Income Definition Under Income Tax Act 1961

Total income means the total amount of income referred to in section 5 computed in the manner laid down in this act.

Income definition under income tax act 1961. Article is been prepared keeping in view the amendments made by finance no. However under the income tax act 1961 even certain incomes which do not arise regularly are treated as income for tax purposes e g. The government of india brought a draft statute called the direct taxes code intended to replace the income tax act 1961 and the wealth tax act 1957 however the bill was later scrapped. Association or body which is or was assessable or was assessed as a company for any assessment year under the indian income tax act 1922 11 of 1922 or which is or was assessable or was assessed under this act as a company for any assessment year commencing on or before the 1st day.

The term income is defined in section 2 24 of the income tax act 1961. Revenue receipt vis a vis capital receipt. It is a proper definition as given by the income tax act 1961. Winnings from lotteries crossword puzzles.

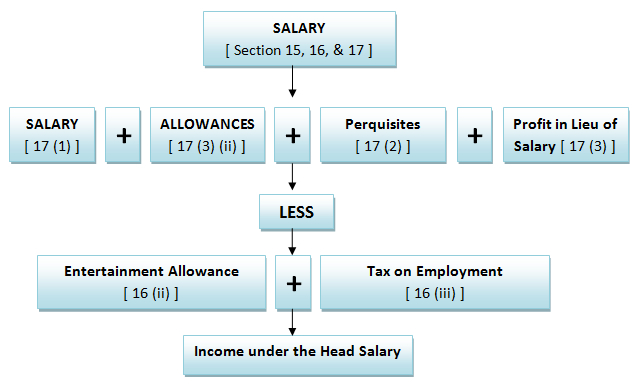

Here individual means all human beings. Income in general means a periodic monetary return which accrues or is expected to accrue regularly from definite sources. The income tax act 1961 is the charging statute of income tax in india it provides for levy administration collection and recovery of income tax. Any commission as a fixed percentage of turnover or overtime payment paid or payable by an employer to employee will be taxable under the head salary as it is forming part of the definition as defined under income tax act.

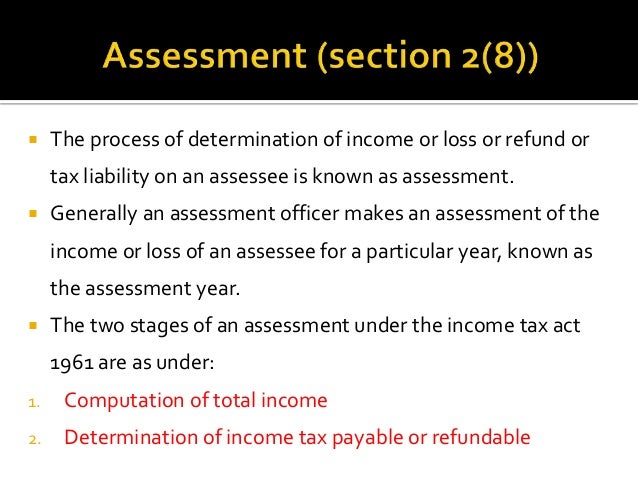

As per income tax act 1961 section 2 7 an assessee is a person who is liable to pay the taxes under any provision of income tax act 1961. Assessee can also be a person with respect of whom any proceedings have been initiated or whose income has been assessed under the income tax act 1961 assessee is any person who is deemed assessee under any. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. Therefore even the income tax act 1961 gives an inclusive definition of the term.

The term gti has been defined in sub section 45 of section 2 chapter ii of income tax act 1961 as under. However since income has a very broad scope it is not possible to attribute some characteristics to the term and define it exhaustively. 2 act 2020 and applicable for a y. The article all about income which are exempt from tax under income tax 1961 and covers income exempt under section 10 1 to section 10 49.

