Income From Operations Reported Under Variable Costing

In this case ansara s inventory be the same as the meaning it sold.

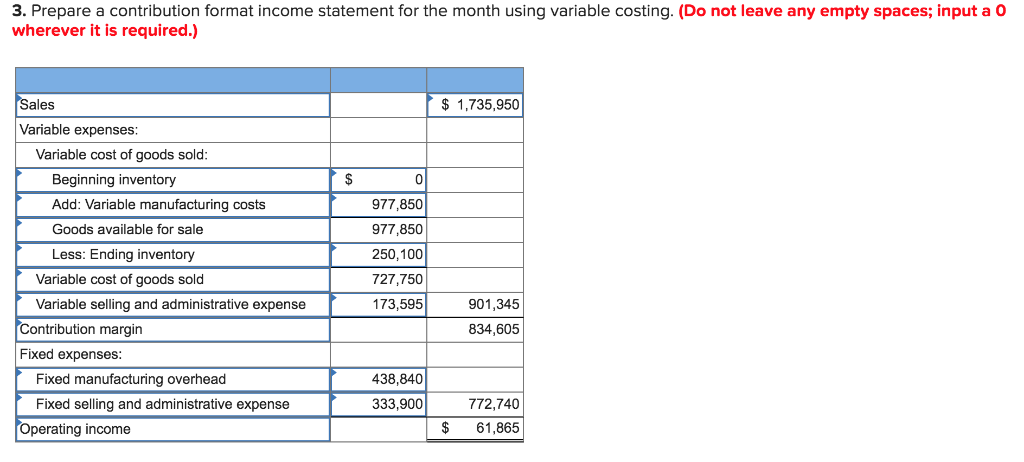

Income from operations reported under variable costing. In this way a portion of fixed cost that relates to the current period is transferred to. 8 comments on exercise 2 variable. Operating income reported under full costing will exceed operating income reported under variable costing for a given period if. A d v e r t i s e m e n t.

