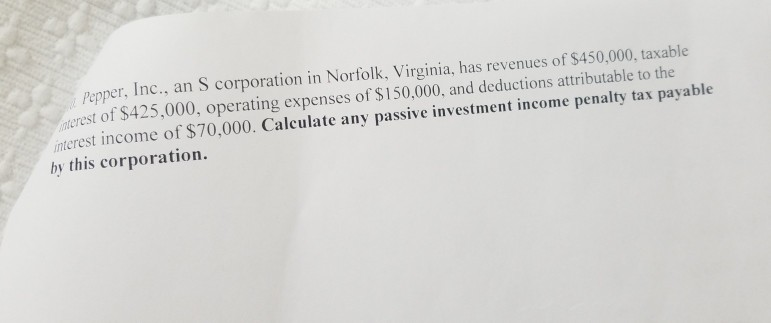

Passive Investment Income Penalty Tax Payable By This Corporation

Brew has accumulated e p of 22 000 and ordinary income of 50 000.

Passive investment income penalty tax payable by this corporation. This rate is to be reduced to 9 percent in 2019. In 2019 the company will earn 500 000 of active business income. Excess net passive income tax. The small business limit the amount of income annually that is eligible for the small business rate is 500 000 federally and in most provinces except for.

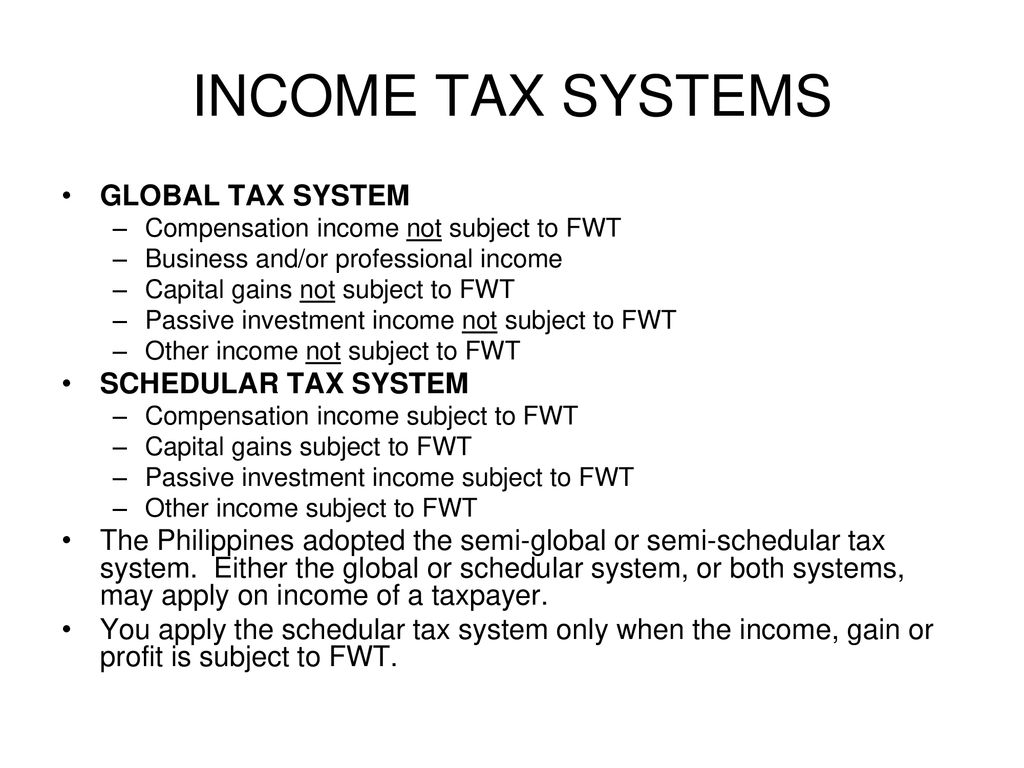

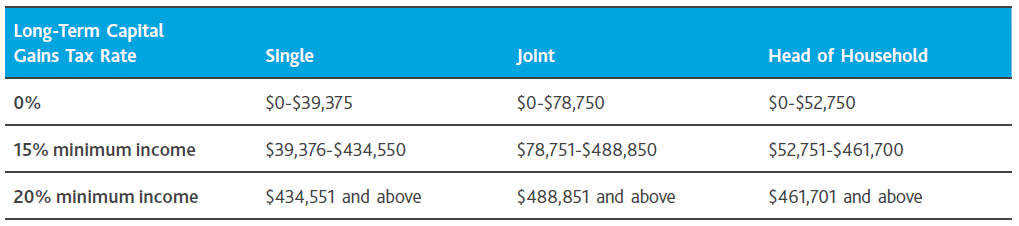

As illustrated in the table below the passive income rule change will result in the company paying 40 000 more tax than it would have before the cra passive income tax changes. Taxable income 10 000 5 000 tax payable 47 4 700 2 350 net income 5 300 7 650 rdtoh 26 67 of taxable income 2 667 1 333 cda 50 of capital gain not taxable 5 000 assumes corporate tax rate of 47 per cent. The highest corporate rate is applied to the s corporation s excess net passive income as follows. In 2018 the company earned 100 000 of passive investment income.

