Income Driven Repayment Plan Taxable Income

Borrowers bills are capped at a portion of their income.

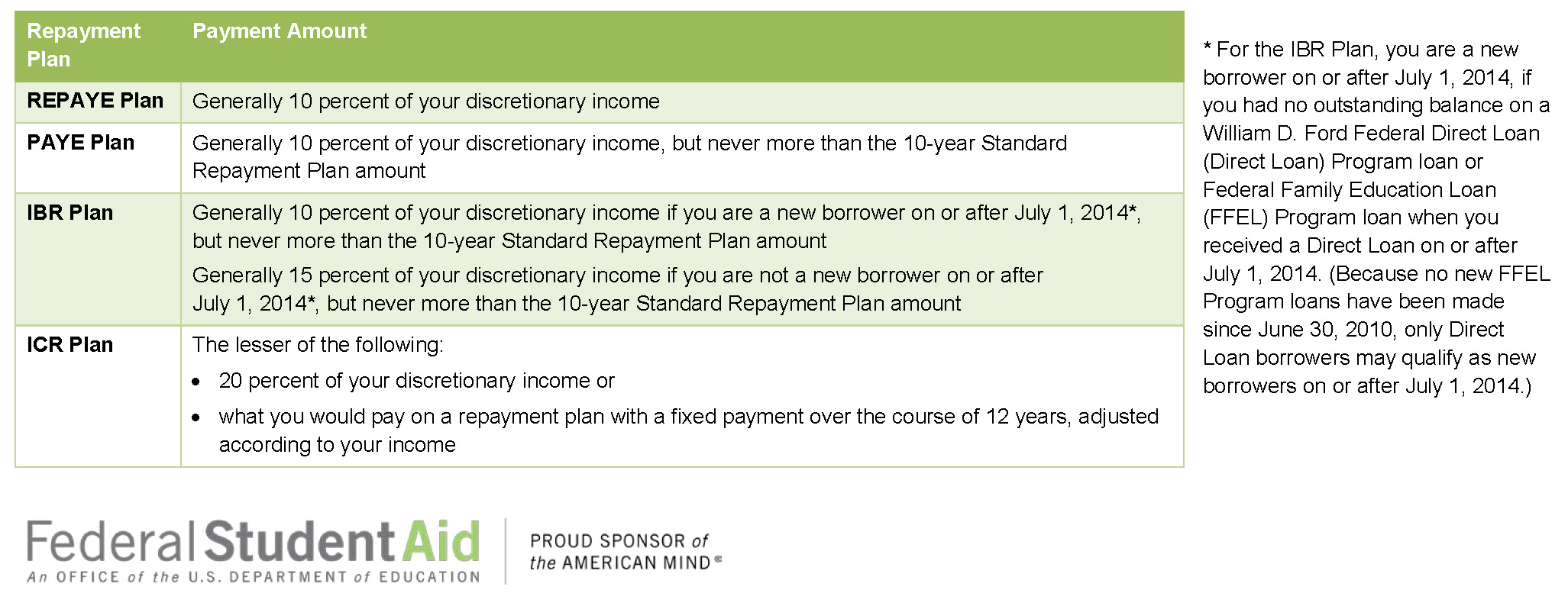

Income driven repayment plan taxable income. The monthly payment will be 20 of your discretionary income or what you would pay to repay the loan in a 12 year period. Ford federal direct loan direct loan program and federal family education loan ffel programs. However those payments might not be affordable. Some payments wind.

The complexity of the income driven repayment plans can cause borrowers to choose the wrong income driven repayment plan. Pros and cons of income based repayment plans compared to what. Government accountability office gao has found signs of potential fraud involving more than 110 000 borrowers who are repaying their federal student loans in income driven repayment plans. You ll be allowed to pay the lesser of these two options.

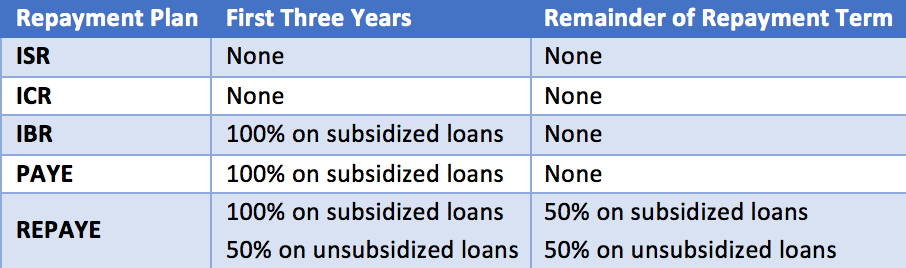

1845 0102 form approved expiration. The choice of income driven repayment plan depends on the borrower s specific circumstances and goals. Income driven student loan repayment plans which started with income contingent repayment icr in 1993 can make monthly repayment substantially more affordable for many borrowers by limiting student loan payments to no more than a certain percentage of income. For the revised pay as you earn repaye pay as you earn paye income based repayment ibr and income contingent repayment icr plans under the william d.

Income driven repayment idr can be a lifeline for millions of student loan borrowers. Income driven plans only make sense in comparison to the standard repayment plan. Under the standard program you make fixed monthly payments that cover your interest costs and loan balance over 10 years. Idr is a category of federal student loan repayment plans that allows borrowers to have an affordable.

If the borrower s goal is to have the lowest monthly payment the choice of income driven repayment plan matters. Enter income driven repayment plans which some 8 million borrowers are enrolled in. These borrowers may have understated their income or overstated their family size to reduce their student loan payments in the income driven repayment plans. Department of health and human services hhs.

The final option for income driven repayment plans is the income contingent repayment plan.