Qbi Deduction On Passive Income

The inclusion of reits in the qbi deduction therefore provides.

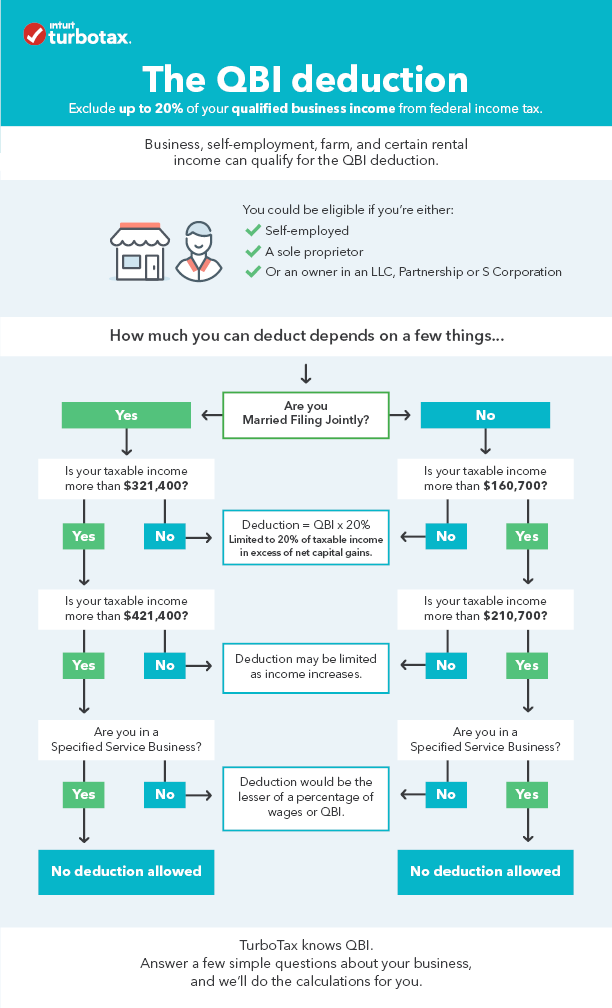

Qbi deduction on passive income. Joint filers with taxable income before the qbi deduction of 315 000 or less 157 500 for all other filers will compute the qbi deduction in a few easy steps. First they must determine the net taxable income from all their businesses. With the qbi deduction most self employed taxpayers and small business owners can exclude up to 20 of their qualified business income from federal income tax. In addition any losses disallowed before jan.

