Passive Income Tax Rate 2019

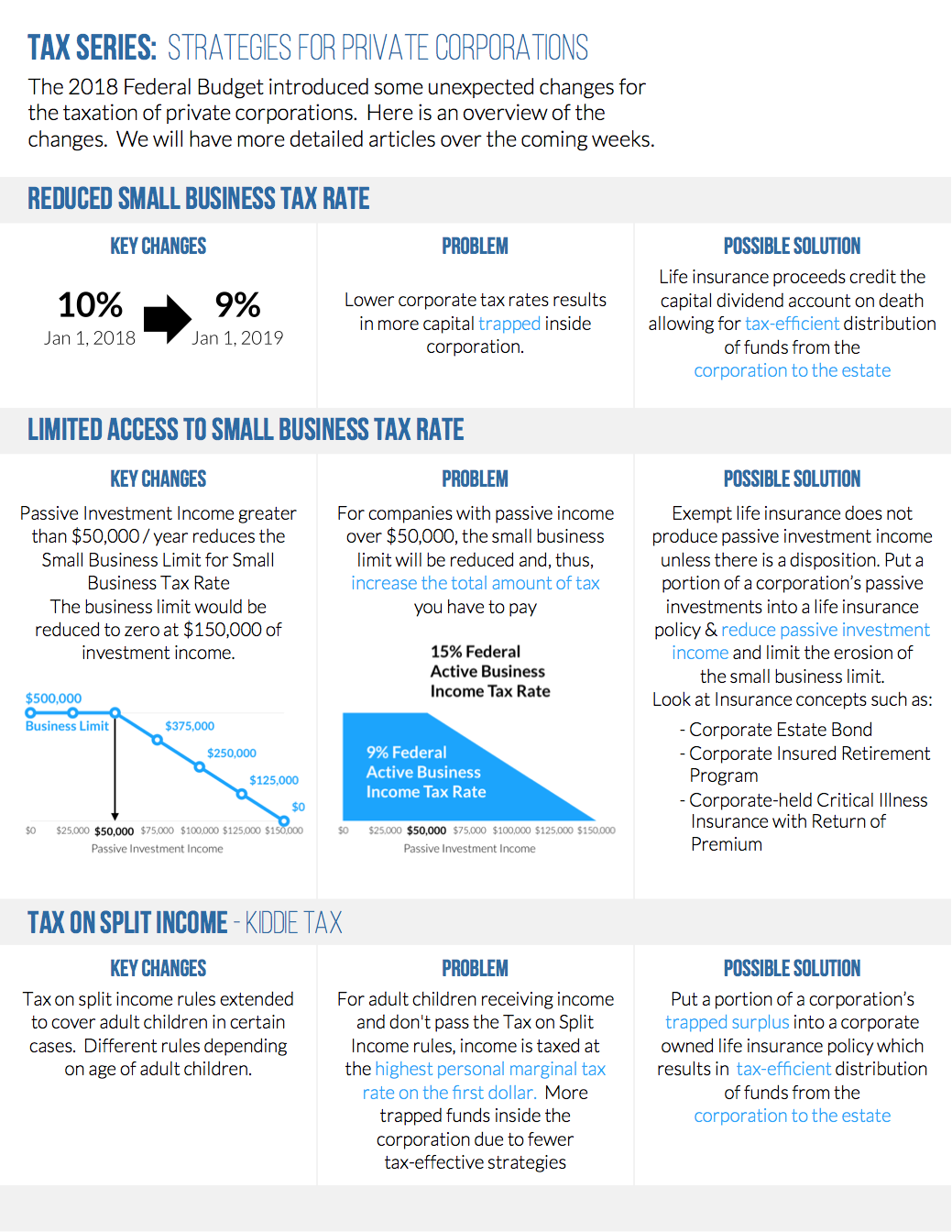

For every 1 over 50 000 in passive income earned in a given year the threshold for the small business tax rate will be lowered by 5 in the following year.

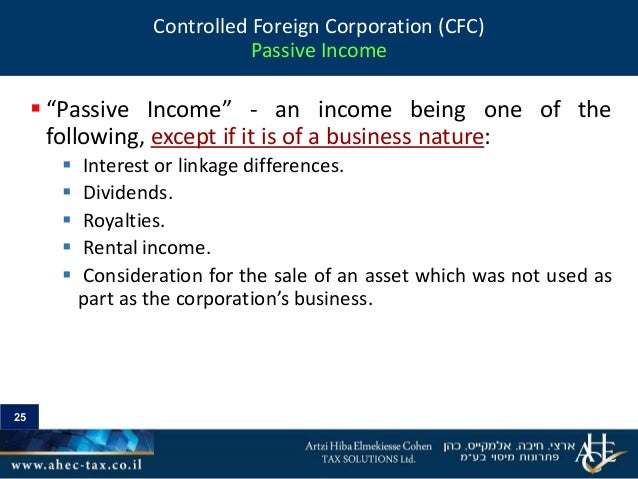

Passive income tax rate 2019. For 2017 passive income that is taxed as ordinary income will be taxed in the 2017 tax brackets and so the income tax rates range from 10 to 39 6 percent depending on your annual income. Long term capital gains and qualified dividends are taxed at zero 15 and 20 percent for 2017 but the brackets are different. Passive income broadly refers to money you don t earn from actively engaging in a trade or business. 10 12 22 24 32 35 and 37.

