Income Capitalization Approach Excel

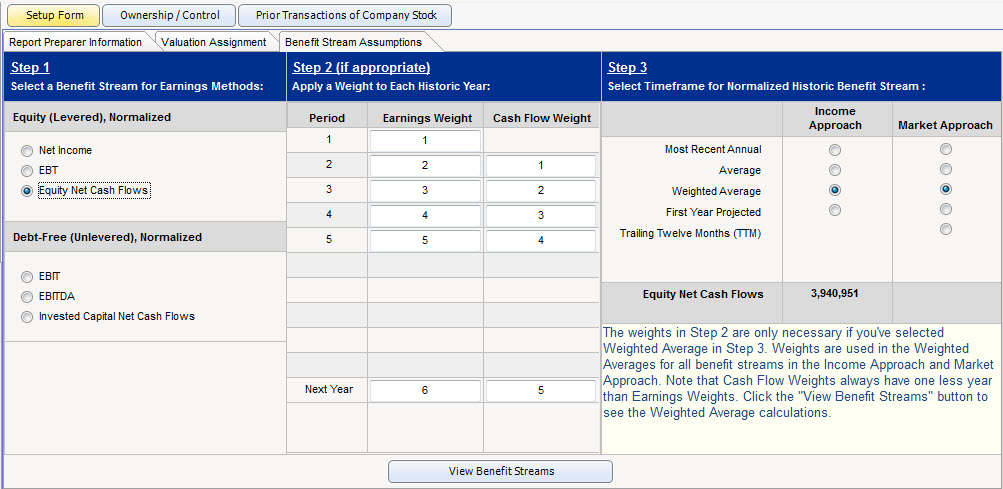

The direct capitalization method.

