Income Approach Formula Valuation

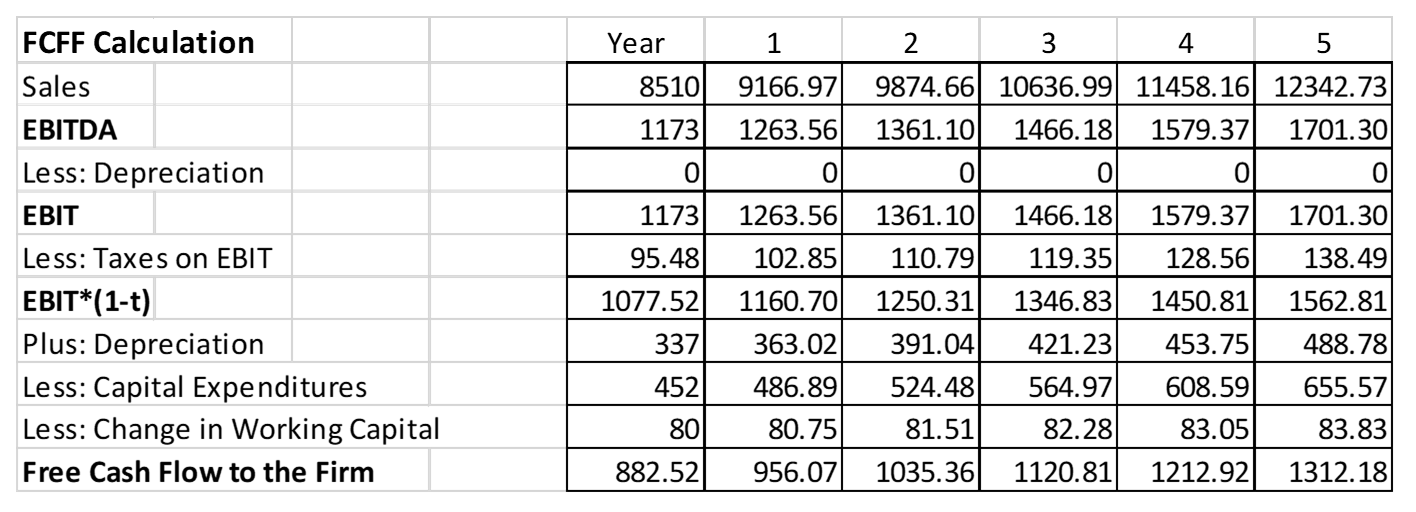

A initial period of say 5 years for which net cash flows and growth rate for each year can be determined and b period after the initial period for which year by year projection is unreliable.