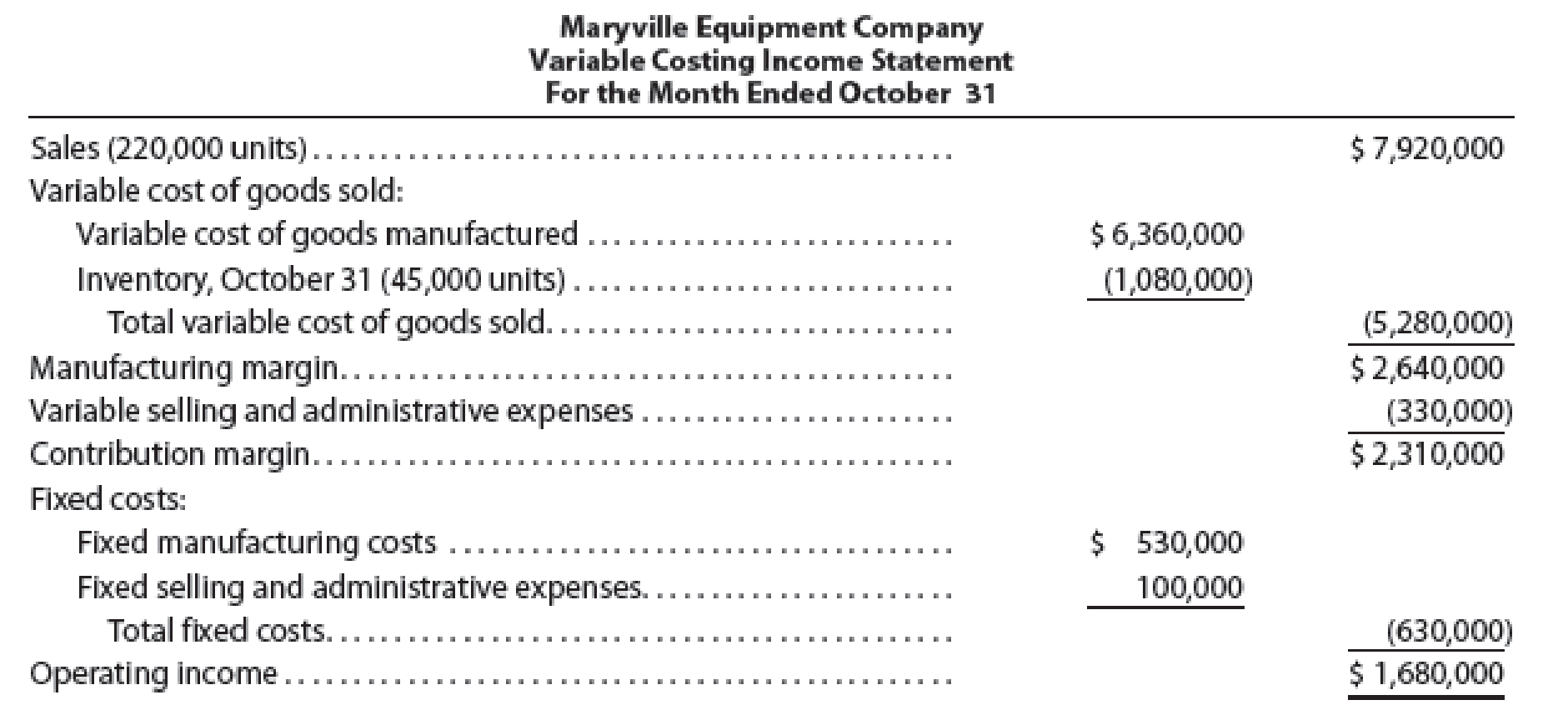

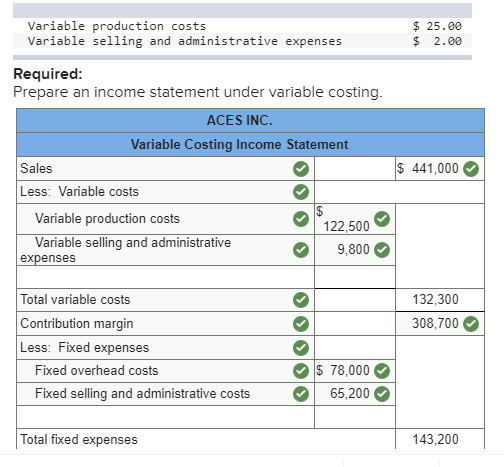

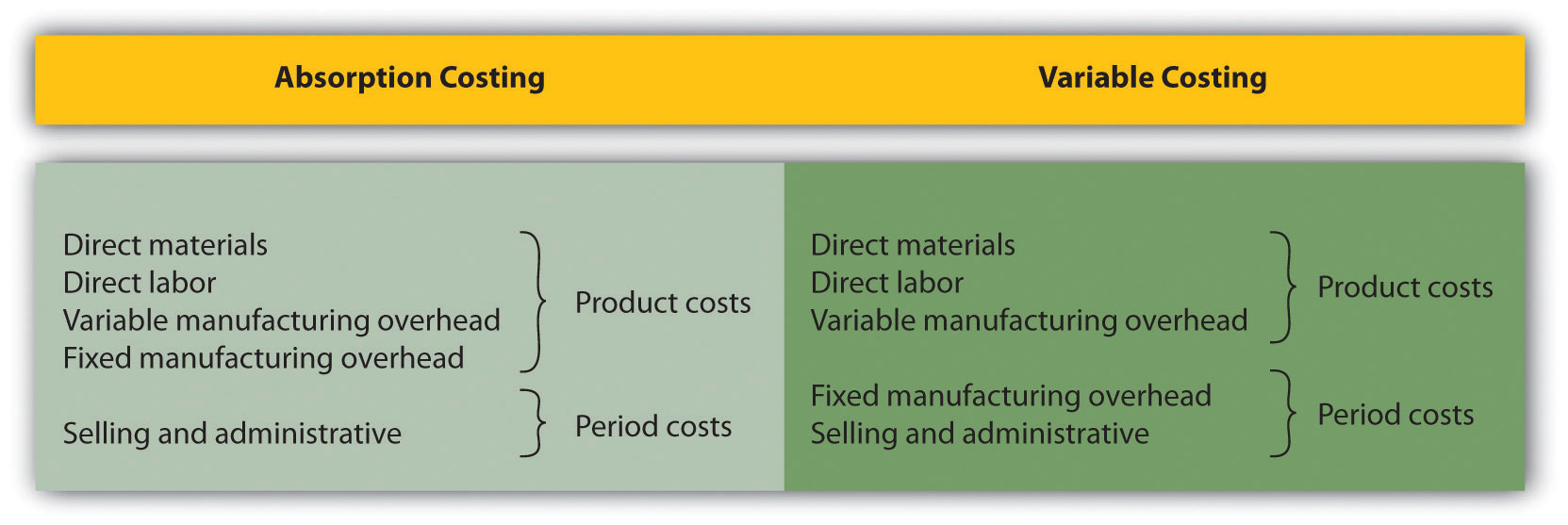

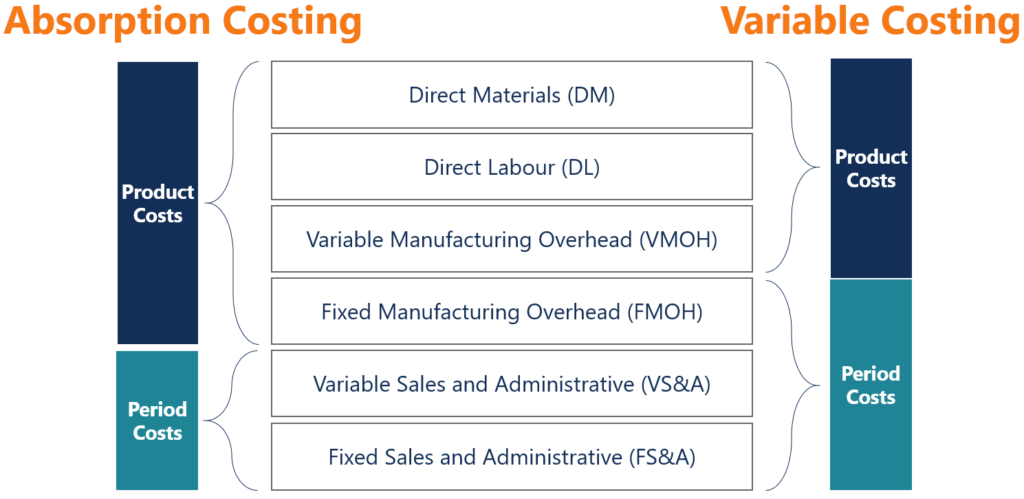

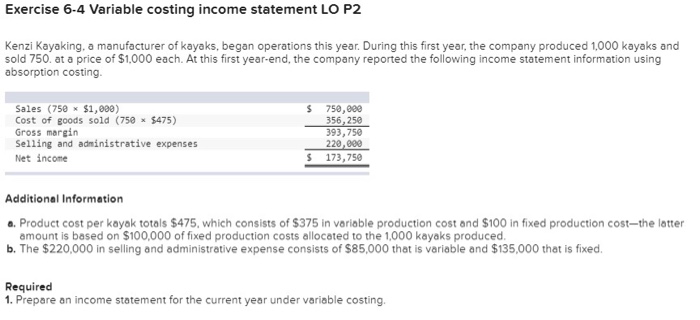

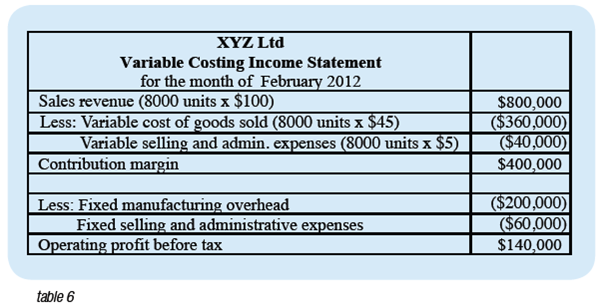

It is useful to create an income statement in the variable costing format when you want to determine that proportion of expenses that truly. This difference is due to including 1 560 of fixed baking cost in the august 1 inventory under absorption costing 600 units 2 60. Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is incurred in the period that a product is produced. A variable costing income statement is one in which all variable expenses are deducted from revenue to arrive at a separately stated contribution margin from which all fixed expenses are then subtracted to arrive at the net profit or loss for the period.

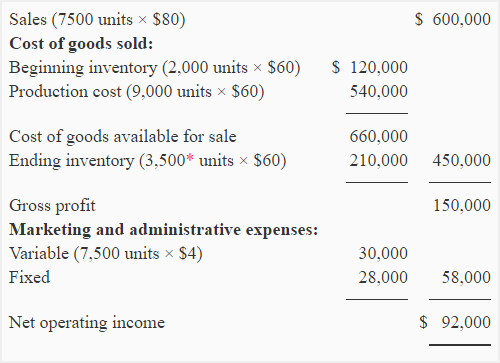

Notice that the net operating income under absorption costing is 7 500 92 000 84 500 higher than the net operating income under variable costing. Thus this 1 560 was included in august s cost of goods sold under absorption cost ing. This is the same difference that we noticed in the value of inventory. Reporting of operating income.