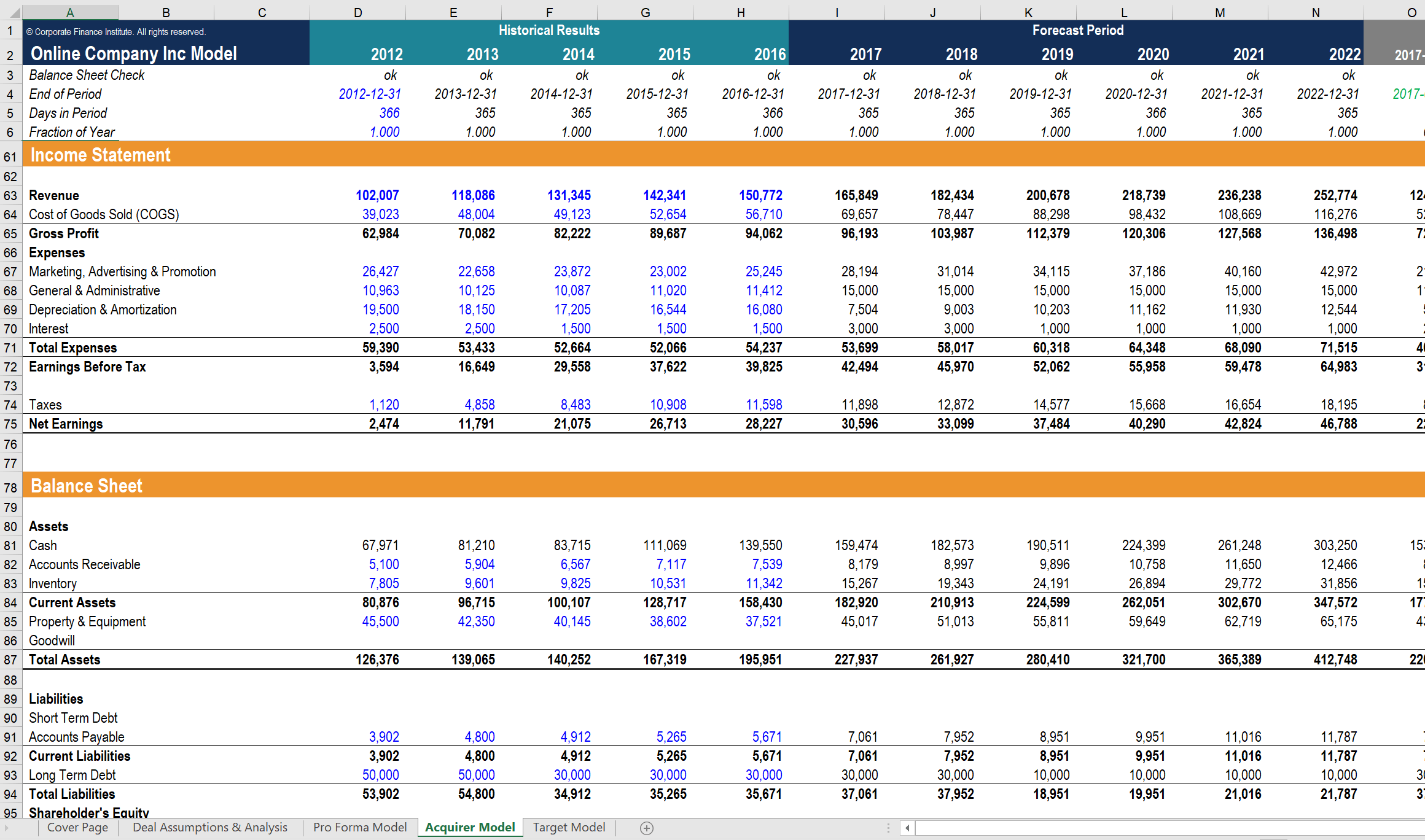

Income capitalization approach excel. The three most common are the cost approach the sales comparison method and the income approach. The capitalization rate is a profitability metric used to determine the return on investment of a real estate property. Income capitalization approach excel. On this page we focus on the direct capitalization method.

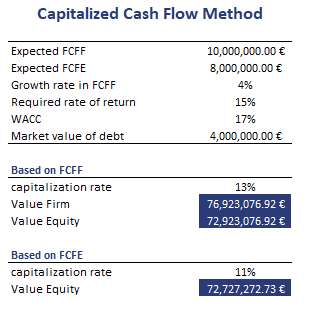

The capitalized cash flow method cmm is a method used to value private companies. However since value is very sensitive to estimates of growth rate and required rate of return these inputs must be sound. The difference is that the direct capitalization method estimates value using a single year s income while the yield capitalization method incorporates income over a multi year holding period. Valuation real estate real estate valuation income approach capitalization method cost approach.

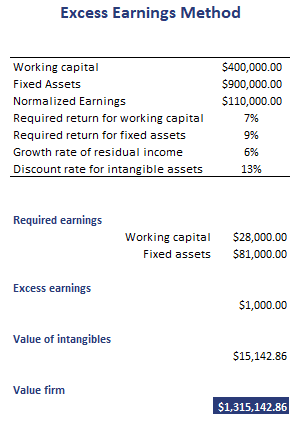

It also known as the capitalized income valuation method or capitalization of earnings method under this method a single value of economic benefit is capitalized at a capitalization ratio to arrive at the firm s value. Let s take a look at both methods in some more depth. Also it includes a sensitivity analysis of the output value obtained through the income approach. There are two approaches that fall under the income approach the direct capitalization approach and the discounted cash flow method.

In commercial real estate there are a few generally accepted methods for appraising or valuing real property. Net operating income i capitalization rate r value v you can break this formula down into these three steps. The capitalized income approach or direct capitalization income approach is a valuation method used for real estate. Capitalization rate can be defined as the rate of return for an investor investing money in real estate properties based on the net operating income that the property generates.

Relative valuation it doesn t rely on any past similar transactions. The second income approach method is the discounted. Applying the irv formula to arrive at a value estimate. Income approach is a powerful and effective approach because unlike market approach i e.

The direct capitalization method and the yield capitalization method. The formula for the capitalization rate is calculated as net operating income divided by the current market value of the asset. The program will teach you how to build a model in excel from scratch. Determining the capitalization rate.

There are two methods for capitalizing future income into a present value. The basic formula for this approach commonly referred to as irv is. The income approach includes two methods the simpler of the two is the direct capitalization method which this post will cover. Capitalization rate net operating income current market value of the property examples of capitalization rate formula with excel template.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)