Does Passive K 1 Income Qualify For Qbi

Do you qualify for the qbi deduction.

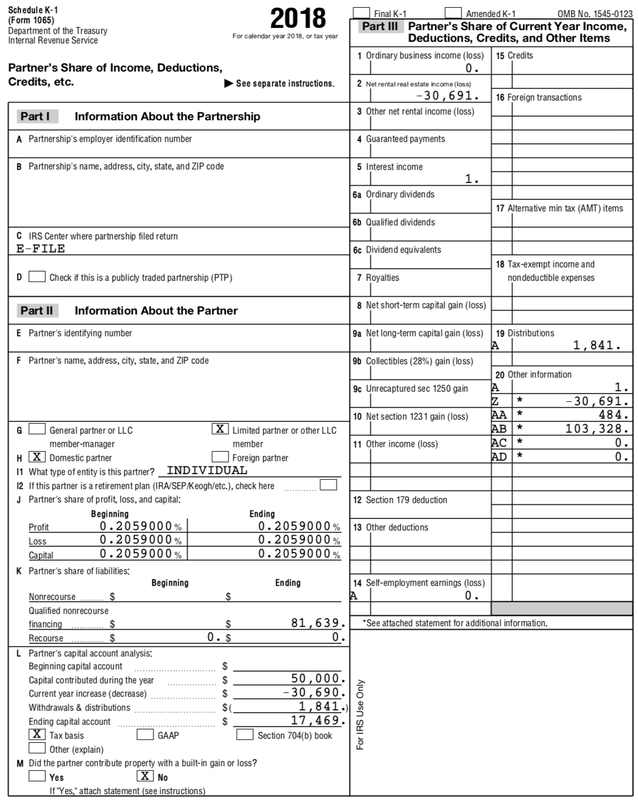

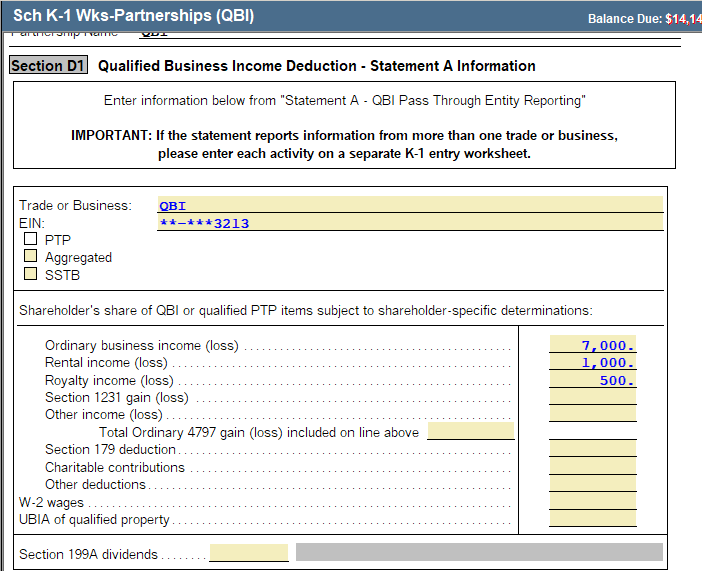

Does passive k 1 income qualify for qbi. The qbi deduction applies to qualified income from sole proprietorships partnerships limited liability companies llcs that are treated as sole proprietorships or as partnerships for tax purposes and s corporations. Form 8995 a qualified business income deduction. The 2017 pal is the older previously disallowed pal and is otherwise allowed against passive income in the current tax year. Beginning any kind of brand new business particularly an on line business can be really tough.

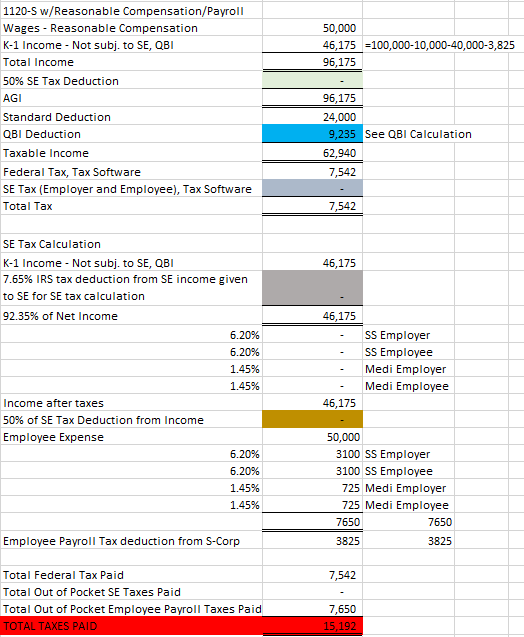

C income 100 000 k 1 income 100 000. In example 1 qbi would equal the full 35 000 in 2019. Section 199a was added to the internal revenue code under the tax cuts and jobs act of 2017 to provide taxpayers with a 20 deduction from income attributable to qualifying trades or businesses. The qualified business income qbi deduction is a tax deduction for pass through entities.

