Total Income Tax Brackets Quebec

Quebec tax rates current marginal tax rates quebec personal income tax rates quebec 2021 and 2020 personal marginal income tax rates.

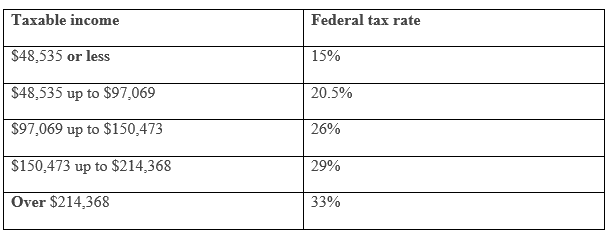

Total income tax brackets quebec. Please read the article understanding the tables of personal income tax rates. Including the net tax income after tax tax return and the percentage of tax. The federal tax value of the basic personal credit the spousal credit and the equivalent to spouse credit represents the amount available to taxpayers in the highest tax bracket. Note that the federal amount of 13 229 is gradually reduced to 12 298 from taxable income of.

More than 89 080 but not more than 108 390. Income tax rates for 2020 the income tax rates for the 2020 taxation year determined on the basis of your taxable income are as follows. Up to 48 535. The information deisplayed in the quebec tax brackets for 2020 is used for the 2020 quebec tax calculator.

2019 quebec income tax brackets 2019 quebec income tax rate. The lowest rate is 15 00 and the highest rate is 25 75. The quebec tax brackets and personal tax credit amounts are increased for 2021 by an indexation factor of 1 0126. Calculate the total income taxes of the quebec residents for 2020.

For eligible dividends table takes into account the gross up of 38 the federal tax credit of 15 and the provincial tax credit of 11 78. The 2020 tax year in quebec runs from january 2020 to december 2020 with individual tax returns due no later than the following april 30 th 2021. 25 75 these amounts are adjusted for inflation and other factors in each tax year. Each province has its own rates and tax brackets.

There are 4 tax brackets in quebec and 4 corresponding tax rates. Quebec provides a net income deduction on eligible work incl. Annual income taxable tax brackets tax rates maximum taxes per bracket maximum total tax. More than 44 545 but not more than 89 080.

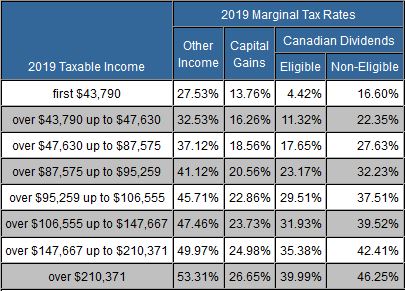

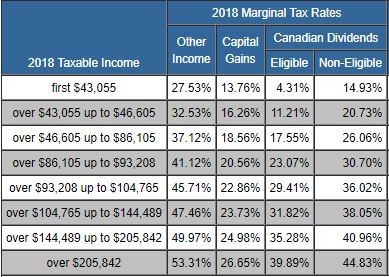

2020 income tax in quebec is calculated separately for federal tax commitments and quebec province tax commitments depending on where the. 2020 personal income tax rates québec marginal rate taxable income federal tax québec tax total tax average rate table takes into account federal basic personal amount of 13 229 and provincial basic personal amount of 15 532. 2019 personal income tax rates québec marginal rate taxable. For non eligible dividends table takes into account the gross up of 15 the federal tax credit of 9 03 and the provincial tax credit of 5 55.

The period reference is from january 1st 2020 to december 31 2020.