Income Tax Brackets Lebanon

Some other taxes for instance property tax substantial in many countries such as the united states and payroll tax are not shown here.

Income tax brackets lebanon. Choose a specific income tax year to see the lebanon income tax rates and personal allowances used in the associated income tax calculator for the same tax year. Personal income tax pit is levied on wages and salaries at progressive rates. Income tax rates and thresholds annual tax rate taxable income threshold. Lebanon residents income tax tables in 2019.

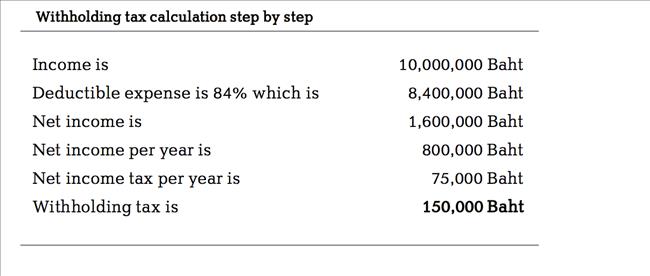

The following tax rates are applied to the net income from. Under the income tax law in lebanon tax is levied based on income type. Databases at the lebanese ministry of finance namely the income tax on wages salaries and income tax on profits databases. The brackets for the progressive payroll tax rates became between 2 and 25 instead of between 2 and 20 as per article 23 of budget law 2019 which amended article 58 of the income tax law.

