Passive Activity Income Tax Rate

When discussing passive income tax it s important to know that the irs has a very specific definition of what passive income is.

Passive activity income tax rate. This is a federal calculation only as the provinces do not have a refundable component. As you will soon discover passive income is technically taxed a lot like active income. That s an average tax rate of just under 17. Below is a summary table showing how much i earned from each passive income stream and the tax for each.

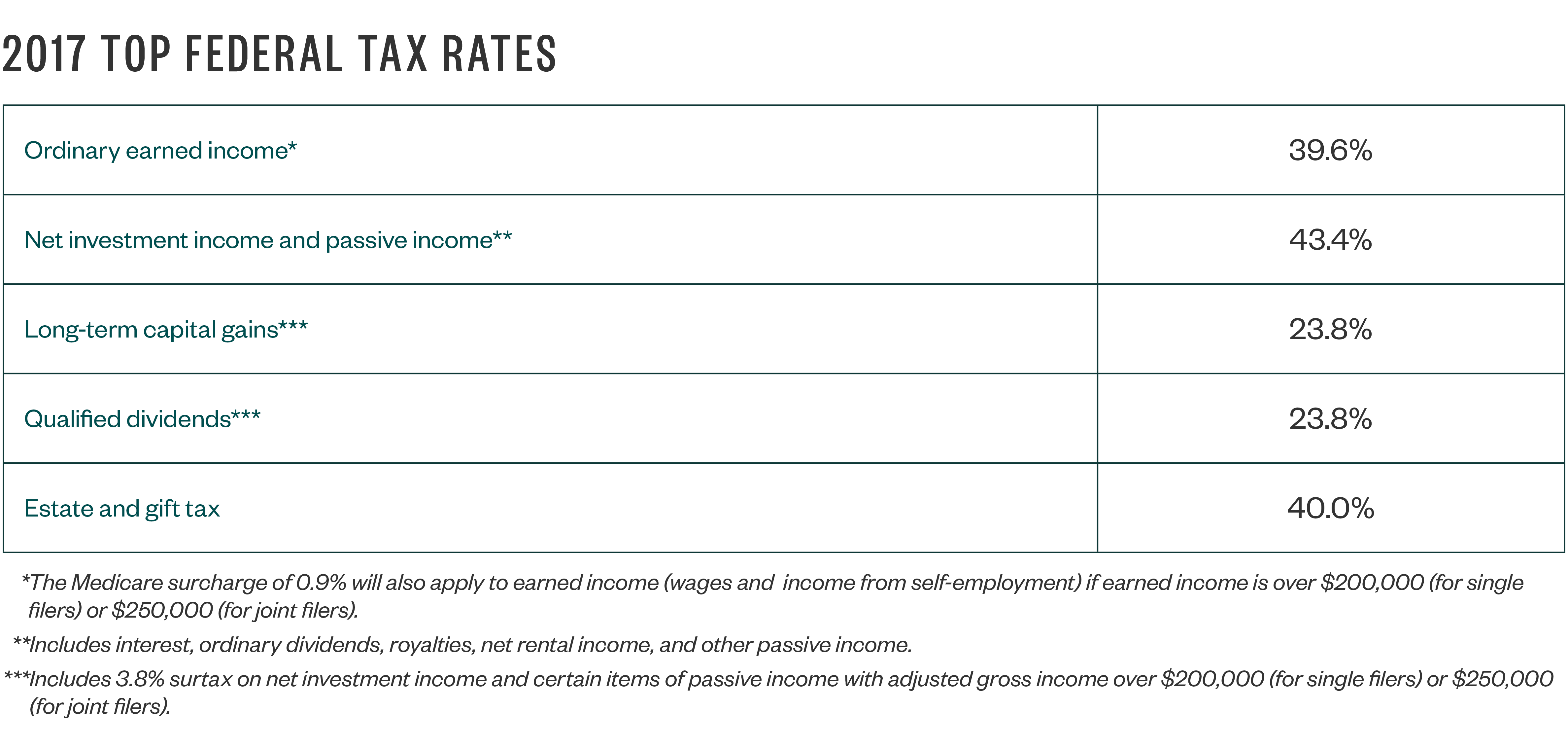

The current tax rates for short term gains are as follows. In total i owed 127 44 as a result of the 752 59 in passive income i earned. Short term passive income tax rates. Long term capital gains and qualified dividends are taxed at zero 15 and 20 percent for 2017 but the brackets are different.

The passive income tax rate. It is also worth noting one additional difference investors need to account for. The cumulative tax bill above is 1 835 on 14 373 of gross annual passive income yielding a blended passive income tax rate of 13 on my personal lineup of passive investments. It s therefore vital to understand the tax rules surrounding passive activity income in order to assess investments in passive activities correctly.

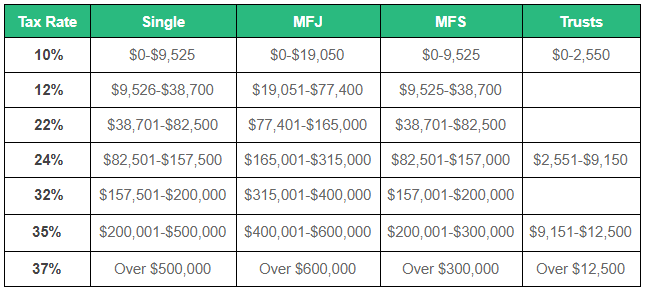

Passive investors on the other hand tend to gravitate towards buy and hold assets. As mentioned previously short term gains apply to assets held for a year or less and are taxed as ordinary income. 10 12 22 24 32 35 and 37. Gee that sure beats the 40 tax treatment on an extra work shift in december.

I find it interesting that i paid the most tax on the savings account interest. For 2017 passive income that is taxed as ordinary income will be taxed in the 2017 tax brackets and so the income tax rates range from 10 to 39 6 percent depending on your annual income. The irs has a somewhat technical process for figuring out passive income and losses that are allowable on an individual s tax. When an individual earns passive income from a partnership he must report the income on his personal tax return.

As outlined the effective tax rate on passive income is 50 7 while dividend income is taxed at 38 3. Tax code you can at best put yourself in a situation where you might not have to pay taxes on all your income. In other words short term capital gains are taxed at the same rate as your income tax.