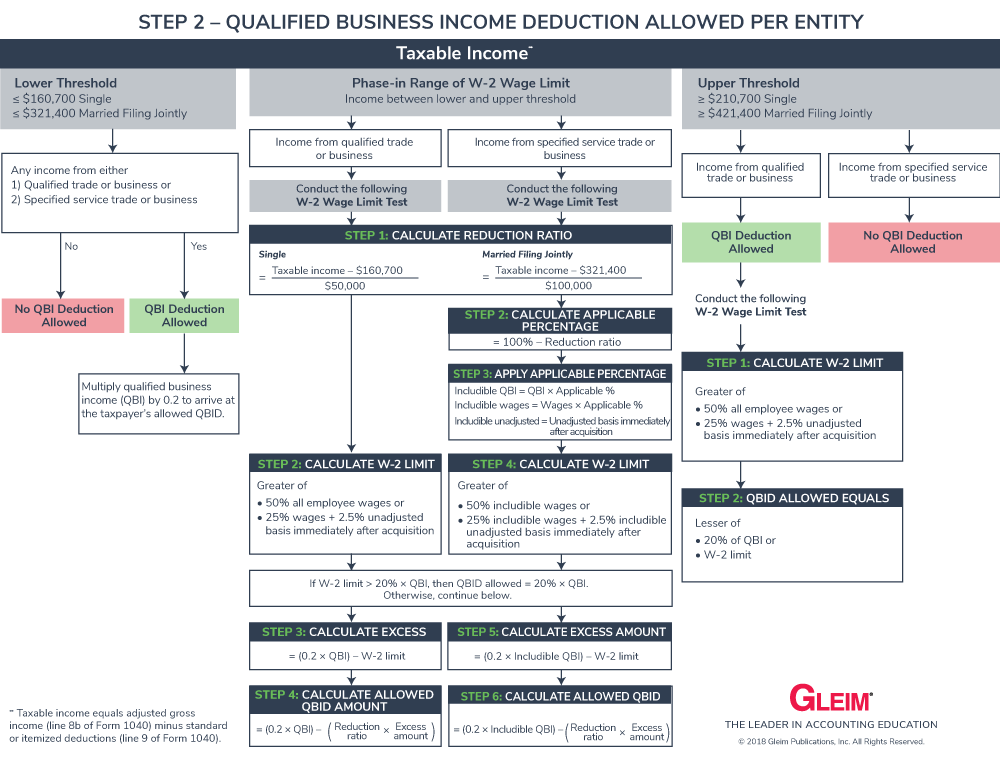

The deduction allows an individual to deduct up to 20 percent of their qualified business income qbi plus 20 percent of qualified real estate investment trust reit dividends and qualified publicly traded partnership ptp income. Since the taxable income is below the threshold amount the deductible amount of llc s qbi for trust b and trust c is 20 of 87 500 or 17 500 each for a total qbi deduction of 35 000. 199a deduction when trusts are being. Given that there are many nontax reasons to establish separate trusts for each beneficiary advisers should consider the potential tax savings of a higher sec.

There is just so much information around as well as most of it simply does not work is obsoleted as well as incorrect or is just merely scammy. Irs rejected suggestions to use the 469 passive activity rules. Does passive income qualify for qbi. However because it is carried over from a pre 2018 tax year it is disregarded for purposes of determining qbi.

Once you reach a certain income limit you no longer qualify for the deduction at all. You can learn more about sstbs in the next section. When doing tax planning for 2019 it is important to. Also please note that at taxable income under the the lowest threshold level under the threshold of personal taxable income of 157 000 single and 315 000 joint the qbi is calculated as either 20 of your qualified business income which is self employed business profit less self employment taxes self employed health insurance and or self employed retirement etc or 20 of your personal taxable income less capital gains dividends whichever is less.

Learn if your business qualifies for the qbi deduction of up to 20. Thresholds are determined by your filing status.