Sallie Mae Income Driven Repayment Plan Form

Your payment may be allocated and applied differently depending on whether you have a federal or private loan the status of your loan and if you have multiple loans that are combined into one billing or loan group.

Sallie mae income driven repayment plan form. Loans in hardship forbearance or on a modified repayment plan like income driven or graduated repayments can t qualify. Sallie mae private student loan repayment options. To be considered for an. Demonstrated ability to make repayments on your own.

Standard graduated and extended repayment plans can change the number of years you pay so your payments are more manageable. Plus you have a six month grace period after graduation. This plan helps you cut down on accruing interest. We offer a number of repayment options over the life of your loan.

Private student loans don t have the same repayment options as federal loans and those specific options can differ from lender to lender. You pay 25 a. Sallie mae or the student loan marketing association was founded in the early 70s as a federal government sponsored organization. Income driven programs such as the pay as you earn repayment plan income based repayment plan income contingent repayment plan and income sensitive repayment plan take your earnings into consideration by instituting a graduated payment or longer period or both.

This requirement isn t all or nothing. 1845 0102 form approved expiration date. To find out the repayment term for your student loans log in to your sallie mae account. It no longer answers to.

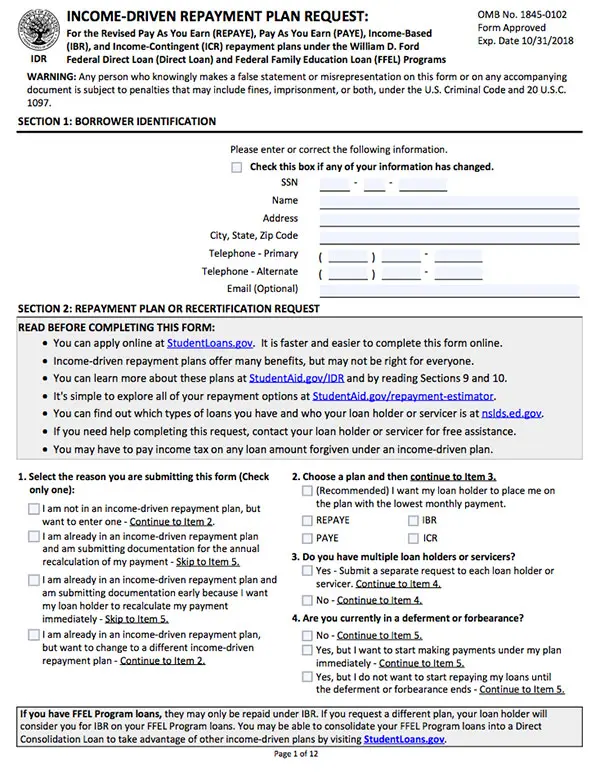

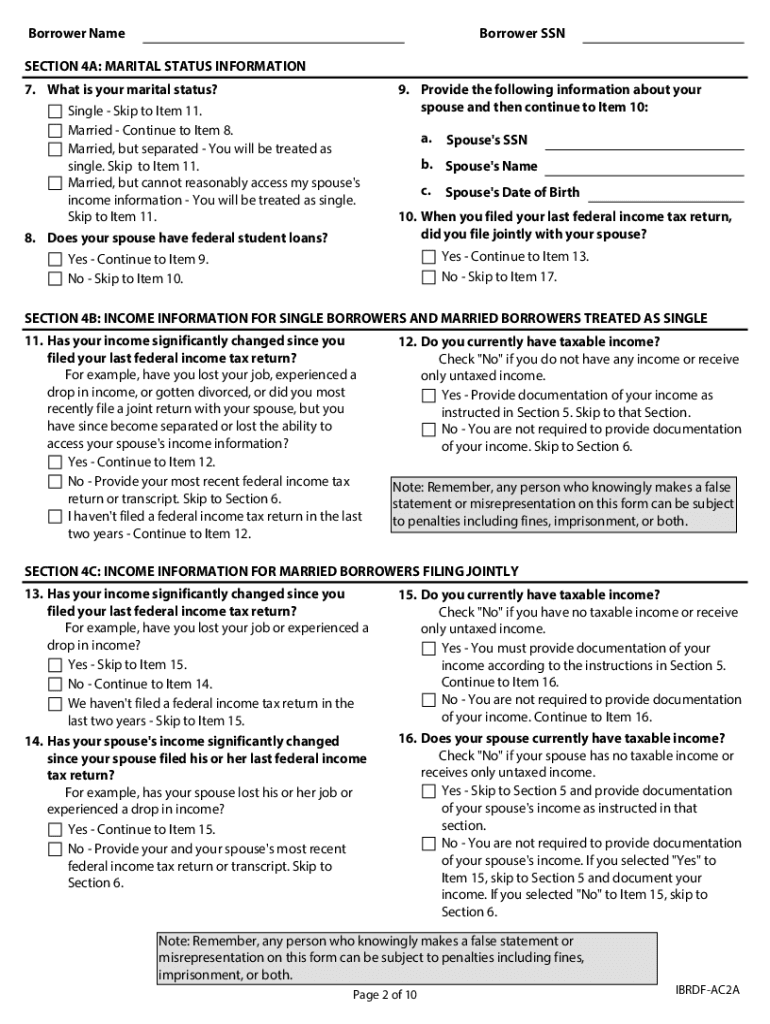

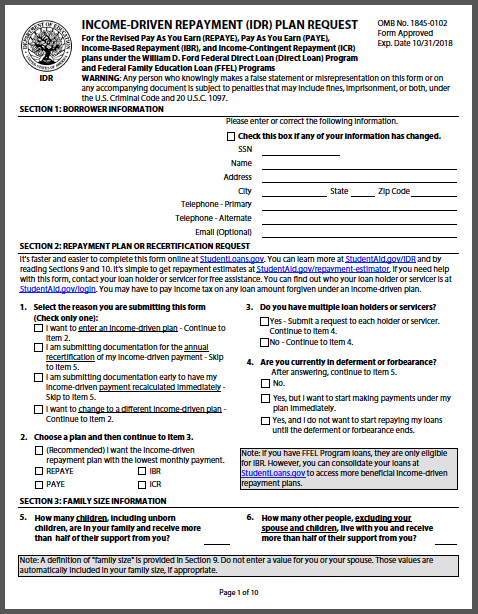

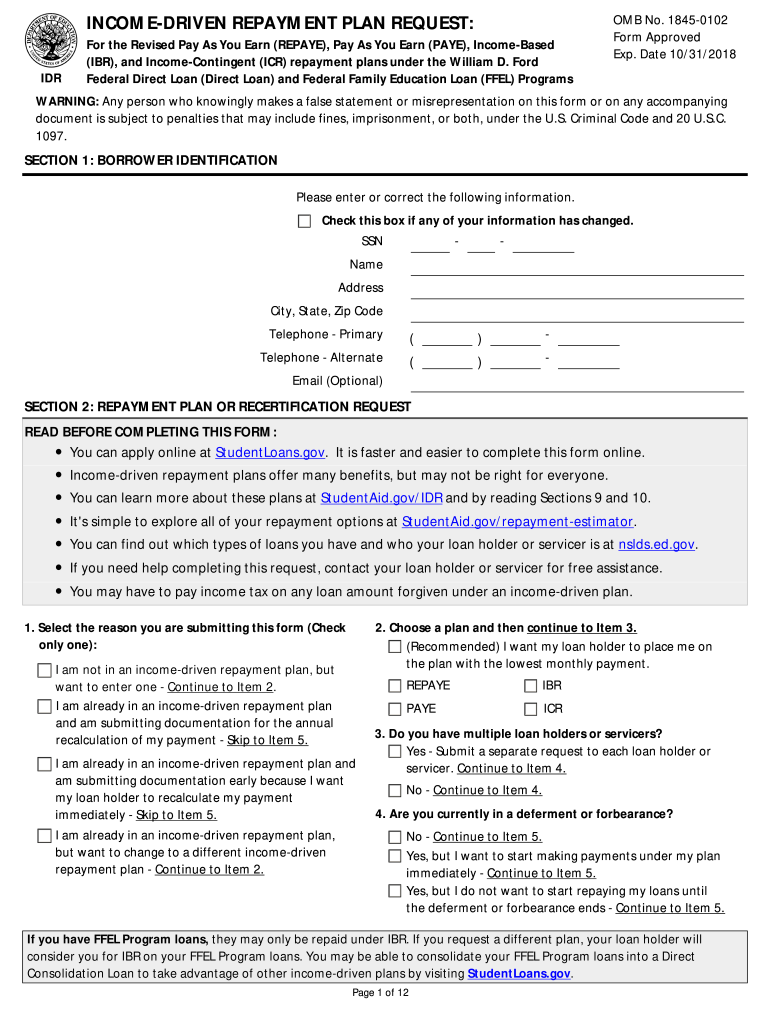

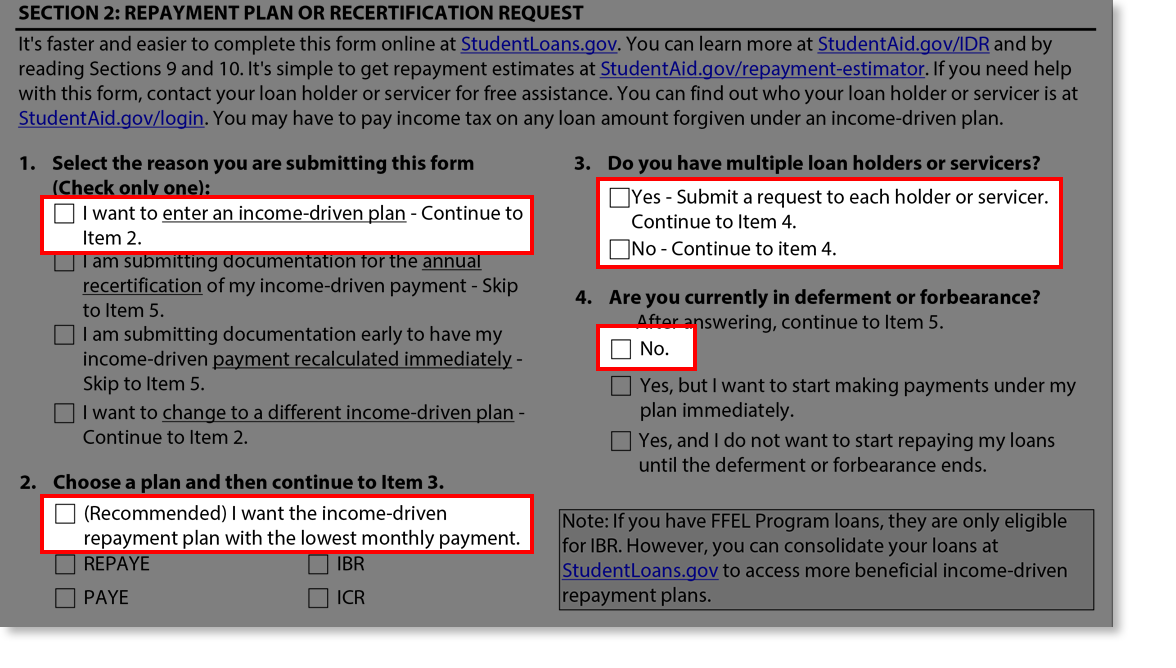

What sallie mae is and what role they play in granting and managing student loans can be confusing. If you need help in filling out the form contact your loan servicer. For the revised pay as you earn repaye pay as you earn paye income based repayment ibr and income contingent repayment icr plans under the william d. Income driven repayment idr plan request.

It s currently a publicly traded company on the nasdaq stock market. If only some of your sallie mae loans are ineligible you can still apply for cosigner release on the others that qualify. If you need to make lower monthly payments or if your outstanding federal student loan debt represents a significant portion of your annual income one of the following income driven plans may be right for you. Fill out the form attach necessary documentation and mail to the address as instructed.

Ask your student loan servicer for the income driven repayment plan form. Sallie mae repayment options. Income driven repayment idr plans are designed to make your student loan debt more manageable by reducing your monthly payment amount. Ford federal direct loan direct loan program and federal family education loan ffel programs.

Sallie mae offers three repayment plans for private student loans. A quick history should clear this up. With this option you make no scheduled loan payments at all while you attend school. Here s a sample but be sure to use the official application form provided by your servicer.

No forbearance or modified repayment plans. But it later became privatized. Which information you ll need to provide.