Income Tax Brackets In Sweden

From 468 700 kronor to 675 700 kronor.

Income tax brackets in sweden. You can deduct a basic allowance of between sek 13 700 and sek 35 900 on taxable earned income employment and business activity if you have had unlimited tax liability for the whole year. The same rate applies when a pension is paid by a swedish source to a person not tax resident in sweden. Sweden has a progressive income tax the general rates for 2018 are as follows based on yearly incomes. 0 from 0 kronor to 20 008 kronor.

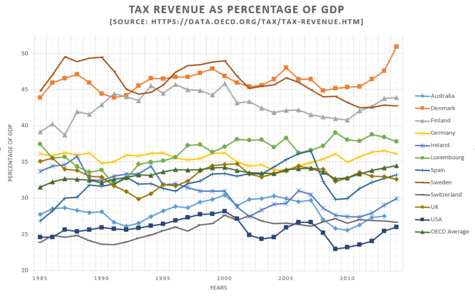

Below we have highlighted a number of tax rates ranks and measures detailing the income tax business tax consumption tax property tax and international tax systems. The personal income tax rate in sweden stands at 57 20 percent. From 20 008 kronor to 468 700 kronor. Sweden residents income tax tables in 2020.

Income tax rates and thresholds annual tax rate taxable income threshold. Tax rates 2020 persons with unlimited tax liability. If you are over 65 years of age you will instead get an basic allowande of between sek 24 100 and sek 99 100. How does the sweden tax code rank.

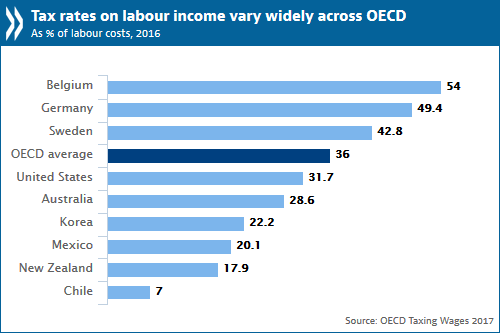

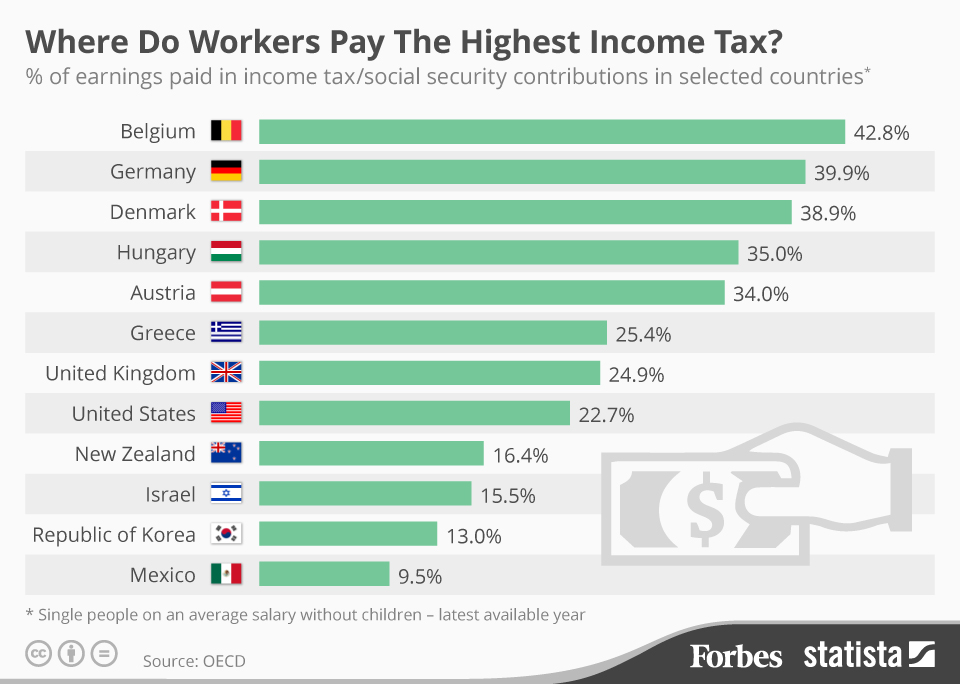

The first step towards understanding the sweden tax code is knowing the basics. Sweden has a 70 percent marginal tax rate and it kicks in not at 10 million like aoc proposes but at around 98 000. Personal income tax rate in sweden averaged 56 60 percent from 1995 until 2020 reaching an all time high of 61 40 percent in 1996 and a record low of 51 50 percent in 2000. One thing missing from the discussion so far is the point that a 70 percent top tax rate exists not merely in mid century us tax codes or in academic papers but also in the real world right now.

Denmark s corporate income tax rate is 24 5 percent norway s general corporate income tax rate is 27 percent and sweden has a corporate tax rate of 22 percent. Marginal corporate tax rates in scandinavian countries are around the oecd average of 25 percent and much more competitive than the united states rate. Non residents working in sweden for a swedish employer or a foreign employer with a permanent establishment pe in sweden are taxed a flat rate of 25 at source. Employment income tax for non residents.

Sweden has one of the lowest income taxes in the world charging a maximum income tax of 25 00.