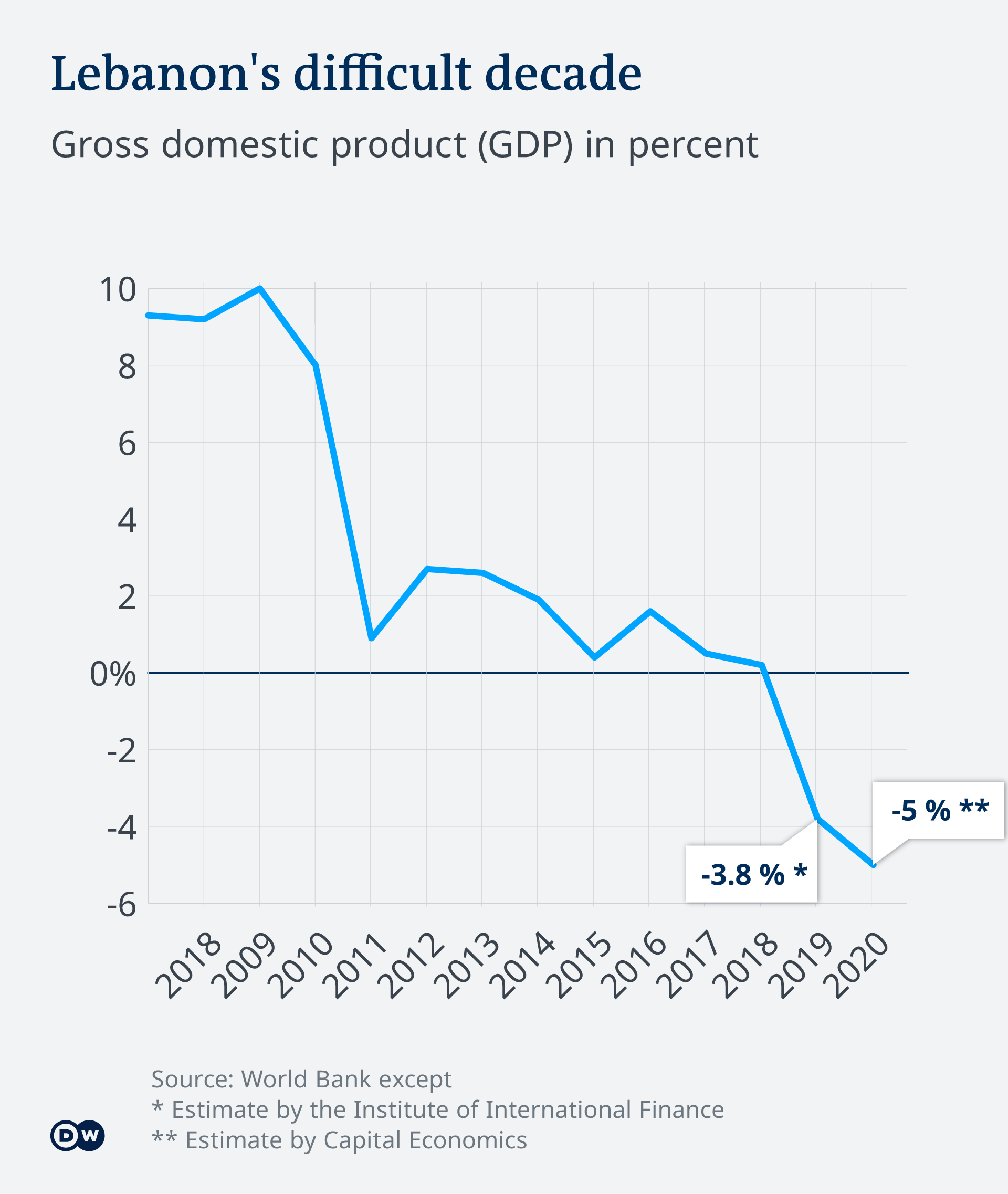

Accordingly the income tax law divides income into the following three categories. The deemed profit percentage is 50 on services and 15 on products and the tax rate is 15. Tax filing deadline extended the state of ohio has taken legislative action and now the city of lebanon is able to extend the deadline for filing 2019 income tax returns to july 15 2020 which is now consistent with the federal filing date. This page provides lebanon personal income tax rate actual values historical data forecast chart statistics economic calendar and news.

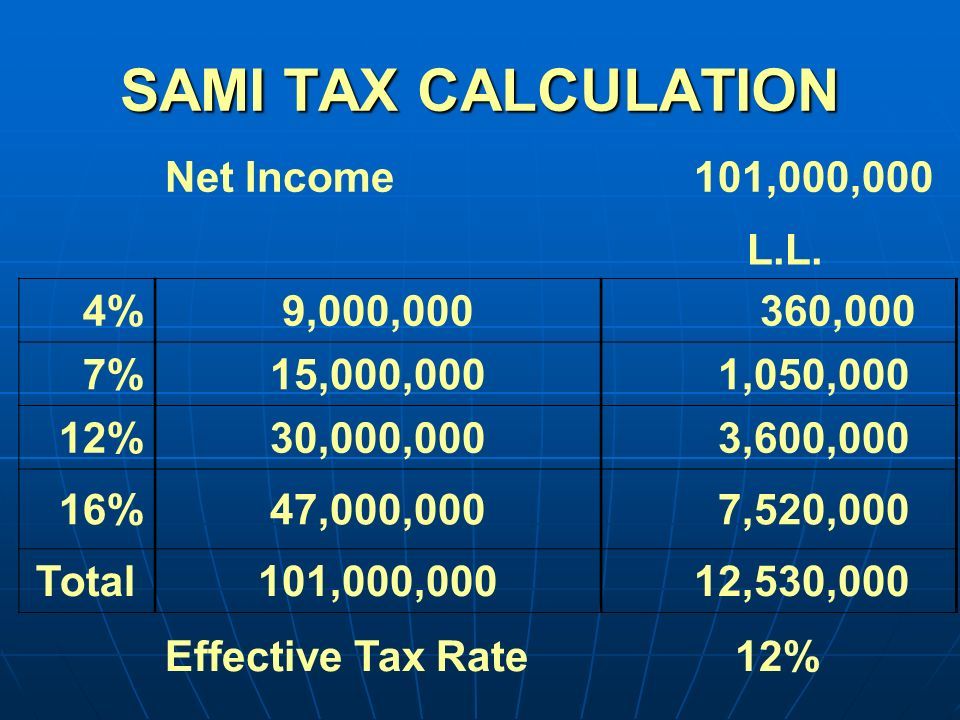

Corporate tax individual income tax and sales tax including vat and gst but does not list capital gains tax. Article 24 of budget law 2019 amended article 32 on the income tax law related to the annual progressive brackets for income tax on profits to become 4 to 25 instead of 4 to 21. Income levels are available on a disaggregated basis or in other terms for every single taxpayer but could only be obtained for this study in compiled form under six income brackets as per the income tax law table 1. Lebanon has one of the most competitive corporate income tax rates regionally and internationally equal to 17 as per latest regulations making lebanon s business environment one of the most attractive and competitive for foreign and national companies.

The list focuses on the main indicative types of taxes. Nonresident persons and entities without a registered place of business in lebanon who earn business income in lebanon are taxed on a deemed profit of the amounts received from lebanon. Personal income tax rate in lebanon averaged 20 25 percent from 2004 until 2019 reaching an all time high of 24 percent in 2019 and a record low of 20 percent in 2005. Review the latest income tax rates thresholds and personal allowances in lebanon which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in lebanon.

The 2020 first and second quarter estimated payment due dates have also been extended to july 15 2020.

:max_bytes(150000):strip_icc()/UAETaxBrackets2-0db7d9918b414b2e978772ebeeb0f101.jpg)