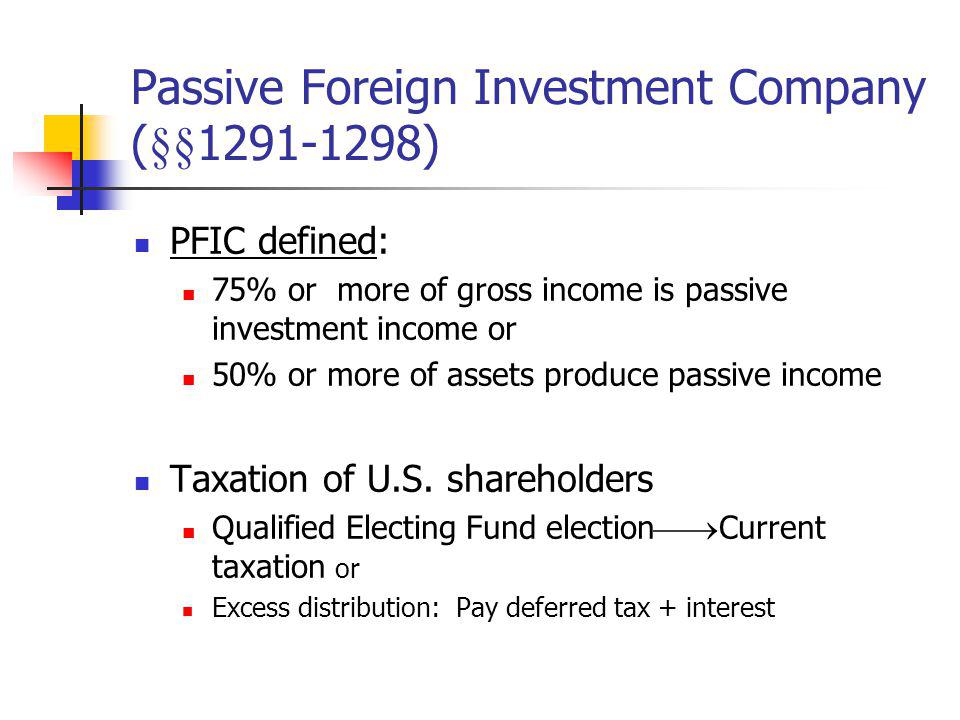

It has passive investment income of 100 000 with 40 000 of expenses directly related to the. In 2018 canadian controlled private corporations ccpcs pay corporate income tax on small business income at 10 percent federally. Passive investment income penalty tax brew an s corporation has gross receipts of 190 000 and gross income of 170 000. In february 2018 the government of canada introduced new rules for passive income that could affect how your small business clients are taxed.

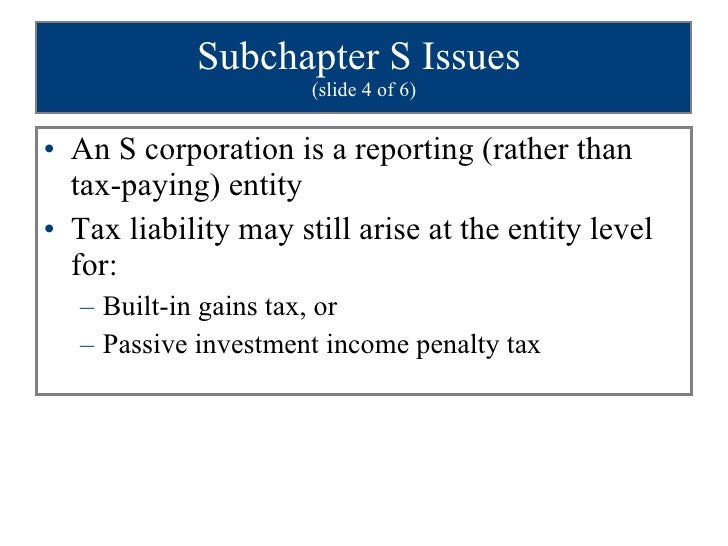

It has passive investment income for the tax year that is in excess of 25 of gross receipts. A corporation must pay the enpi tax if all the following apply. Along with relevant topics like passive activity 2020 passive income tax rates and how investors can qualify for the many tax advantages offered in the new tax cuts act of 2018. It has accumulated earnings and profits e p at the close of the tax year.

Passive investment income penalty tax means a tax imposed on the excess passive activity income of an s corporation that has accumulated earnings and profits. The maximum rates applicable to the distributed earnings of c corporations and pass through entities are now fairly comparable 36 8 to 39 8 for c corporations depending on the applicability of the 3 8 tax on net investment income and 37 to 40 8 for pass through entities depending on the applicability of the 3 8 tax on net investment. Taxation of investment income within a canadian corporation corporation s after tax income 5 300 7 650 corporation keeps 44 more. Also learn about the financial impact of short term versus long term investments and how they are taxed differently.

:max_bytes(150000):strip_icc()/dotdash_Final_Investment_Income_Apr_2020-01-fae8874a0f0c4ab38e8e3cc18801e803.jpg)