Income From Operations As A Percentage Of Sales

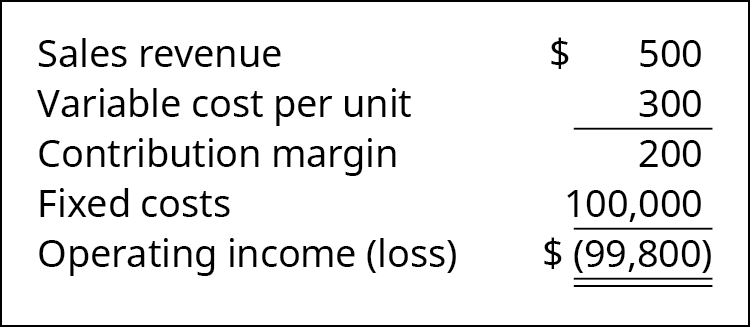

Example of income from operations for example if a car company spends 100 000 building and selling cars then sells them for 110 000 it has 10 000 in income from operations.

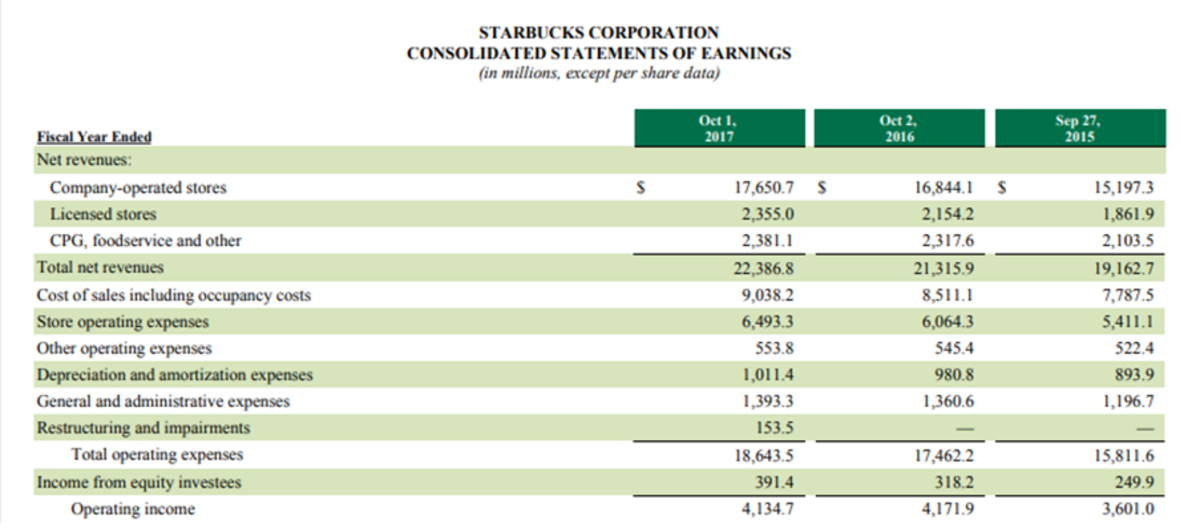

Income from operations as a percentage of sales. Ideally there should be a parallel increase in operating cash flows with the increase in sales. The percent change in operating income describes the proportional increase or decrease in operating profit from one year to the next. The operating margin ratio also known as the operating profit margin is a profitability ratio that measures what percentage of total revenues is made up by operating income. Total expenses increased from 99 0 to 99 8.

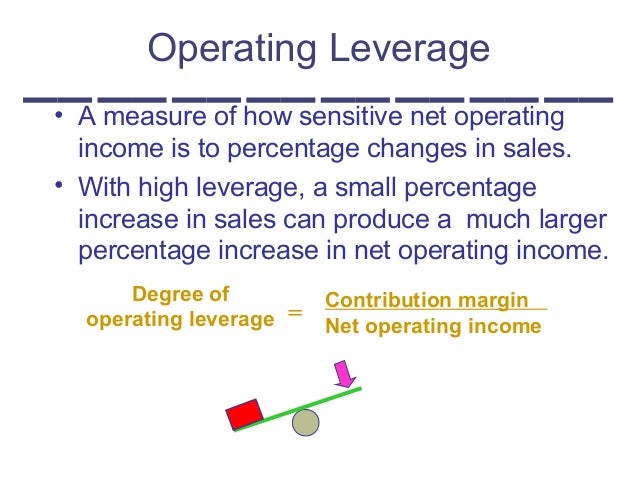

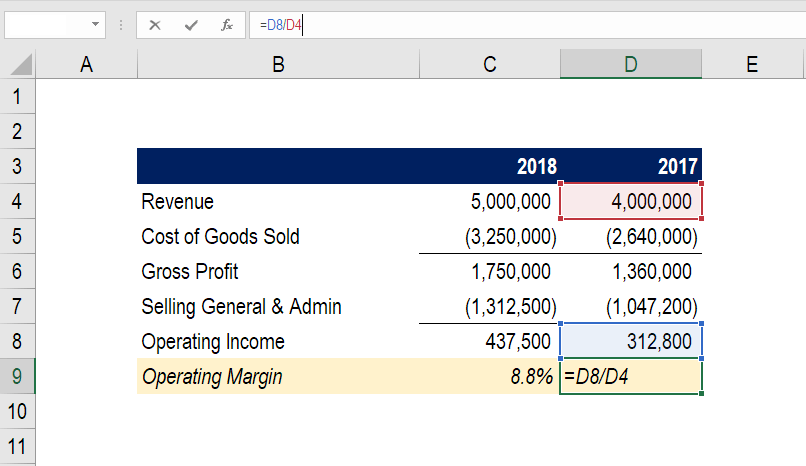

O p e r a t i n g m a r g i n o p e r a t i n g i n c o m e r e v e n u e. Operating profit equals the gross profit minus selling administrative and general costs. It will be worrisome if the changes in cash flows are not parallel to the changes in sales revenue. Examples of operating costs include office salaries advertising and office rent.

In business operating margin also known as operating income margin operating profit margin ebit margin and return on sales ros is the ratio of operating income operating profit in the uk to net sales usually presented in percent. For instance the acme widget company has operating expenses of 500 000. This ratio gives the analysts and investors indications about the ability of a company to generate cash from its sales. This is a common profit ratio derived from your company s income statement.

The operating profit percentage reveals the return from standard operations excluding the impact of extraordinary items and other comprehensive income. The vertical analysis indicates that the income from operations declined from 1 0 to 0 2 of sales between the two years. If the cash flows do not increase with the increase in sales it may. In other words the operating margin ratio demonstrates how much revenues are left over after all the variable or operating costs have been paid.

It is a good measure of management efficiency. It shows the extent to which a company is earning a profit from standard operations as opposed to resorting to asset sales or unique transactions to post an artificial profit. In other words it shows the ability of a company to turn its sales into cash. Subtract this amount from gross profit of 900 000 to find the operating profit of 400 000.

It is expressed as a percentage. Operating income expressed as a percentage of sales is referred to as operating profit margin or just operating margin.

:max_bytes(150000):strip_icc()/ExxonIncojmestatement2019June-55cdf08720b24bc7b27ade3de5b6dc32.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/Apple12-29-2018incomestatement-5c537a8fc9e77c0001cff2a8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)