Does Passive Income Qualify For Qbi

Of course there are always exceptions.

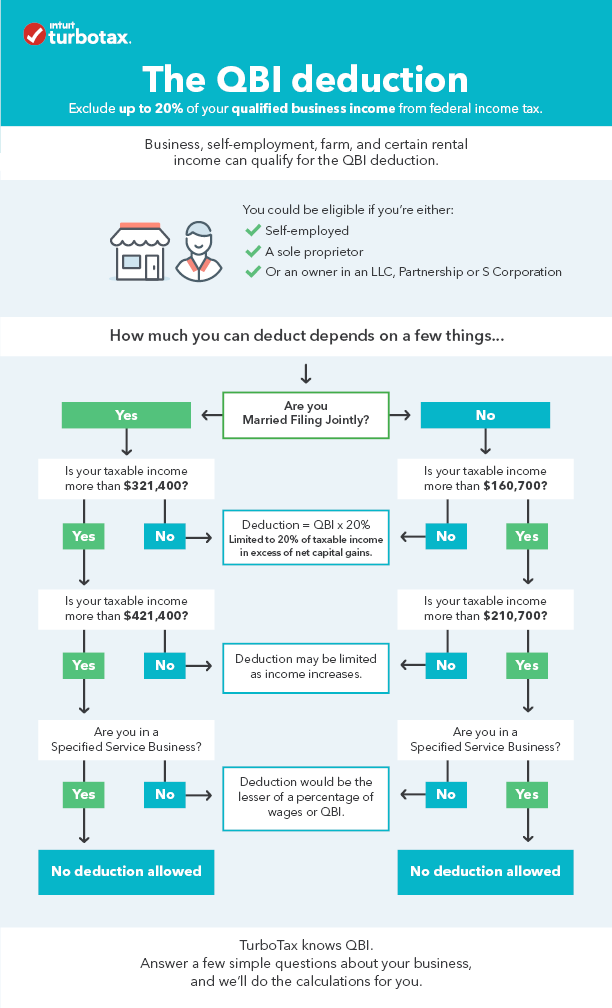

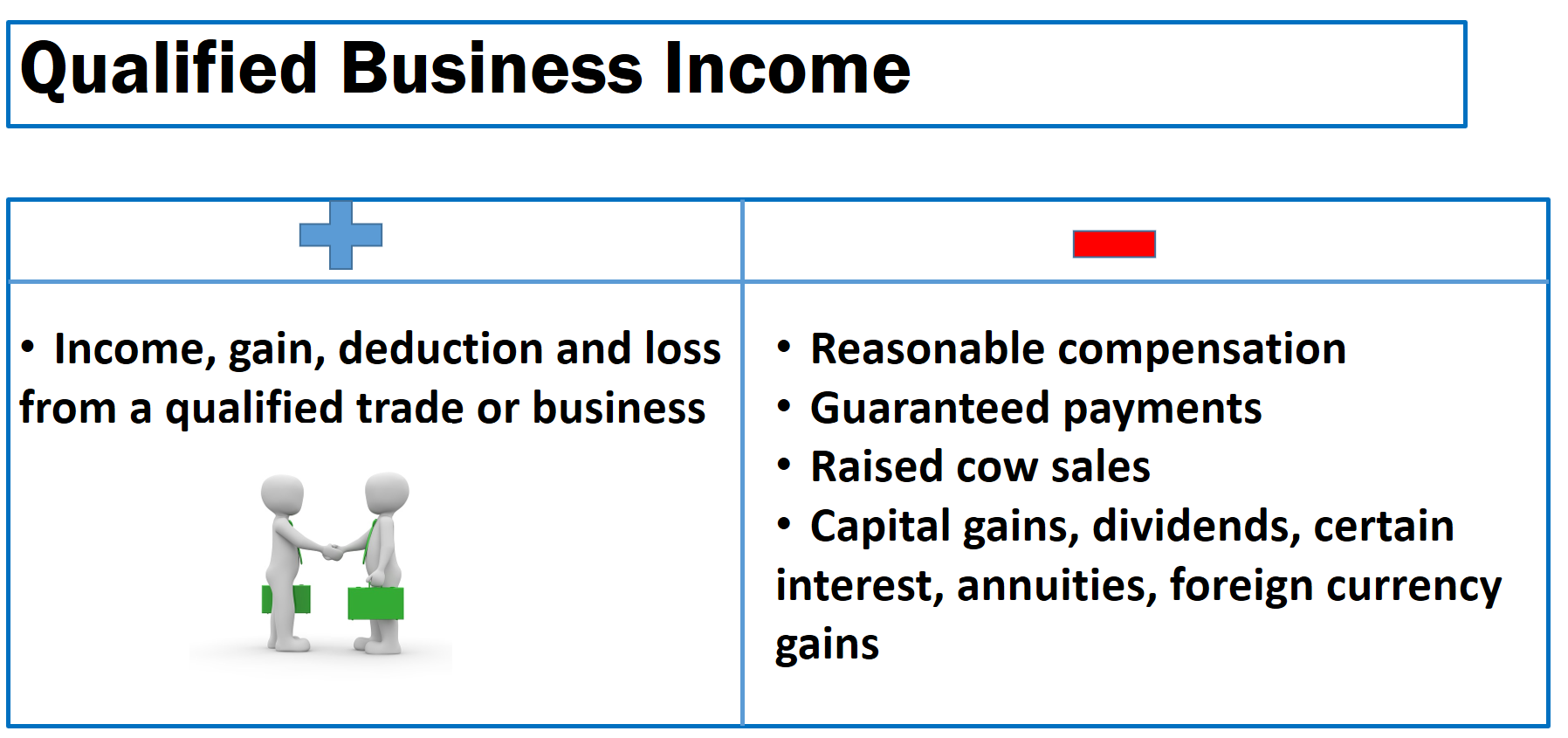

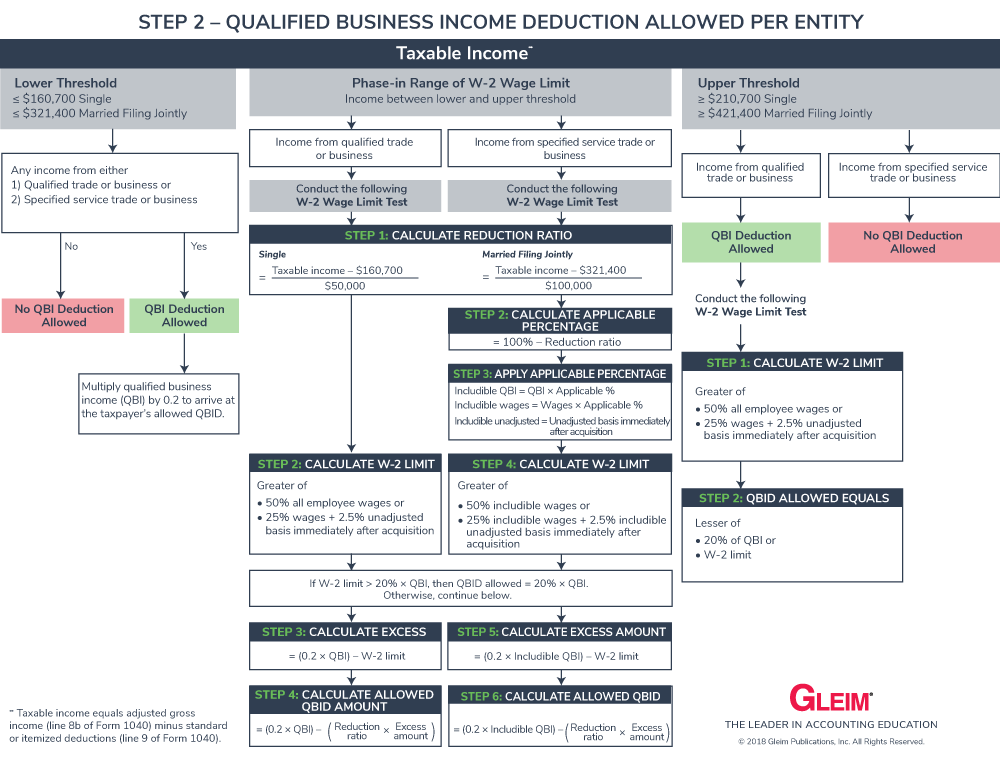

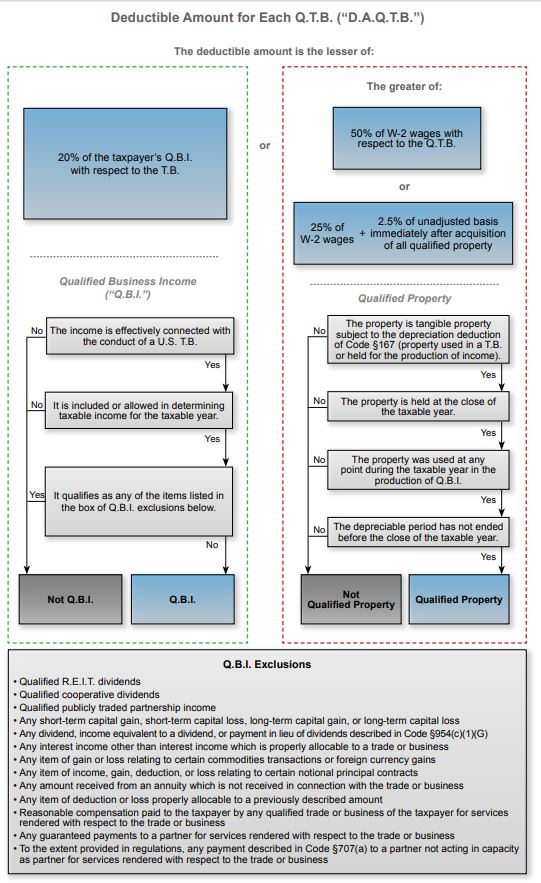

Does passive income qualify for qbi. The tax cuts and jobs act tcja added a new tax deduction for owners of pass through entities a 20 deduction of qualified business income qbi from a qualified trade or business. The answer is it s not 100 percent clear but the general consensus among tax practitioners is that income from rental properties will be deemed qbi and qualify for the deduction. In addition any losses disallowed before jan. If all the general requirements which vary based on your level of taxable income are met the deduction can be claimed for a rental real estate activity but only if the activity.

