Income Tax Brackets California Single

Like the federal income tax california s income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Income tax brackets california single. California also has a considerably high sales tax which ranges from 7 25 to 9 50. The bracket you land in depends on a variety of factors ranging from your total income your total adjusted income filing jointly or as an individual dependents deductions credits and so on. 2019 tax brackets for single individuals schedule x if you are a single taxpayer your tax brackets for 2019 have changed. These income tax brackets and rates apply to california taxable income earned january 1 2019 through december 31 2019.

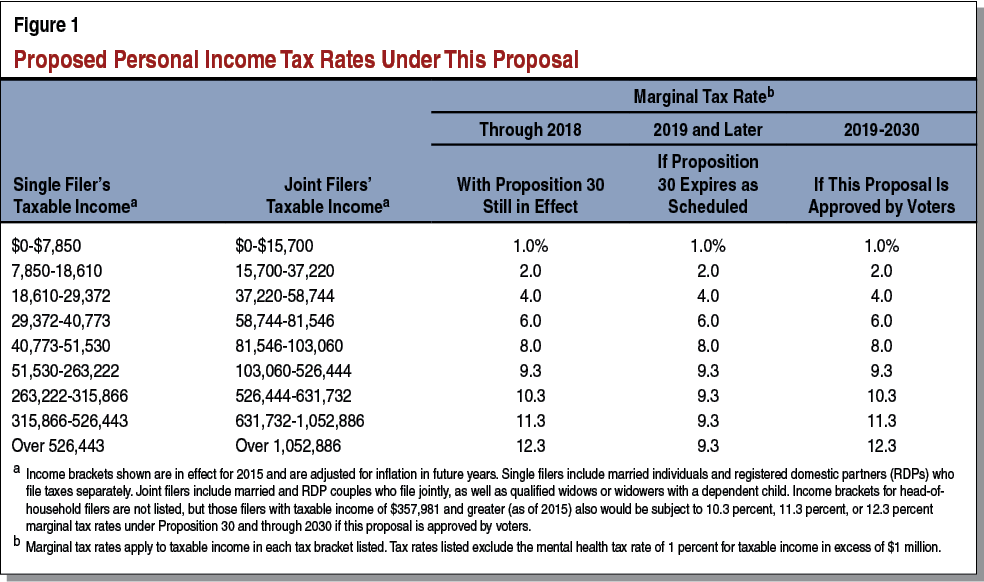

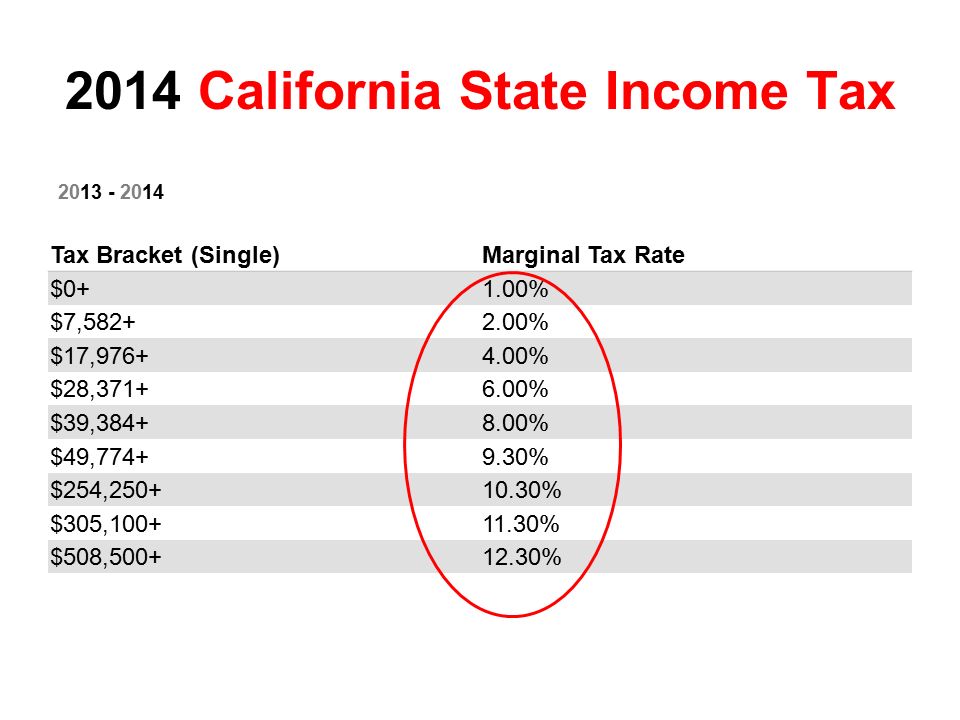

California has ten marginal tax brackets ranging from 1 the lowest california tax bracket to 13 3 the highest california tax bracket. Each marginal rate only applies to earnings within the applicable marginal tax bracket. The tax rates in california are between 1 to 13 3 while the average tax burden is 9 47 of personal income. California collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

These tables are effective as of january 1 2019 and do not take into account any types of tax credits or deducations such. The california single filing status tax brackets are shown in the table below. California s maximum marginal income tax rate is the 1st highest in the united states ranking directly below. In california different tax brackets are applicable to different filing types.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Single tax brackets generally result in higher taxes when compared with taxpayers with the same income filing as married filing jointly or head of household. Unlike the federal income tax brackets the marginal rates are increased gradually. The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in compliance with california government code sections 7405 and 11135 and the web content accessibility guidelines 2 1 or a subsequent version june 22 2019 published by the web accessibility.

This is because the single filing type does not enjoy the tax benefits associated with joint filing or having dependants. Back to california income tax brackets page. The tax on gasoline on the other hand is 62 05 cents per gallon and 87 21 cents per gallon of diesel. 2020 california tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator.