Long Term Passive Income Tax Rate

Any investment income dividend capital gains or even interest income is considered a passive income.

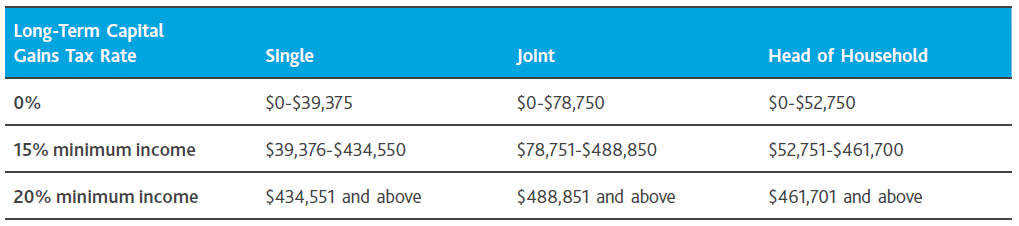

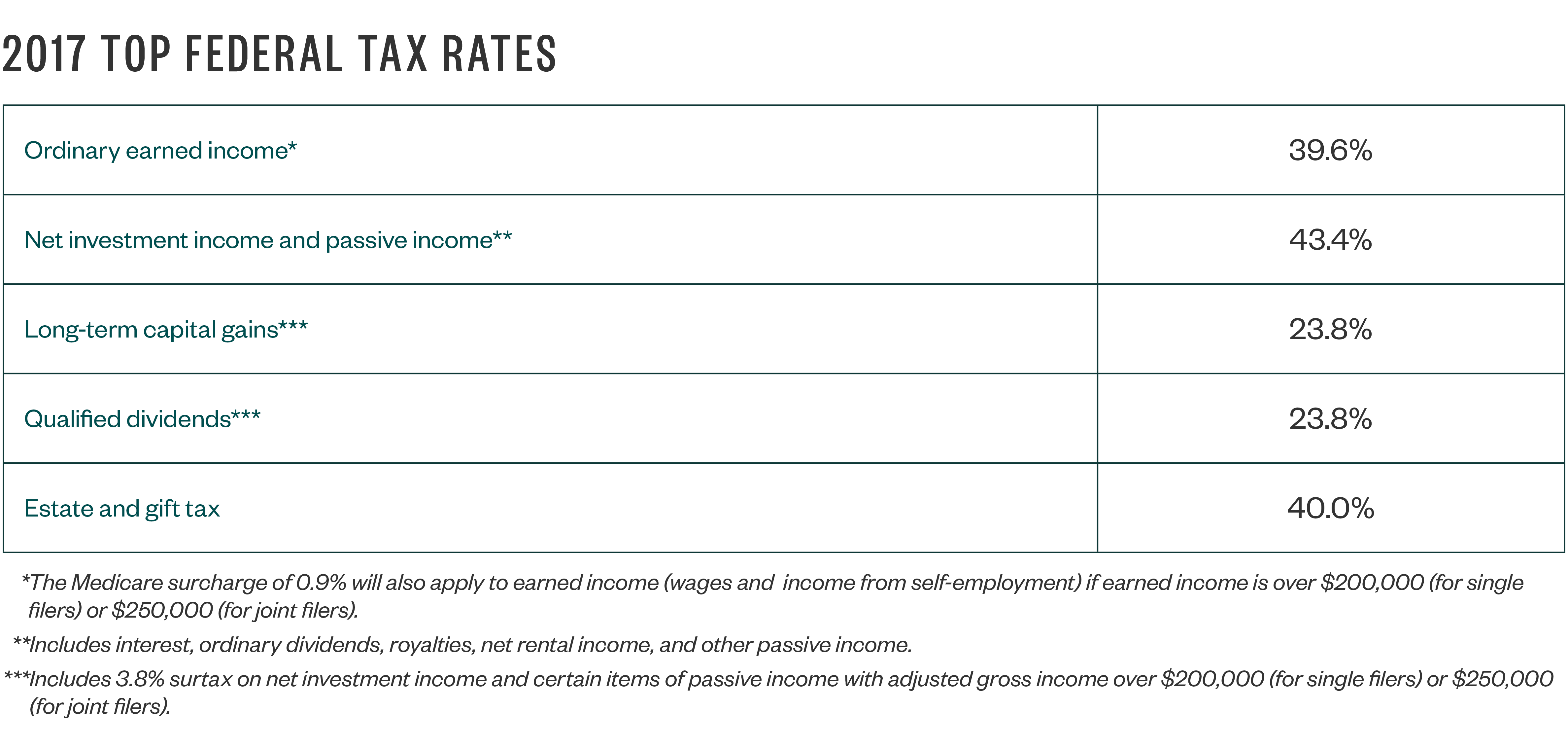

Long term passive income tax rate. If you fall in the 35 37 bracket the rate is 20. Long term capital gains and qualified dividends are taxed at zero 15 and 20 percent for 2017 but the brackets are different. On the other hand long term capital gains get favorable tax treatment. For 2017 passive income that is taxed as ordinary income will be taxed in the 2017 tax brackets and so the income tax rates range from 10 to 39 6 percent depending on your annual income.

As you will soon discover passive income is technically taxed a lot like active income. The passive income tax rate. 0 15 and 20 based on your income bracket. Long term passive income tax rates long term capital gains assets held for more than one year are taxed at three rates.

You would have heard this word especially while filing tax returns. It is also worth noting one additional difference investors need to account for. As the name suggests this essentially refers to the profit that you earned from long term holdings. If you fall into the 22 32 tax brackets the long term capital gains tax is 15.

In the 12 or less bracket the rate is 0. The long term capital gains tax rate is lower than your federal income tax rate. The maximum tax rate for them is capped at 15. They are taxed at rates of 0 15 or 20 depending on the investor s taxable income but these rates are generally lower.

While the two sources of income are relatively similar. The passive income is the money that you earn without actively engaging in an activity or trade. These are taxed at the normal income tax rate that you are eligible for.