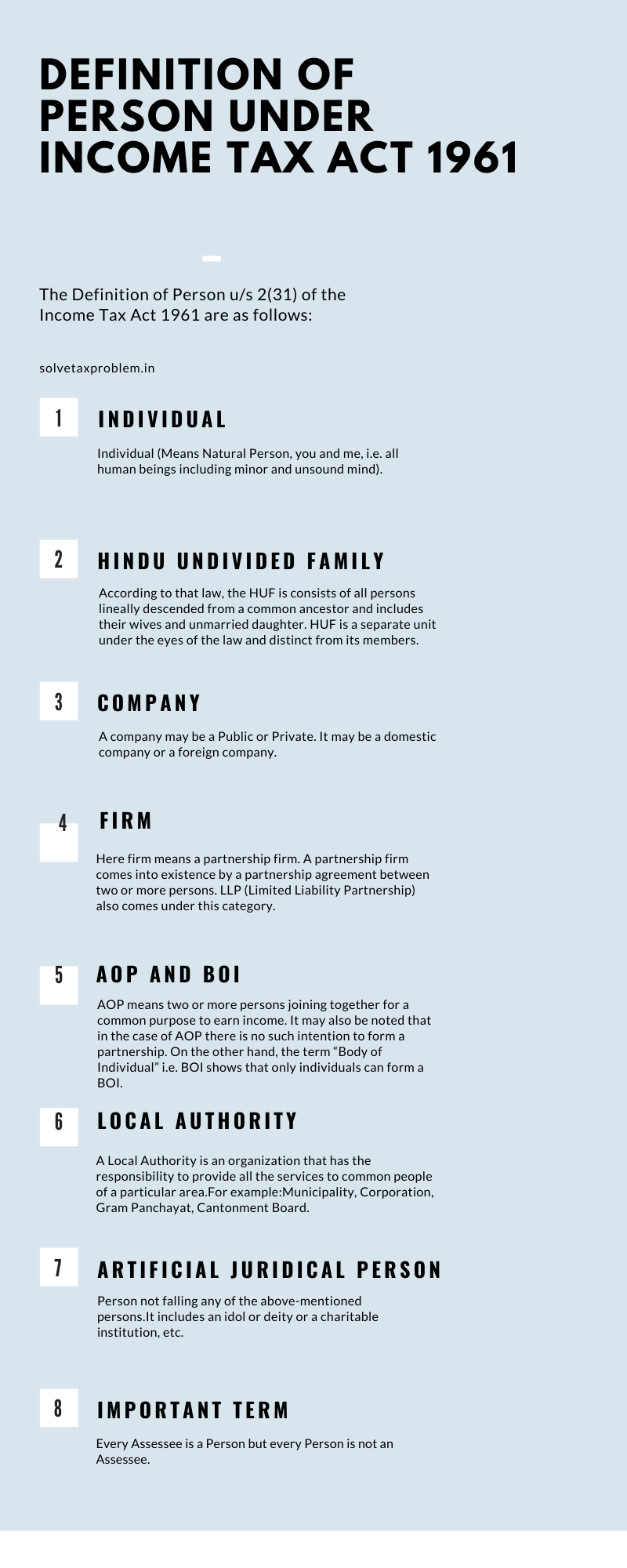

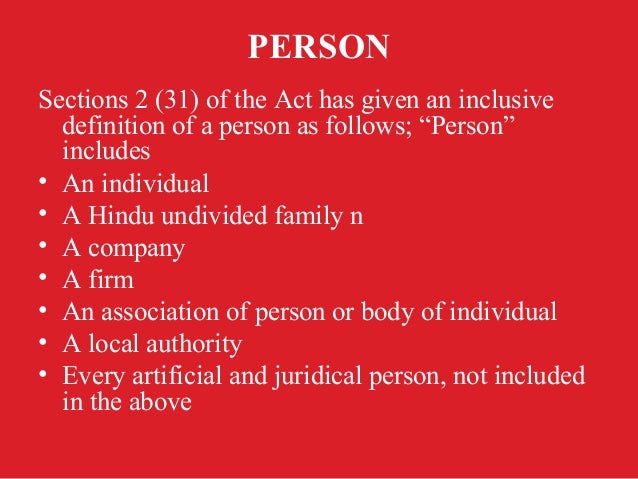

Home section 2 of the income tax act 1961 definition. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. It may also be noted that the term person includes a minor or an unsound mind. 2021 22 and onwards any income derived from saplings or seedlings grown in a nursery shall.

It may be anybody.