Income Tax Brackets Ontario And Federal 2019

The federal tax brackets and personal tax credit amounts are increased for 2021 by an indexation factor of 1 010.

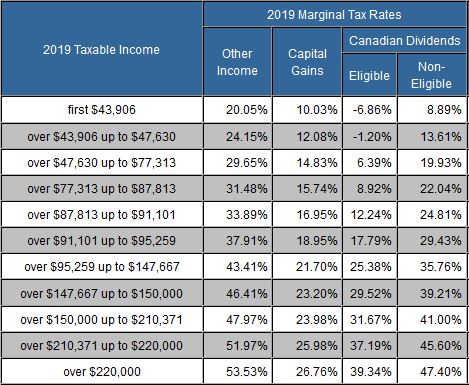

Income tax brackets ontario and federal 2019. The tax rates include the provincial surtaxes and reflect budget proposals and news releases up to 15 june 2019. Please read the article understanding the tables of personal income tax rates. The federal income tax rates and brackets for 2020 are. There are 5 ta.

Taxable income marginal rate on ontario 1. 2020 federal tax bracket rates. The 2019 tax year in ontario runs from january 2019 to december 2019 with individual tax returns due no later than the following april 30 th 2020. The federal and ontario tax brackets and personal amounts are increased for 2020 by an indexation factor of 1 019 except for the ontario 150 000 and 220 000 bracket amounts which are not indexed for inflation.

Tax rates for previous years 1985 to 2019 to find income tax rates from previous years see the income tax package for that year. The federal personal income tax rates and brackets refer to taxes payable on your taxable income which is your gross income minus deductions tax credits and other adjustments. The rates do not include the ontario health premium see note 5 below. Use the 2018 tax rates when you file taxes in april 2019.

2019 income tax in ontario is calculated separately for federal tax commitments and ontario province tax commitments depending on where the. Please read the article understanding the tables of personal income tax rates. The information deisplayed in the ontario tax brackets for 2019 is used for the 2019 ontario tax calculator. Ontario 2020 and 2019 personal marginal income tax rates.

Eligible dividends are those paid by public corporations and private companies out of earnings that have been taxed at the general corporate tax rate. For 2018 and previous tax years you can find the federal tax rates on schedule 1 for 2019 and later tax years you can find the federal tax rates on the income tax and benefit return you will find the provincial or territorial tax rates on form 428 for the. Ontario tax rates current marginal tax rates ontario personal income tax rates ontario 2021 and 2020 personal marginal income tax rates. Where the tax is determined under the alternative minimum tax provisions amt the above table is not applicable.

Notice that new tax brackets and the corresponding income thresholds go into effect for the 2019 tax year. The ontario basic personal amount has also been increased to 10 783 for 2019 from 10 582 in 2020. 2019 combined federal and ontario corporate income tax rates. The ontario tax brackets personal amount and surtax amounts were increased for 2020 by an indexation factor of 1 019 except for the two highest brackets which are not indexed.

10 15 25 28 33 35 and 39 6. The brackets before the tax reform were.