Passive Investment Income Tax Rates Canada

In july and october 2017 proposals to tax investment income in private corporations were put forward by the federal government.

Passive investment income tax rates canada. However a portion of the federal tax on passive and dividend income is refundable when a taxable dividend is paid to a corporation s shareholder. Short term passive income tax rates as mentioned previously short term gains apply to assets held for a year or less and are taxed as ordinary income. In 2019 the company will earn 500 000 of active business income. That means that an increase in passive investment income of 100 000 from 50 000 to 150 000 would result in an additional 80 000 of tax on active business income.

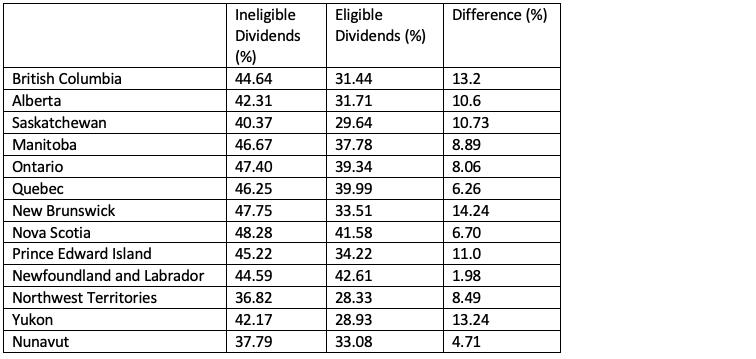

But the tax rate on the business income made has gone up from 13 5 under the old rules to 21 8 under the new rules. Combined federal provincial tax rate on investment income earned by ccpcs will decline from 50 67 to 49 67 and the combined tax rate on investment income earned by non ccpcs will decrease from 27 00 to 26 00. The tax rate on the passive investment income is 50 which is the same under the old and new rules. As outlined the effective tax rate on passive income is 50 7 while dividend income is taxed at 38 3.

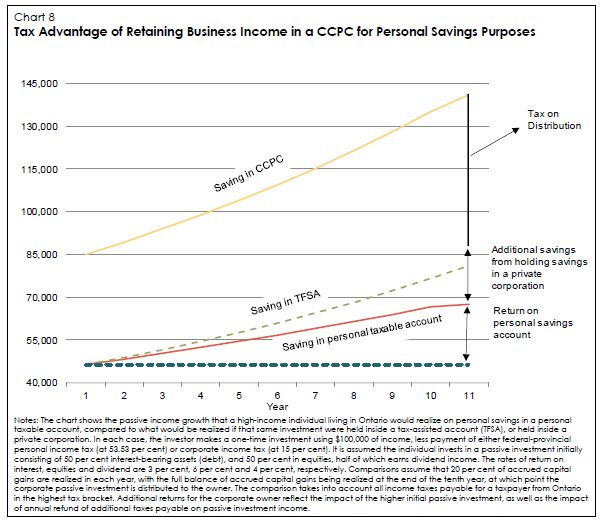

Remember for canadian controlled private corporations ccpc that income below 500 000 will be taxed at the federal small business tax rate of 9 and above 500 000 will be taxed at the federal active business income tax rate of 15. Registered plans like tax free savings accounts tfsas or registered retirement savings plans rrsps may fully or temporarily shield investment earnings from inclusion in the income of the. Below the calculator you will also find the table on the tax treatment of assets held within a ccpc. Passive investment income on july 18 2017 the government released a consultation paper with proposals to address tax planning strategies using private corporations including an outline of possible approaches to limit the tax deferral opportunities that are associated with holding passive investments inside a private corporation.

In other words short term capital gains are taxed at the same rate as your income tax. As illustrated in the table below the passive income rule change will result in the company paying 40 000 more tax than it would have before the cra passive income tax changes. 10 12 22 24 32 35 and 37. British columbia increased its general corporate income tax rate from 11 00 to 12 00 effective 1 january 2018.

All passive income earned through investments that are part of a non registered investment plan or portfolio are considered to be taxable income in canada. This is a federal calculation only as the provinces do not have a refundable component. The current tax rates for short term gains are as follows.