S Corporation Passive Income Limitation

Fn8 but where a company becomes an s corp and its passive income exceeds 25 of its annual income it will be required to pay tax at the corporate rate of 21 on its passive income in excess of 25.

S corporation passive income limitation. A partner allocates its distributive share of partnership income between passive limitation income and general limitation income based on the character of the income at the partnership level. More than 25 of its gross receipts for the year are passive investment income and. If the business does generate more than 25 percent of its receipts from passive income the excess is taxed at the highest corporate income rate. The excess business loss limitation is applied at the s corporation shareholder level and for purposes of applying the limitation an s corporation shareholder will take into account its allocable share of entity income loss gain and deduction from trades or businesses attributable to the s corporation in its tax year within which the tax year of the s corporation ends.

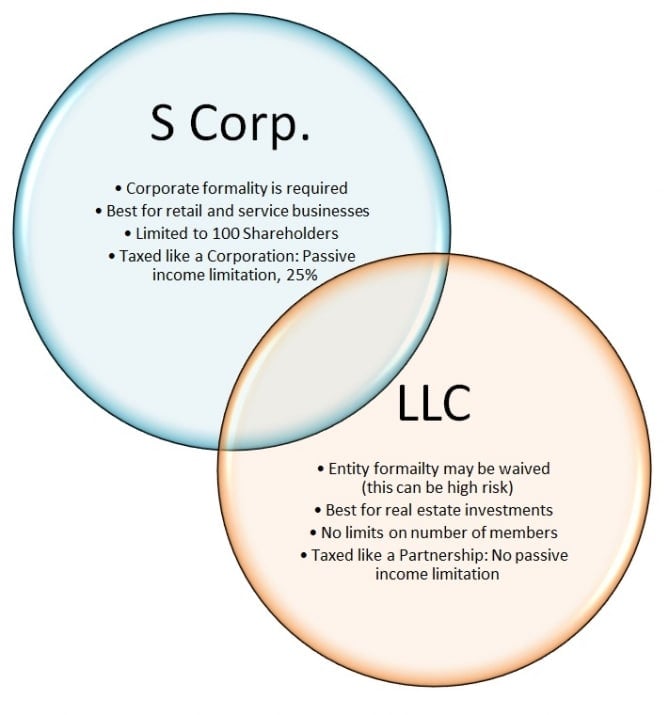

Some people opt to establish an s corporation in the united states for their contract which means the w 2 and schedule k 1 income are excluded from income tax up to a certain amount. If an s corporation has income earnings for the year no more than 25 percent of its gross receipts for the year may be generated by passive income. One example of passive versus non passive income is the money an author earns from the sale of his book. An s corporation is not permitted to generate more than 25 percent of its gross receipts from passive income in any given year if it has accumulated earnings and profits.

If the s corporation has accumulated earnings and profits from its days as a c corporation the irs limits its passive income to 25 percent of its gross receipts. The tax is imposed at the highest corporate tax rate 35. Because d materially participates in s s operation the income from s will be nonpassive and d cannot offset it with passive losses. D s adjusted gross income agi in the years before his retirement is 125 000 as determined in exhibit 1.

The rules applicable to partners in a partnership also apply to shareholders in an s corporation. The corporation has accumulated e p from tax years in which it was a c corporation. Capital gains and or losses. An s corporation election may be terminated involuntarily if the entity ceases to qualify as a small business corporation or its passive income exceeds the passive income limitation.

People working abroad can exclude a percentage of their earned income while working overseas. An s corporation ceases to qualify as an s corporation if it does not meet the criteria in sec. Allocating foreign income taxes.