Income Capitalization Approach Vs Discounted Cash Flow

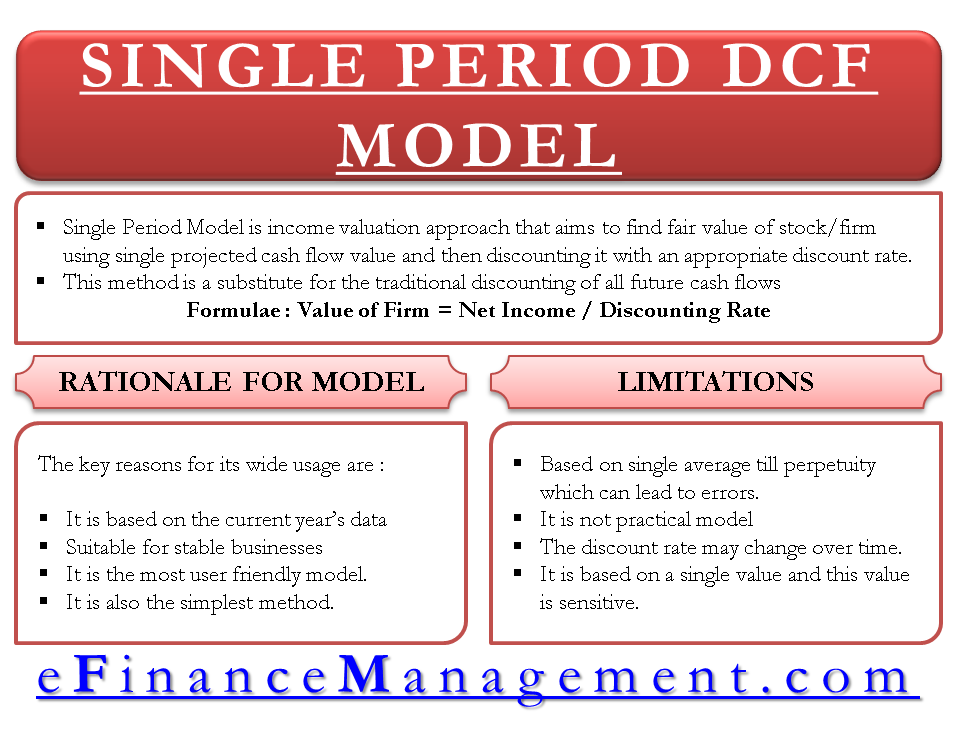

Under the income approach future cash flow drives value.

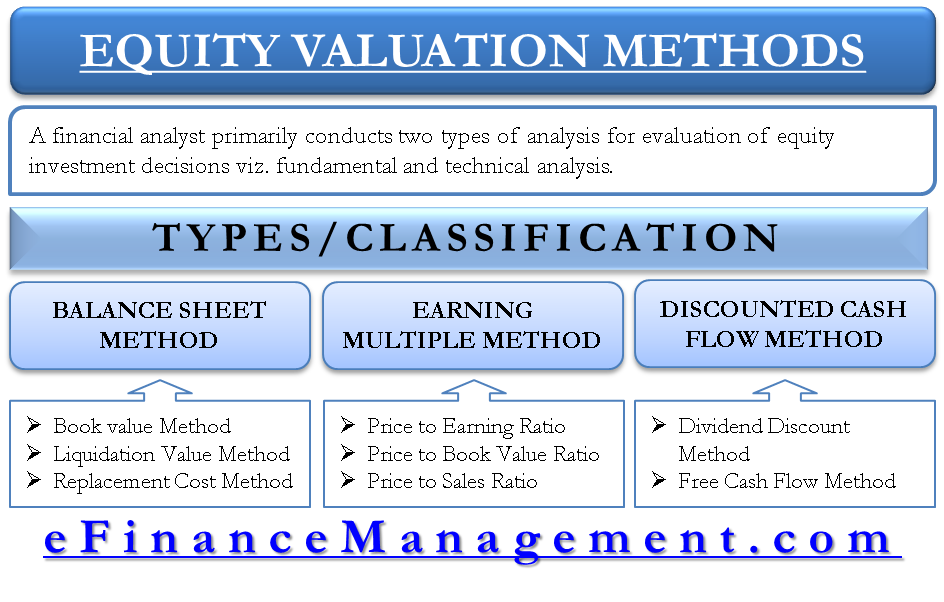

Income capitalization approach vs discounted cash flow. Although that sounds simple there are several methods that fall under the income approach including discounted cash flow and capitalization of earnings. How do these two commonly used methods compare and which one is appropriate for a specific investment. Now compare the above with the well known result for the sum of the so called geometric series. The international glossary of business valuation terms defines discounted cash flows as a method within the income approach whereby the present value of future expected net cash flows is calculated using a discount rate.

Philippe dubois msf icvs a. There are two income based approaches that are primarily used when valuing a business the capitalization of cash flow method and the discounted cash flow method. Discounted cash flow versus capitalization of earnings. These methods are used to value a company based on the amount of income the company is expected to generate in the future.

:max_bytes(150000):strip_icc()/DiscountedCashFlowsvs.Comparables2-fea4624dffab4bd8bec311cb6d134a2f.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Top_3_Pitfalls_Of_Discounted_Cash_Flow_Analysis_Feb_2020-01-a5c2306a3b294872a505aa63bd2cea7e.jpg)