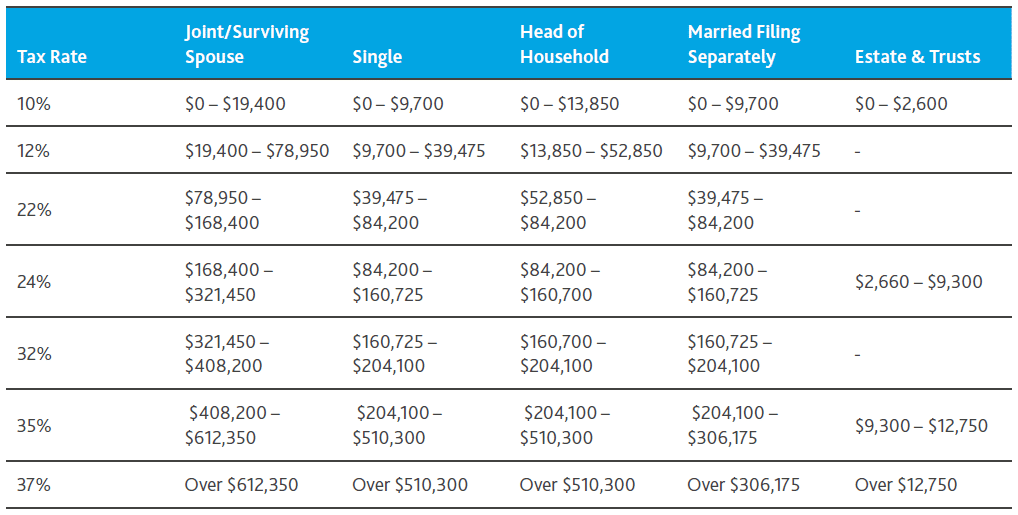

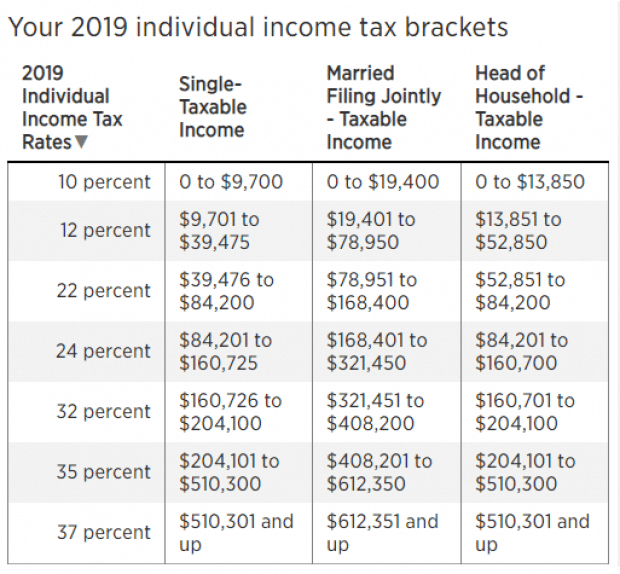

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510 300 and higher for single filers and 612 350 and higher for married couples filing jointly. Tax code you can at best put yourself in a situation where you might not have to pay taxes on all your income. Income tax brackets and rates. Short term passive income tax rates.

That s an average tax rate of just under 17. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. The cumulative tax bill above is 1 835 on 14 373 of gross annual passive income yielding a blended passive income tax rate of 13 on my personal lineup of passive investments. Summary how is passive income taxed in 2019 below is a summary table showing how much i earned from each passive income stream and the tax for each.

By its broadest definition passive income would include nearly all investment income. While rental income is considered taxable income in canada passive income from a rental property allows taxpayers to deduct many expenses associated with the earning of the rental income. These new cra passive income changes will first apply to fiscal years that start in 2019 and will reduce the maximum small business deduction available to a ccpc or associated group of ccpcs by 5 for every 1 of passive investment income earned in the previous fiscal year in excess of 50 000. Beginning in 2019 as your passive income increases there is a corresponding decrease in the amount of your active business income that can be taxed at the small business tax rate.

The current tax rates for short term gains are as follows. When discussing passive income tax it s important to know that the irs has a very specific definition of what passive income is. Gee that sure beats the 40 tax treatment on an extra work shift in december. In total i owed 127 44 as a result of the 752 59 in passive income i earned.

As mentioned previously short term gains apply to assets held for a year or less and are taxed as ordinary income.