Production equals sales for that period. Thus income reporting differs under both cost accounting methods. For august the income from operations reported under absorption costing is less than the income from operations reported under variable costing by 1 560. Variable and absorption costing exercises show your love for us by sharing our contents.

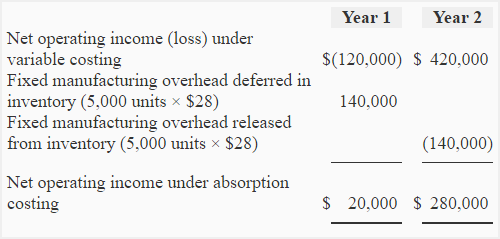

Next back to. The ending inventory absorbs a portion of fixed manufacturing overhead and reduces the burden of the current period. Explain the difference between the amount of income from operations reported under the absorption costing and variable costing concepts the income from operations under the variable costing concept income from operations under the absorption costing concept when the inventories either increase or decrease during the year. 2 reconciliation of net operating income.

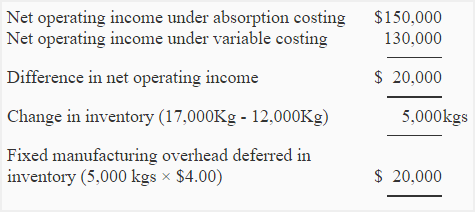

This difference is because of fixed manufacturing overhead that becomes the part of ending inventory under absorption costing system. Variable costing income statement. Reconcile any difference in net operating income figure under variable costing system and under absorption costing system. Would be smaller than the income from operations reported under the variable costing concept.

We can clearly see in the income statement absorption costing reports an operating income of 12 100 whereas variable costing says an operating profit of 6 100.