Passive Activity Loss Form

Passive activity loss limitations.

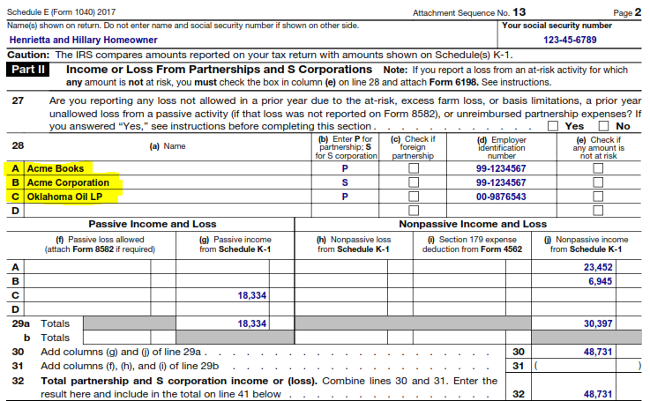

Passive activity loss form. Form 8582 passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Form 8582 is used by individuals estates and trusts with losses from passive activities to figure the amount of any passive activity loss pal allowed for the current tax year. Form 8582 passive activity loss limitations pdf. Attach to form 1040 form 1040 sr or form 1041.

Limiting passive activity losses began with the tax reform act of 1986 as a means of discouraging economic activity undertaken strictly as a tax shelter. Passive income and losses includes businesses and rentals without material participation by the investor taxpayer. All forms are printable and downloadable. The form 8582 passive activity loss limitations pdf form is 3 pages long and contains.

On average this form takes 58 minutes to complete. Form 8582 department of the treasury internal revenue service 99 passive activity loss limitations see separate instructions.