Passive Loss Deduction Income Limit

The passive activity loss rules are perhaps the largest limiting factor when it comes to deducting rental income losses and they apply to non active rental property investors.

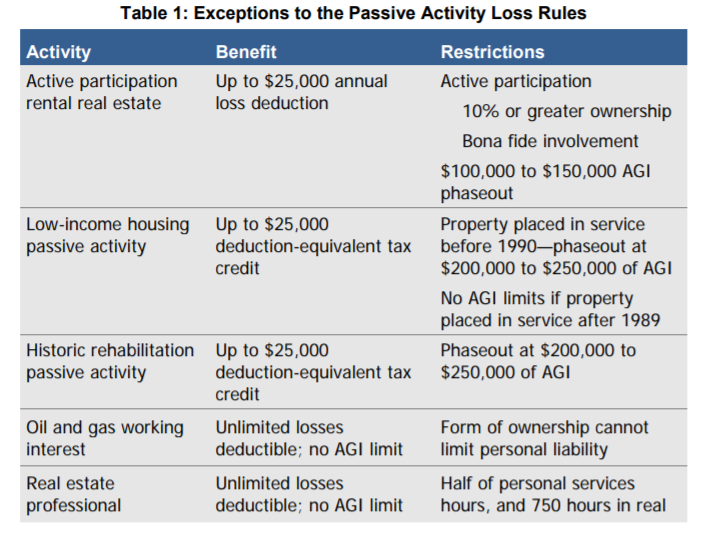

Passive loss deduction income limit. However come tax time he s in for a shock. If your modified adjusted gross income is 150 000 or more or 75 000 or more if you re married and filing separately you usually can t claim passive activity loss against other income. If you aren t a. This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out.

Specifically passive loss reduces 1 for every 2 over 100 000 adjusted gross income and by 150 000 for married couples the passive loss deduction is 0. 25 000 limit is reduced to 20 000. A passive activity is one wherein the taxpayer did not materially. For purposes of item 1 above an item of deduction arises in the taxable year in which the item would be allowable as a deduction under the taxpayer s method of accounting if taxable income for all taxable years were determined without regard to the passive activity rules and without regard to the basis excess farm loss and at risk limits.

Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. Your joint income pushes you over the threshold so you can t claim passive losses against other types of income. Because passive losses are only deductible from passive income sidney cannot deduct his 75 000 passive loss from his medical practice income or his investment income. The term was defined in 1986 when the passive activity loss rules went into effect to try to close a tax loophole that allowed high income individuals with substantial on paper passive losses to.

Passive loss limits max out at 25 000 and that number decreases as your gross income increases.