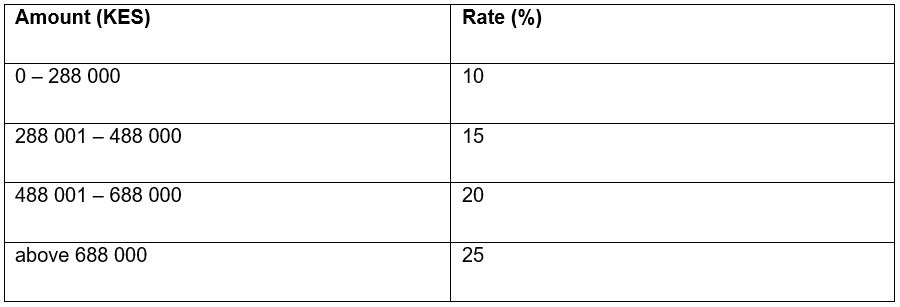

Income Tax Bands Zimbabwe

56 760 40 for each usd above 180 001.

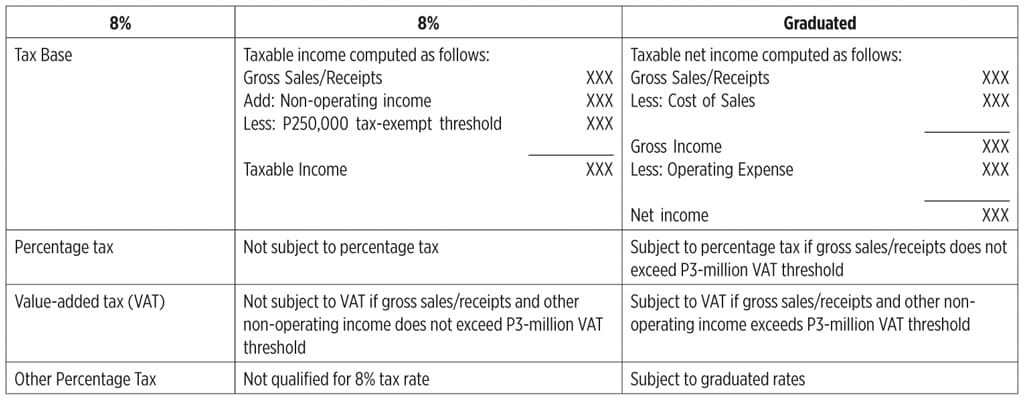

Income tax bands zimbabwe. What categories are subject to income tax in general situations. Remuneration and benefits and trade income. Review the 2019 zimbabwe income tax rates and thresholds to allow calculation of salary after tax in 2019 when factoring in health insurance contributions pension contributions and other salary taxes in zimbabwe. Business rents is taxed at the corporate rate of tax currently 24.

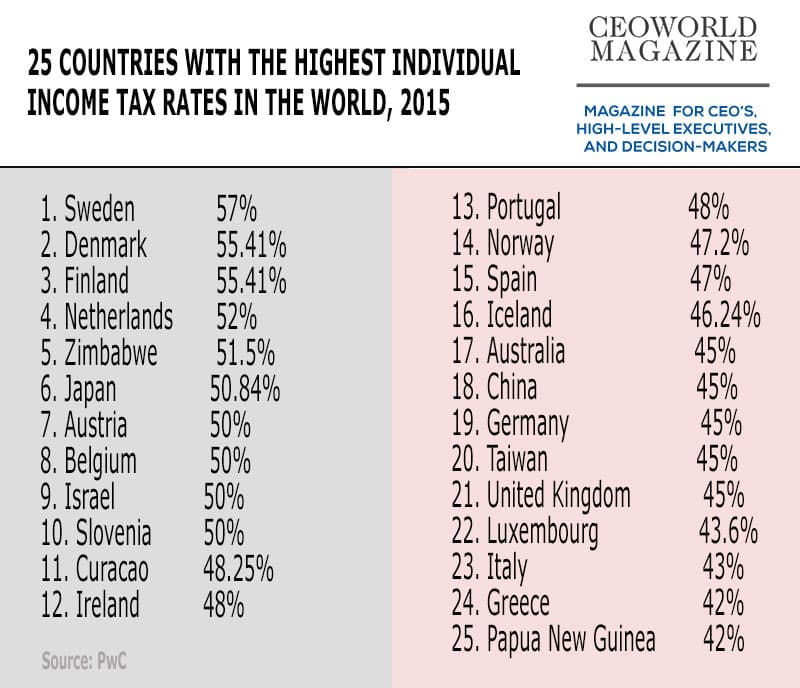

Personal income tax rate in zimbabwe averaged 40 76 percent from 2004 until 2020 reaching an all time high of 51 50 percent in 2015 and a record low of 24 72 percent in 2020. Zimbabwe presently operates on a source based tax system. Will a non resident of zimbabwe who as part of their employment within a group company is also appointed as a statutory director i e. As of 1 january 2020 the corporate income tax cit rate for companies other than mining companies with special mining leases but including branches is reduced to 24 72 previously 25 75.

The personal income tax rate in zimbabwe stands at 24 72 percent. That together with the aids levy gives an overall effective rate of 24 72. 14 xinhua the zimbabwean treasury has unveiled foreign currency denominated income tax bands with tax free threshold at 350 u s. Icalculator zw excellent free online calculators for personal and business use.

Lower limit upper limit specified percentage 0 usd840 0 usd841 usd3 600 20 usd3 601 usd12 000 25 usd12 001 usd10 000 30 usd4 800 usd36 000 35 usd36 000 40 nb. Dollars a month and a rate of 40 percent for people earning more than 15 000 u s. Member of the board of directors in a group company situated in zimbabwe trigger a personal tax liability in zimbabwe. The draft finance bill appears to have an error on the last fourth and fifth tax bands.

The following tax rates and allowances are to be used when answering the questions. Review the latest income tax rates thresholds and personal allowances in zimbabwe which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in zimbabwe. Tax rates individuals employment income year ended 31 december 2013 taxable rate amount cumulative income income band of tax within band tax liability us us us up to 3 000 0 3 000 0 3 001 to 12 000 20 9 000 1 800 12 001 to 24 000 25 12 000 4 800. This rate includes a base rate of 24 plus a 3 aids levy.