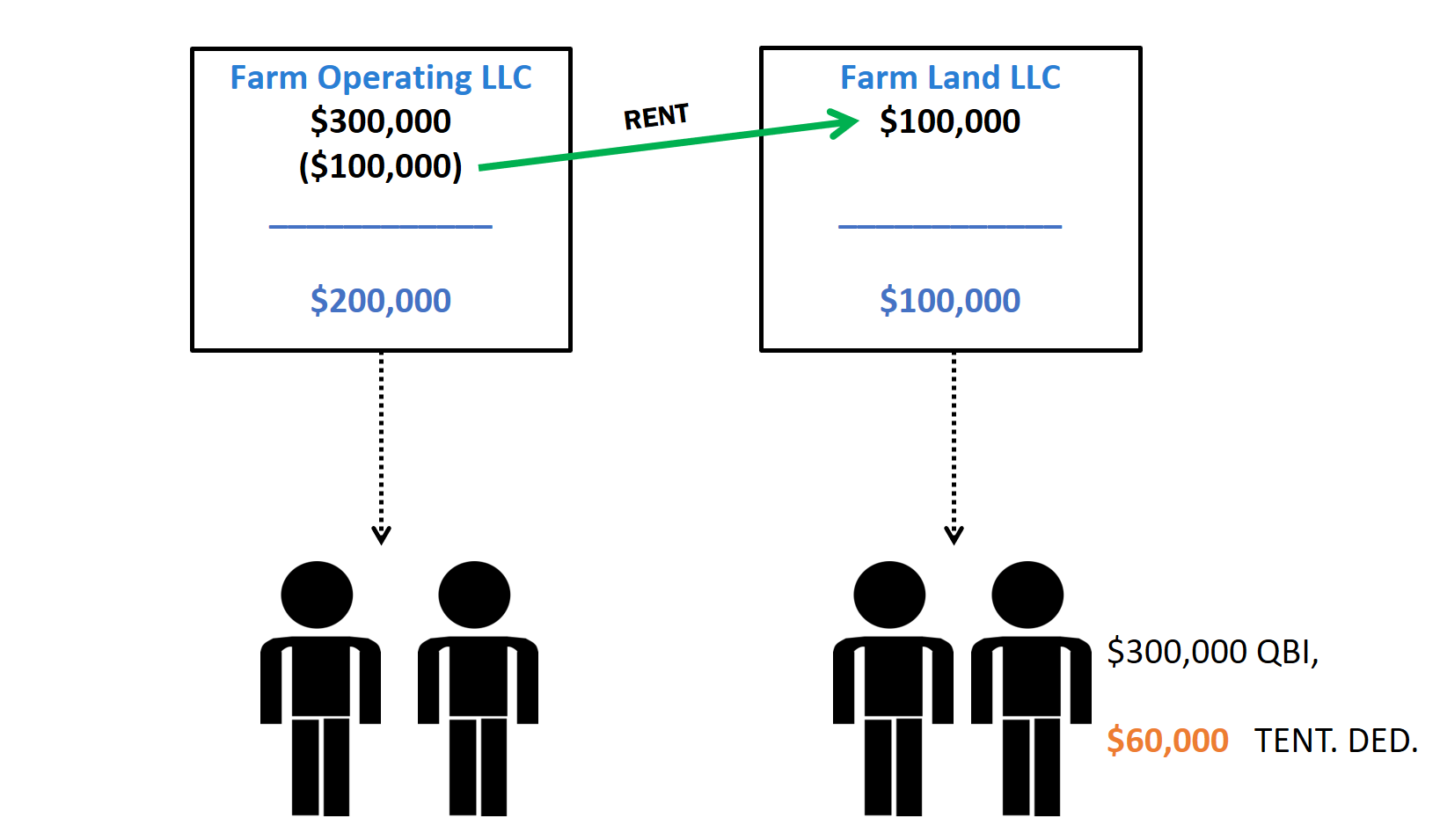

Taxpayer a has disallowed pals of 30 000 and 50 000 for 2018 and 2017 respectively and has passive income of 35 000 in 2019. The qbi deduction offers a way to lower the effective tax rate on the profits of owners of pass through entities trade or business where the income passes through to the owner s individual tax return. The qualified business income qbi deduction is a tax deduction for pass through entities. Consider the following scenario.

If the net overall qbi is less than zero it is carried forward as a loss from a separate qualified business and will reduce any potential qbi deduction in the following year irc sec. Rental real estate as passive income although real estate has some favorable provisions compared to w2 income. Learn if your business qualifies for the qbi deduction of up to 20. There are some aspects that bother me.

All income and losses are from qualified trades or businesses. Passive rental activities that are not considered a trade or business for example a single family dwelling rented out for a year or more in which there is little or no interaction between the landlord and the tenants other than periodically collecting rent and the occasional repair. Qbi deduction for taxpayers below the threshold. Those who can claim the qbi deduction include sole proprietors the partners of a partnership the shareholders in s corporations as well as some.

Reits traditionally invest primarily in commercial real estate or real estate financing and can either be publicly or privately traded. The qbi deduction is typically not available to those who only receive passive investment income e g dividends interest capital gains. Income from these types of rentals is specifically excluded for the purposes of the qbi deduction. It drastically cut the corporate tax rate but it also introduced the qualified business income qbi deduction.

Qualified business income qbi passive activity loss carryover is created when losses from one qbi qualified business are netted against the gains from another.