Income After Tax Calculator Nevada

Budget 2020 21 update this calculator has now been updated with tax changes set out in the october 2020 budget.

Income after tax calculator nevada. 11 income tax and related need to knows. Uniform tax rebate up to 2 000 yr free per child to help with childcare costs. As is mentioned above nevada does not have a state income tax and no cities in the state levy local income taxes. Your average tax rate is 17 24 and your marginal tax rate is 29 65 this marginal tax rate means that your immediate additional income will be taxed at this rate.

Marriage tax allowance reduce tax if you wear wore a uniform. Check your tax code you may be owed 1 000s. This breakdown will include how much income tax you are paying state taxes federal. Using our nevada salary tax calculator.

Since the tax regime changed part of the way through the year you may recieve a tax credit from overpaid payg income tax. Tax free childcare take home over 500 mth. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the u s. To use our nevada salary tax calculator all you have to do is enter the necessary details and click on the calculate button.

The tax rate ranges from 0 all the way up to 37. Of course you must still pay federal income taxes. After a few seconds you will be provided with a full breakdown of the tax you are paying. This calculator is always up to date and conforms to official australian tax office rates and formulas.

Calculate your nevada net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local w4 information into this free nevada paycheck calculator. Now that you have adjusted gross pay you can calculate the amount of federal income tax that your employees owe the irs. You can find all the minute details in the irs publication 15 t. Your average tax rate is 22 08 and your marginal tax rate is 35 98 this marginal tax rate means that your immediate additional income will be taxed at this rate.

Free tax code calculator transfer unused allowance to your spouse. Property taxes are also not a major source of financial concern for most nevadans. The average homeowner in the state pays annual property taxes that are equal to 0 69 of their home s market value so annual property taxes shouldn. Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more.

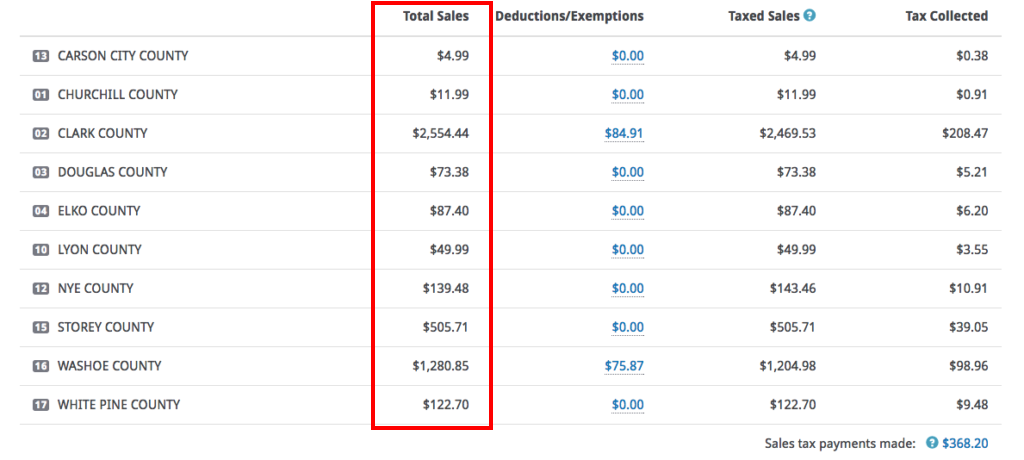

Calculate the federal income tax. If you make 55 000 a year living in the region of nevada usa you will be taxed 9 482 that means that your net pay will be 45 518 per year or 3 793 per month. Nevada s statewide sales tax rate of 6 85 is seventh highest in the u s. The table below shows the county and city rates for every county and the largest cities in the state.