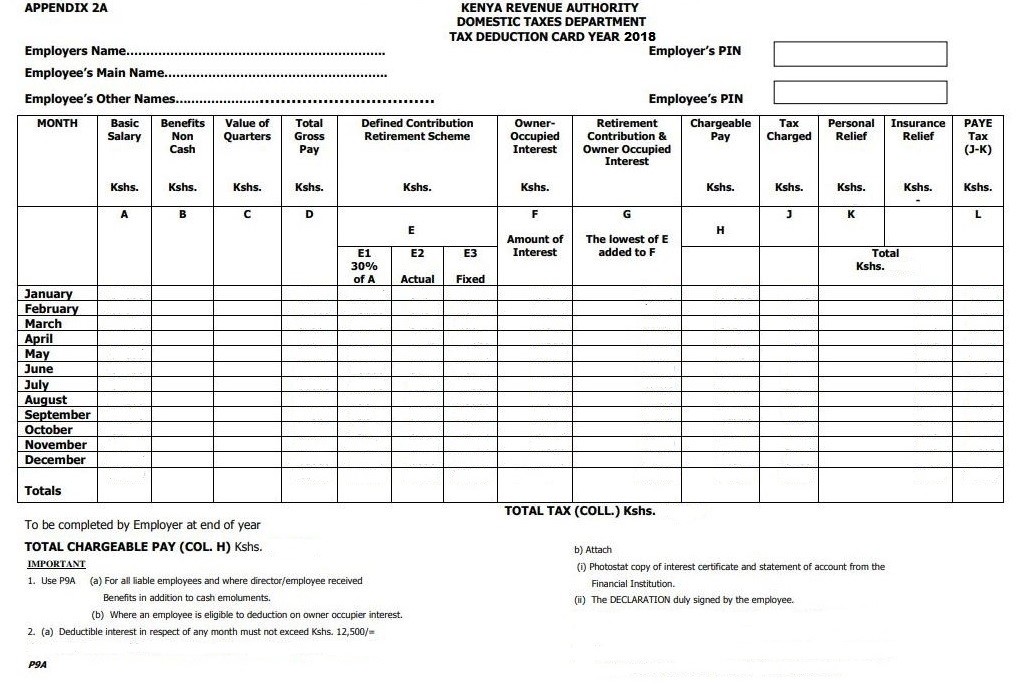

Income Tax Brackets Kenya 2018

Ksh 28 800 per year.

