Passive Losses Offset Ordinary Income

Passive activity loss rules are a set of irs rules that prohibit using passive losses to offset earned or ordinary income.

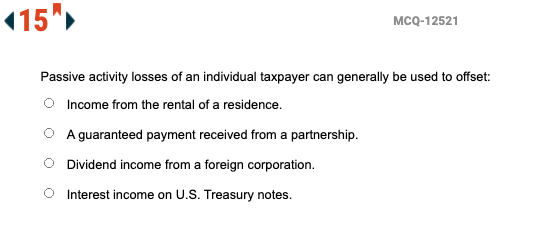

Passive losses offset ordinary income. So if enough passive income is not available as an offset the passive loss will carry forward into the following tax year as a net operating loss nol. Uncertainty exists over the taxa4on of llc income for seemingly passive investors. Business losses may be limited if they result from what the irs calls passive activity that is a business in which the owner does not participate on a regular continuous or substantial basis. Passive losses are only offset by passive income not income from stocks bonds interest and dividends.

Any offset above the 25 000 each year is carried over to the following year. The depreciation deductions are limited to the amount of rental income passive income and cannot be used to reduce ordinary income. Rentals and businesses without material participation. The term was defined in 1986 when the passive activity loss rules went into effect to try to close a tax loophole that allowed high income individuals with substantial on paper passive losses to.

Passive income is subject to ordinary income tax but is exempt from self employment taxes in partnerships. The 500 in losses from her llc interest is active in nature. The suspended and current passive ordinary losses from property a would be deductible against nonpassive income in the year of disposition. Nonpassive income and losses cannot be offset with passive losses or income.

Passive activity loss rules prevent investors from using losses incurred. A limited partner is generally passive due to more restrictive tests for. According to the irs. My adjusted gross income is under 100 000 and so the passive loss including phantom loss from depreciation deductions from mortgage interest and property tax etc from my rental properties will be offsetting my ordinary income by a maximum of 25 000 each year.

However none of property b s current year loss or pal carryover is deductible because the corporation does not have any passive income or active income with which to offset these losses. The active losses can however be carried forward to offset future active income. Losses resulting from passive activity can only be deducted up to the amount of income from that business. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less.

For example wages or self employment income cannot be offset by losses from partnerships or other passive activities.

/Target1-de0fcdc67fc44470805a5ccdf3b105e0.png)