Passive Activity Loss Limitation Rules

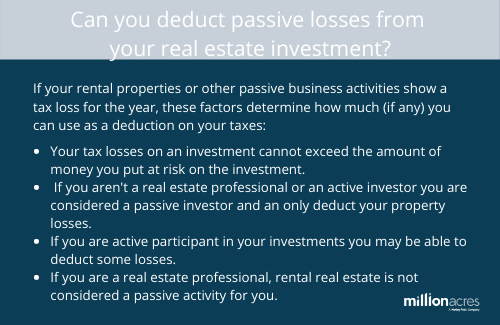

This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out.

Passive activity loss limitation rules. So to prevent this congress passed passive activity rules that allowed passive losses to be deducted only from passive profits. The at risk rules limit your losses from most activities to your amount at risk in the activity. Form 8582 passive activity loss limitations. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less.

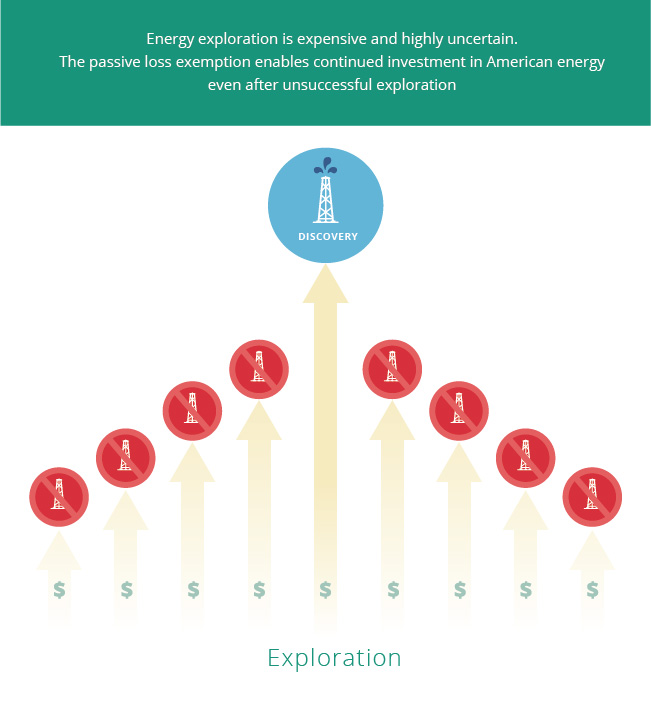

Since the enactment of the passive activity loss limitation rules in 1986 taxpayers and practitioners have been frustrated in attempts to have economic losses incurred in activities described as passive offset income derived from other sources. Form 8582 cr passive activity credit limitations. In a nutshell a taxpayer that spends less than 750 hours in an activity has passive income or loss. Passive activity loss rules are a set of irs rules stating that passive losses can be used only to offset passive income.

Passive activity rules cover real estate investments limited partnerships closely held corporations or any other type of investment in a. A passive activity is one wherein the taxpayer did not materially. You treat any loss that s disallowed because of the at risk limits as a deduction from the same activity in the next tax year. The rules on how to determine a passive activity are pretty straight forward.

If your losses.