Income Tax Brackets Switzerland

For taxable income above chf 755 200 the overall tax rate will be 11 5.

Income tax brackets switzerland. Zurich cantonal tax basic tax. The federal income tax rates range from 0 77 for single taxpayers and 1 for married taxpayers to a maximum rate of 11 5. That means that your net pay will be chf 43 128 per year or chf 3 594 per month. Your average tax rate is 13 7 and your marginal tax rate is 22 9.

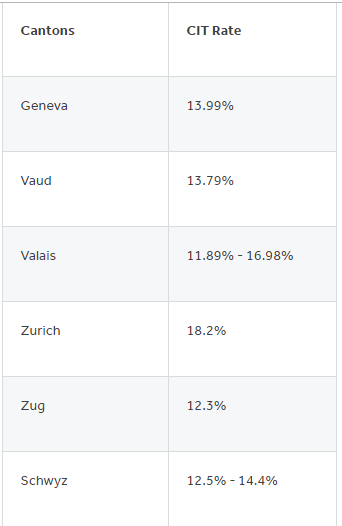

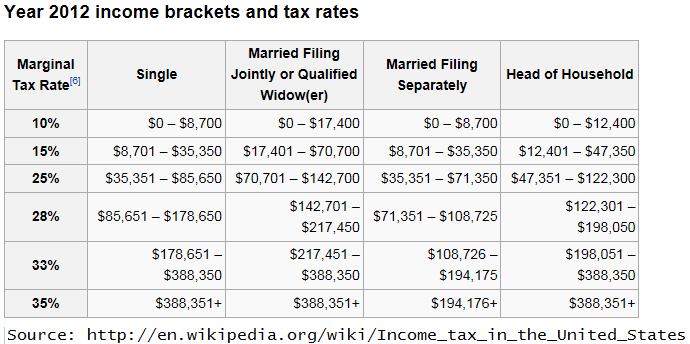

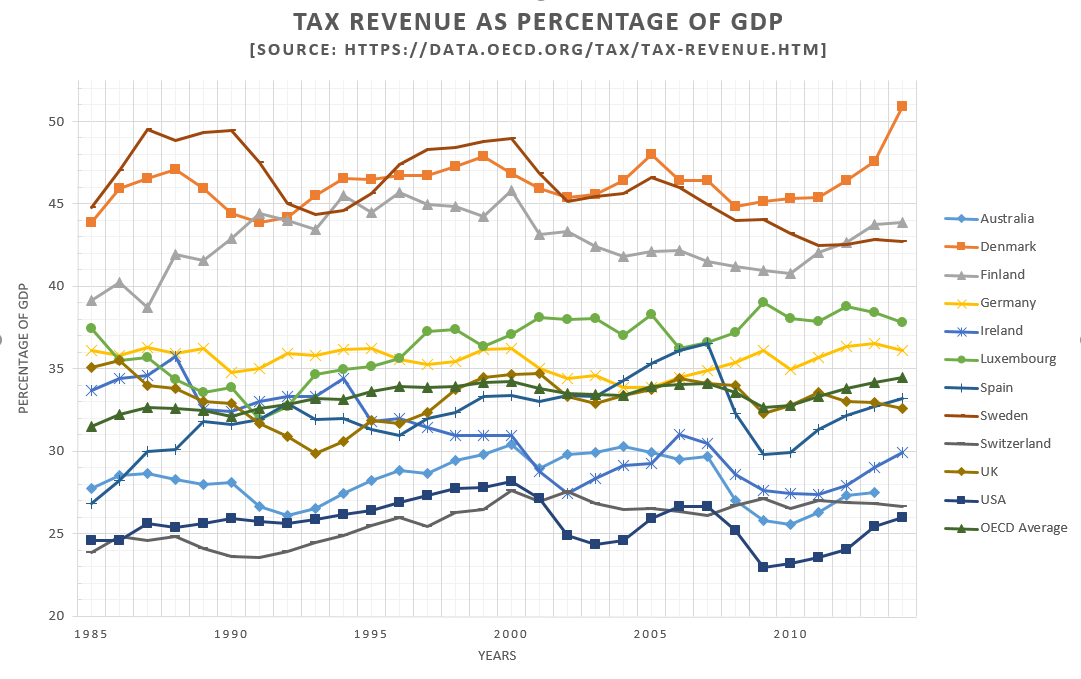

Federal income tax rates range between 10 per cent and 40 per cent and depending what state you live in you can pay an additional state income tax ranging from 0 per cent no tax or at the highest end 13 3 per cent in california. Ii married taxpayers and single taxpayers with minor children for taxable income above chf 895 900 the overall tax rate will be 11 5. Value added tax vat as a matter of principle proceeds of sales and services conducted in switzerland are subject to the general swiss vat rate of 7 7 since 1 january 2018. Foreign employees residing in switzerland whose gross salary does not exceed chf 120 000 per year chf 500 000 in the republic and canton of geneva but who have additional sources of income or additional assets e g income from securities real estate property are also obliged to file a tax return.

The personal income tax rate in switzerland stands at 40 percent. Personal income tax rate in switzerland averaged 40 09 percent from 2004 until 2020 reaching an all time high of 40 40 percent in 2005 and a record low of 40 percent in 2008. Switzerland has a bracketed income tax system with ten income tax brackets ranging from a low of 0 00 for those earning under 13 600 to a high of 13 20 for those earning more then 166 200 a year. Just like in switzerland taxes in the united states are levied at both state and federal levels which sees large differences in income tax paid in different parts of the country.