Passive And Nonpassive Income Irs

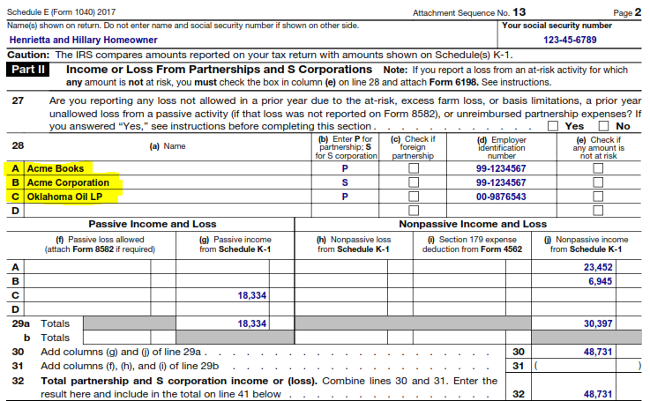

For tax purposes it is important to note that passive income losses cannot be compared or filed under regular income losses.

Passive and nonpassive income irs. Irc 469 disallows a deduction for any passive activity loss subject to a few exceptions. The tax court had to decide whether the hardys properly reported dr. If a taxpayer is nonpassive any losses that are reported can be claimed against all other income. Hardy s income from mbj as passive and if so whether they could deduct a passive activity loss carryover from previous years.

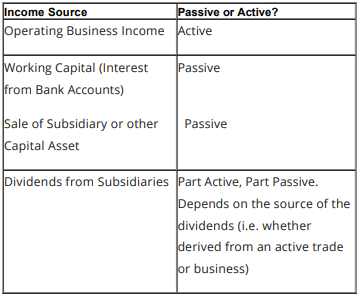

The irs then determined that the activity was non passive. Irs categorizes and treats each category differently and has set different tax deductions for each category. Passive income loss refers to the expected amount of income that was not reached during a single period. Passive activity loss is defined as the excess of the aggregate losses from all passive activities for the taxable year over the aggregate income from all passive activities for that year.

The taxpayer can be able to get all his tax details on the 26as income tax form. According to the irs non passive income loss refers to the losses endured in material business participation. Passive and nonpassive income irs internal revenue service definition is based on how the income received is taxed. That s because the irs has a strict definition which entails that only a given range of activities qualify as passive income.

According to the internal revenue service passive income incorporates a range of specific revenue streams. According to the irs non passive activities are businesses in which the taxpayer works on a regular continuous and substantial basis active non passive activities whether you re making money or losing money the following are typically considered non passive activities. The key difference between passive and non passive income is that passive income refers to the income resulting from rental activity or any other business activity in which the investor does not materially participate whereas non passive income consists of any type of active income such as wages business income or investment income. Nonpassive losses include losses incurred in the active management of a business.

On the other hand losses from a passive activity can only be claimed to offset income from other passive activities unless the interest in the pass through entity was disposed of. Salaries wages and commission income.

/GettyImages-951640954-158bffdec37041f5b772279def9c6d83.jpg)