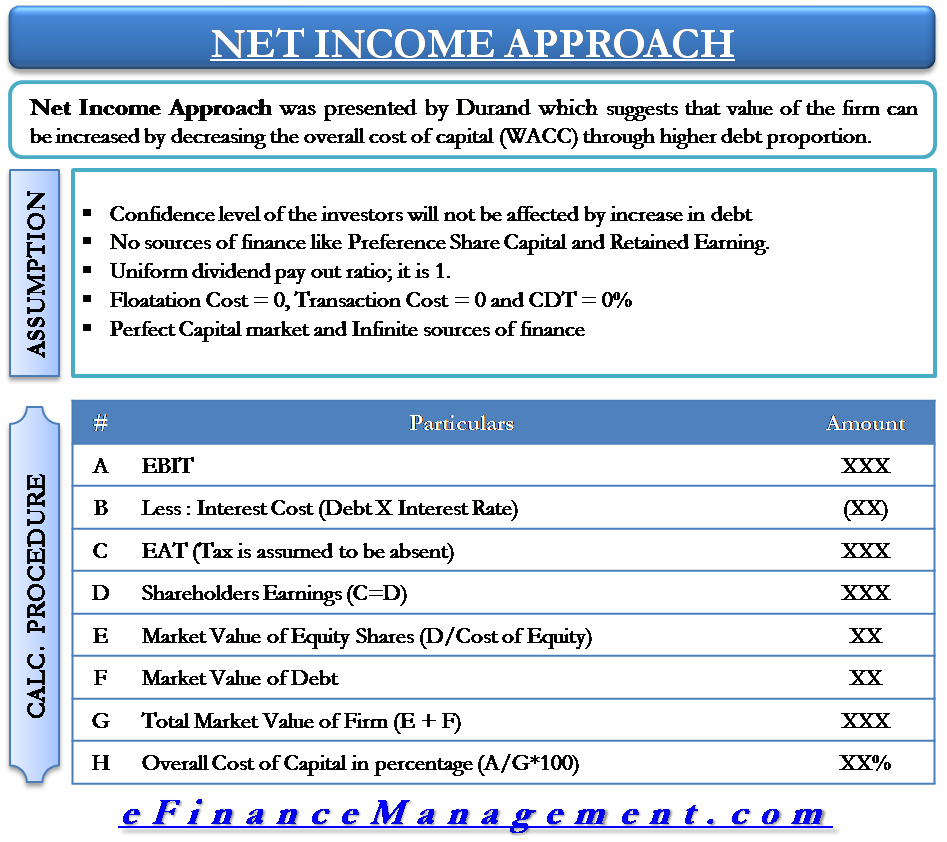

Income approach formula valuation. Create a forecast of the expected cash flows of the business for at least the next five years and then derive the present value of those cash flows. The residual income valuation formula is very similar to a multistage dividend discount model. It is based on the theory that the total value of a business is. The discounted cash flow analysis evaluates net appreciating income and net sales proceeds and discounts these to a current indication of value.

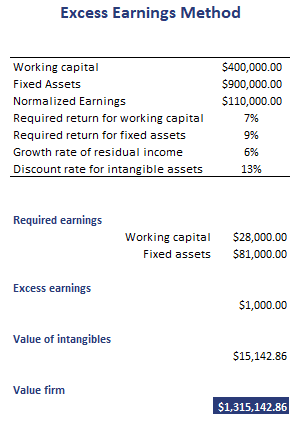

The formula for egrim is. Residual income is the income a company generates after accounting for the cost of capital. This present value figure is the basis for a sale price. Discounted cash flow dcf method.

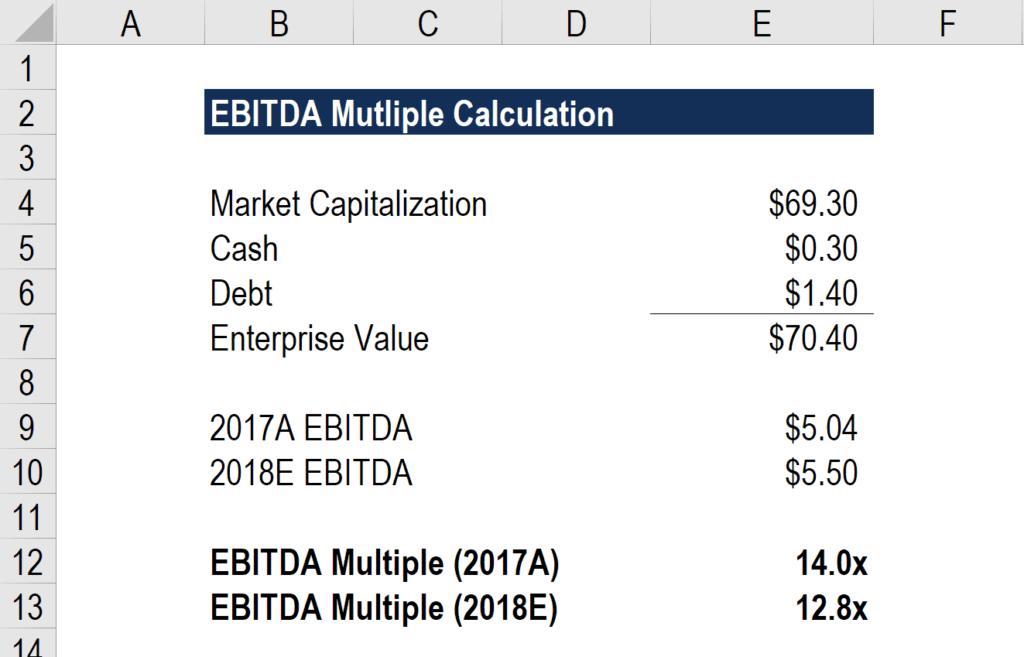

There can be many adjustments to the projected cash flows that can have a profound impact on the present value figure. When a property s intended use is to generate income from rents or leases the income method of appraisal or valuation is most commonly used. The income approach is a real estate valuation method that uses the income the property generates to estimate fair value. Market value effective gross income x egim effective gross income is abstracted from market data and discussions with market participants.

Another approach called multi stage growth model divides future into two or more stages. The net income generated by the property is measured in conjunction with certain other factors to calculate its value on the current market if it were to be sold. The theory behind this method is that the total value of a business is the present value of its projected future earnings plus the present value of the terminal value in this process the expected cash flow of the business. The above equation is based on the formula for present value of a perpetuity.

It s calculated by dividing the net operating income by the capitalization. Working with a company to determine future free cash flows can be valuable in learning more about the company. Discounted cash flow method formula the discounted cash flow dcf method is the second kind of income approach that many companies use for their business valuation. The income approach is one of three techniques commercial real estate appraisers use to value real estate.

Compared to the other two techniques the sales comparison approach and the cost approach the income approach is more complicated and therefore it is often confusing for many commercial real estate professionals.

:max_bytes(150000):strip_icc()/Sinking-fund-factor-1bb9180a4a4340c79a7c3cf470a907ca.jpg)