Passive Activity Loss Rules On Sale Rental Property

Former passive activities are not too common but can cause confusion.

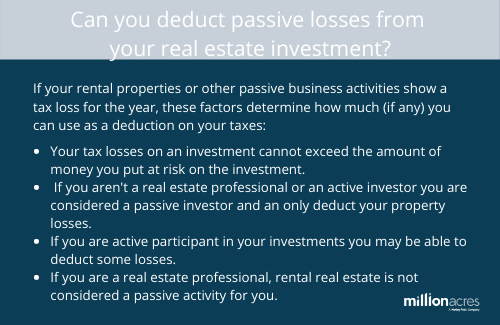

Passive activity loss rules on sale rental property. In other words even if you actively participate the passive activity loss rules still apply to rental property investors who have more than 150 000 in annual income. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. 469 if a taxpayer has a flow through loss from a passive activity the passive loss could not offset earned income or ordinary income at the individual taxpayer level. If the activity is disposed of in a fully taxable as opposed to tax deferred transaction to an unrelated party both current and suspended passive activity losses generated by that activity as well as any loss on the disposition can be deducted sec.

The passive loss rules prevent taxpayers from using losses incurred from income producing. So to deduct your suspended passive losses on real estate you cannot claim any tax deferments or exchanges. Navigate passive activity loss rules with a tax specialist. If you own only one rental property and sell it then you can take the deduction because that property is your entire rental activity.

To take this deduction you must sell substantially all of your rental activity. Any passive activity income or loss included on form 8582 any rental real estate loss allowed to real estate professionals any overall loss from a publicly traded partnership see publicly traded partnerships ptps in the instructions for form 8582 the deduction allowed for one half of self employment tax. For example tax deferred exchanges can pass losses from one activity to another transfers in a divorce a change in business format and the conversion of a property. When a taxpayer disposes of the entire interest in a passive activity that activity is no longer subject to the passive activity rules.

Under the passive activity loss rules contained in irc sec. Disposing of a passive activity allows suspended passive losses to be deducted. There are several ways in which a tax return can include an item which is not passive on the current return but which was passive at some time in the past. What happens to passive losses when a rental property is transferred to an llc answered by a verified tax professional we use cookies to give you the best possible experience on our website.

Passive activity loss rules mandate that the property sale must be taxable and account for income or loss. Figure the loss on form 4797 for the sale of business property and then report the. Rental property capital loss.