Income Capitalization Approach Valuation

The income approach is a real estate valuation method that uses the income the property generates to estimate fair value.

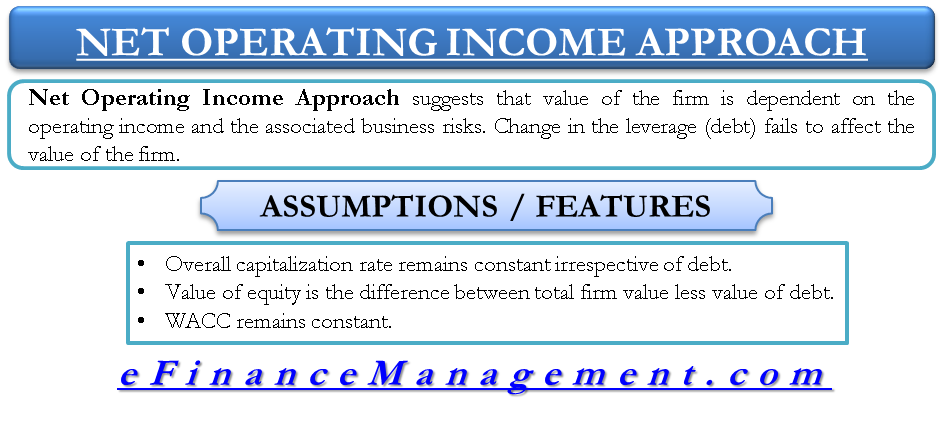

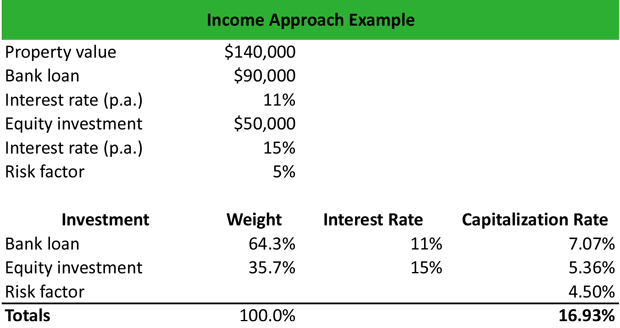

Income capitalization approach valuation. It s calculated by dividing the net operating income by the capitalization. The income valuation method is not suitable for valuing owner occupied residential properties as it relies on income produced as a function of the. Valuation income approach direct capitalization is a real estate appraisal method that values a property by taking net operating income and dividing it by a predetermined capitalization rate. This approach to value is best suited for income generating properties that has adequate market data because it is meant to reflect the behaviors and expectation of participant of typical market.

In essence it focuses on the income the investment property produces. By dividing the net operating income of the subject property by the capitalization rate you have chosen you arrive at an estimate of 100 000 as the value of the building. Yield capitalization banks on the fact that real estate as an investment is a long term goal which the investor should endlessly reap from for a long. Under the capitalization of earnings approach no.

This is an income valuation approach that determines the. Net operating income i capitalization rate r estimated value v 10 000 0 10 100 000. The income capitalization approach is the approach which is applied to determine the value of an investment or commercial property. Income capitalization approach as we have mentioned is one of the three main methods used by real estate appraisers and real estate investors to estimate the value of an investment property.

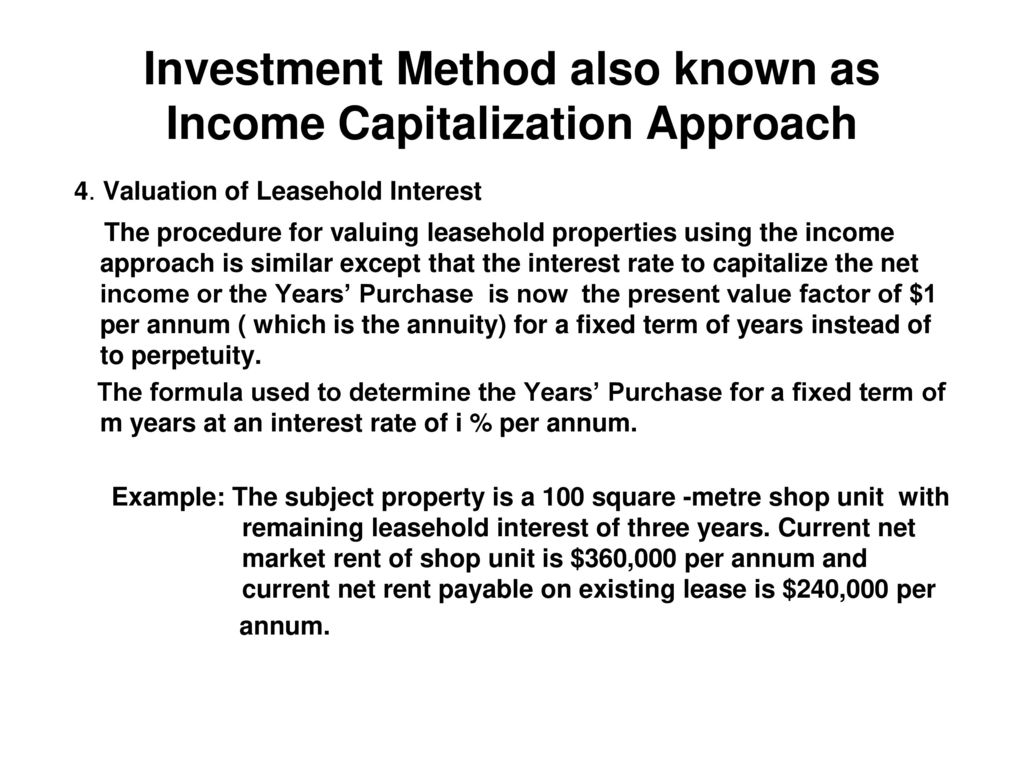

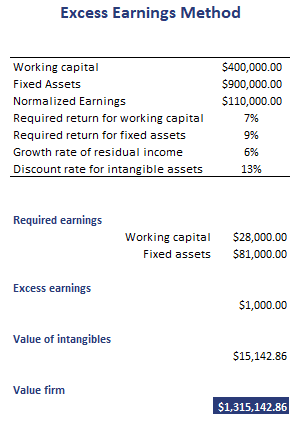

These methods are used to value a company based on the amount of income the company is expected to generate in the future. There are two income based approaches that are primarily used when valuing a business the capitalization of cash flow method and the discounted cash flow method. You can use the numbers from the previous examples to calculate the value. Adding the land value to the value of the improvements results in a total property value estimate of 2 535 000.

In order to estimate the subject property value using the income approach the first step is to create a proforma cash flow statement for the anticipated holding period. In income approach of business valuation a business is valued at the present value of its future earnings or cash flows. Income approach example using yield capitalization. The formula is net present value npv divided by capitalization rate.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)