Does passive income qualify for qbi if you have an interest in affiliate marketing or building an online business as a whole however do not recognize where to start after that this new program freedom breakthrough the affiliate blueprint academy from jonathan montoya is well worth a look. Passive activity losses pals are not taken into account for the qbi deduction if they are disallowed. 199a the combined qualified business income amount is the sum of the sec. 199a creates a qualified business income qbi deduction for taxpayers other than corporations.

199a b 2 amounts plus 20 of the aggregate amount of qualified real estate investment trust dividends and qualified publicly traded partnership income. It also includes up to 20 of qualified real estate investment trust dividends and. So their deduction is equal to 20 of domestic qualified business income from a pass through entity subject to the overall limit based on taxable income. Roughly 97 of your clients have taxable income under the threshold.

Here s what you need to know. This new provision may potentially lower the maximum individual tax rate of 37 on pass through income to 29 8 which makes it more comparable to the new c corporation tax rate of 21. Roughly 3 of your clients are impacted by the threshold. This will be explained in detail later.

Many owners of sole proprietorships partnerships s corporations and some trusts and estates may be eligible for a qualified business income qbi deduction also called section 199a for tax years beginning after december 31 2017. 1 2018 are never taken into account for the qbi deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income qbi plus. The qbi deduction is up to 20 of qbi from a pass through entity conducting a trade or business in the u s.

To qualify for the qualified business income qbi deduction you must be an owner of a pass through entity within the u s have qualified business income and not be barred from taking the deduction due to having substantial income and operating in a particular type of business.