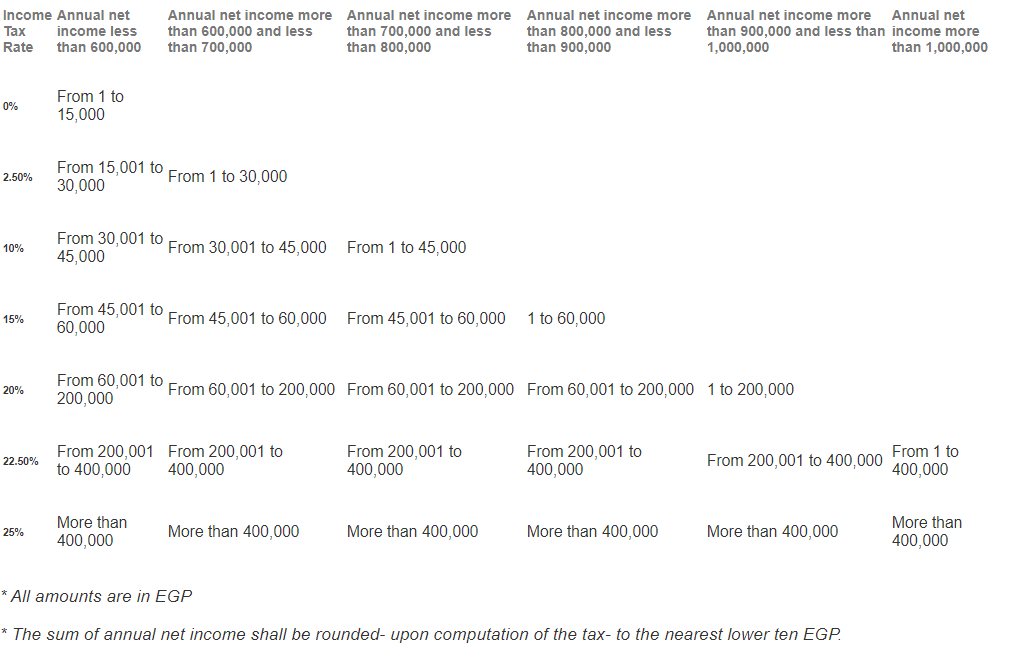

Income tax brackets kenya 2018. To mitigate the effects of covid 19 to the kenyan economy the government has proposed various measures including the following. 11 587 20 on the next kshs. 24 000 reduction of resident corporate income tax rate from 30 to 25. In kenya determination of tax residency is guided by the income tax cap 470.

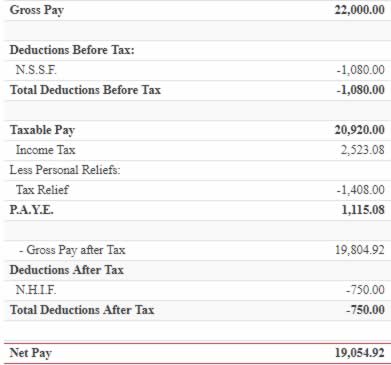

Annual monthly rates on the first kshs. Income from 386 970 01. Non resident employees are taxable only on their income earned from within kenya or derived from kenya. 16 896 per annum kshs 1 408 per month.

In kenya the statutory income tax rate for tax residents is thirty per cent 30. 12 298 10 on the next kshs. On the next 11 587. Kenya residents income tax tables in 2018.

Monthly bands of taxable income kes tax rate. Reduction of personal income tax top rate paye from 30 to 25 100 tax relief for persons earning up to ksh. Ksh 2 400 per month. Income from 134 164 01.

12 298 per month or kes. Up to ksh288 000. Therefore starting with the paye return for the january payroll that is due on 9th february 2018. Real estate capital gains tax of 20 up from the current 5.

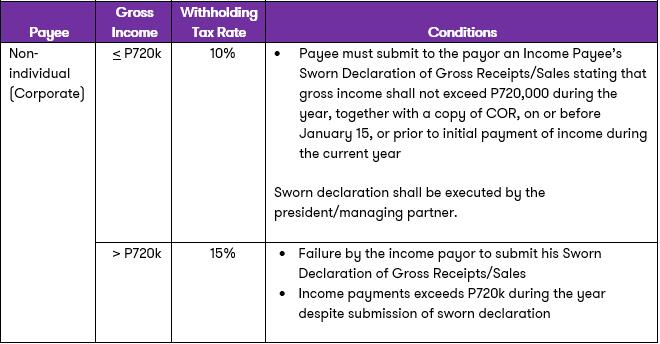

Effective 25 april 2020 the tax rates applicable to taxable income are tabulated as follows. For tax non residents the statutory rate is at thirty seven point five per cent 37 5. 11 587 15 on the next kshs. Any amount paid to non resident individuals in respect of any employment with or services rendered to an employer who is resident in kenya or to a permanent establishment in kenya is subject to income tax charged at the prevailing individual income tax rates.

Personal relief of kshs. Taxation for non resident s employment income. Income tax rate of 35 on more than kshs 750 000 7 500 per month non residents who receive their pensions in kenya will pay a tax of 10 on transfers up from 5 a higher corporate tax of 35 for large companies with taxable income over kshs 500 million 5 million. The new tax bands and rates are as follows.

Kes 13 486 00 per month. 11 587 25 on all income over kshs. On the next 11 587. Ksh40 668 ksh57 333.

Kes 1 408 00 per month. Income tax rates and thresholds annual tax rate taxable income threshold. Income from 260 567 01. Revised lowest tax bracket of 10 upto kes.

147 580 per annum will marginally reduce the paye burden. Ksh288 001 ksh488 000. Ksh488 001 ksh688 000. However please note that this doesn t translate to a 10 paye reduction.

Up to ksh24 000.