which it is cleared that gifts received from relatives are not chargeable under income from other sources further clarifying that they.

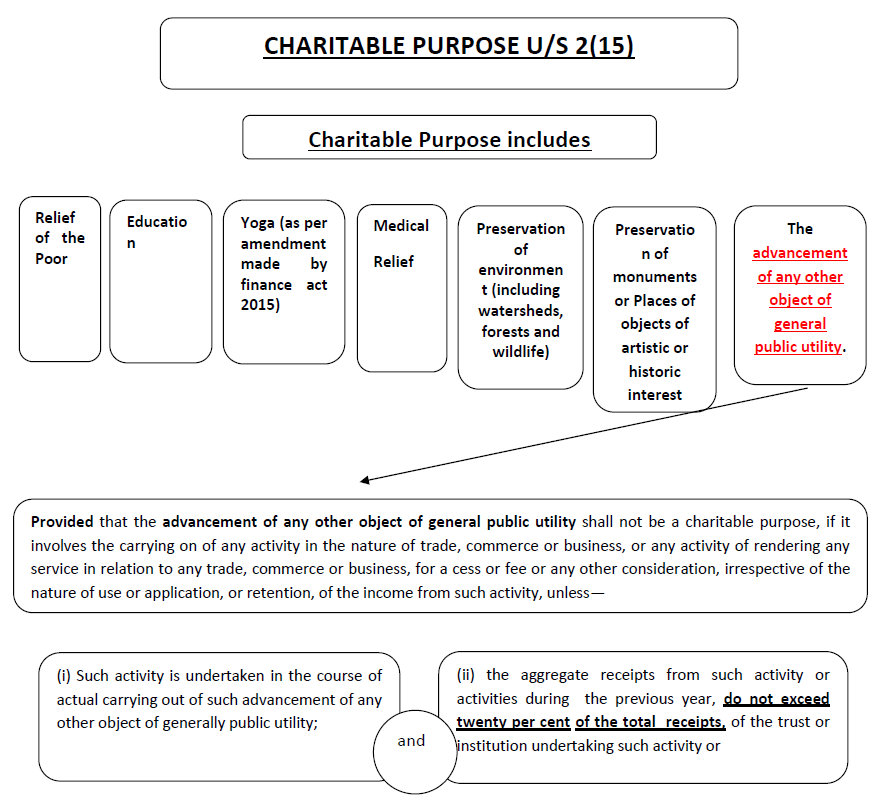

As per gift tax any relative means as per section 56 2 spouse. As per section 56 2 vii if any gift received from relative which are covered under following list will be exempt in the hands of receiver. The term relative has been used many times in various sections of the income tax act and meaning to term relative has been given differently according to the need of each section. This article provides list of relatives covered section 56 2 vii of the income tax act 1961.

Section 2 41 relative in relation to an individual means the husband wife brother or sister or any lineal ascendant or descendant of that individual. Relative meaning jan 1 2020 income tax act 1961 kewal garg as per section 2 41 of income tax act 1961 unless the context otherwise requires the term relative in relation to an individual means the husband wife brother or sister or any lineal ascendant or descendant of that individual. 6 1 although income tax act does not contain any direct reference to such a relationship definition of the word child u s 2 15b may perhaps support it. 19 april 2020 a gift received from relative any time during the year whether in cash or kind is exempt from tax under income tax act 1961.

As per the income tax act. Brother or sister of either parents. A comparative analysis has been done among the definitions provided under. 2 15b defines child in relation to an individual includes a stepchild and an adopted child of that individual.

Section 56 did not envisage any occasion for a relative to give a gift. Son in law falls in definition of relative so this kind of gift not attract any kind of income tax. As per section 2 41 of the income tax act 1961 relative in relation to an individual means the husband wife brother or sister or any lineal ascendant or descendant of that individual.