Passive Activity Loss Rules Self Rental

The passive activity loss rules.

Passive activity loss rules self rental. See irs publication 925 passive activity and at risk rules for further information. Selecting self rental or land will trigger the recharacterization of passive income rules. If you are currently involved in a self rental or are considering this transaction there are methods whereby you can avoid or reduce the disadvantageous tax effect of the self rental rule. Beyond that is one of several recurring themes of this blog of which every tax adviser needs to be mindful when reviewing the tax and economic consequences and the associated risks of a transaction.

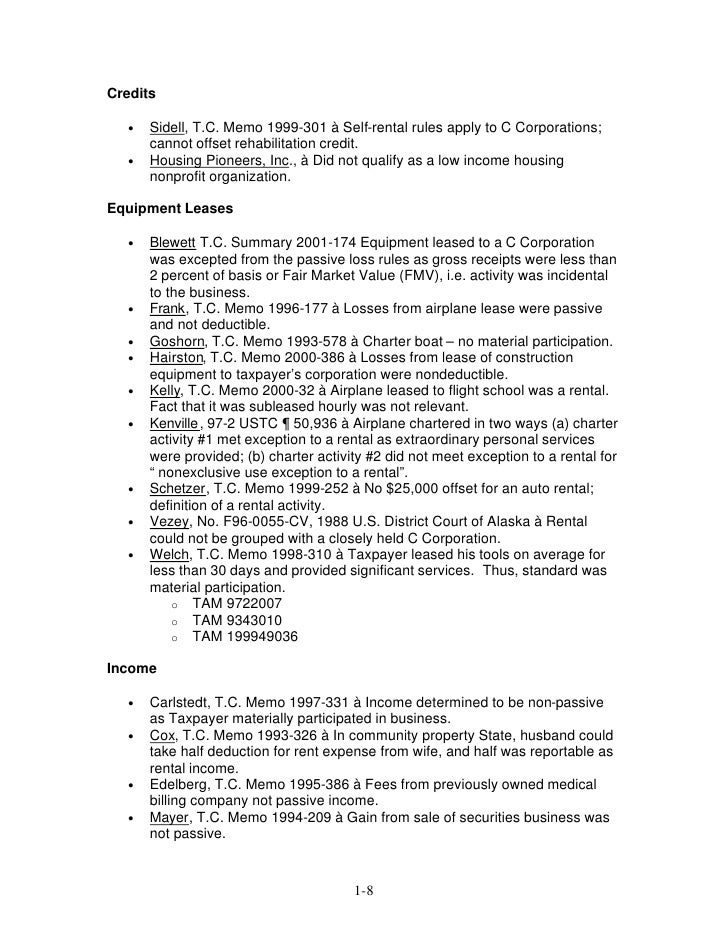

The self rental rule in irc section 469 applies when you rent property to a business in which you or your spouse materially participates. Under the rule any rental losses are still considered passive but the rental income is deemed nonpassive. That means your self rental profits can t be offset by passive losses and the self rental losses. The self rental rule characterizes the 50 000 of rental loss as passive which cannot offset the nonpassive income from the distribution company.

If you rent property to one of your own businesses you may accidentally catch the eye of the irs. Starting with the obvious self charged rental may present an issue for taxpayers whose activities are subject to the passive loss rules. Under the rule any rental losses are still considered passive but the rental income is deemed nonpassive. Under these rules a net loss for the activity will be treated as a passive loss while net income for the activity will be treated as nonpassive income.

To understand the tax repercussions of self rental arrangements you first must understand the passive activity loss rules. The self rental rule in irc section 469 applies when you rent property to a business in which you or your spouse materially participates. A passive activity loss is the excess of the taxpayer s aggregate losses from all passive activities for the year over the aggregate income from all of those activities. That means your rental profits can t be offset by passive losses and the rental losses generally.

Under the self rental rule the rental losses are still considered to be passive losses deductible only to the extent of passive income while the income is treated as active income carlos 123 tc 275 2004. However this provision does not cover any loss that may arise from the rental activity. The court concluded that the self rental rule applied to the s corporation s rental of the real property.