Income Tax Brackets Vancouver

Washington has no state level income taxes although the federal income tax still applies to income earned by washington residents.

Income tax brackets vancouver. Both washington s tax brackets and the associated tax rates have not been changed since at least 2001. As well as federal tax you ll also have to pay the provincial tax rate for british columbia on income over a certain amount. Tax rates are applied on a cumulative basis. The federal general corporate income tax rate is 15.

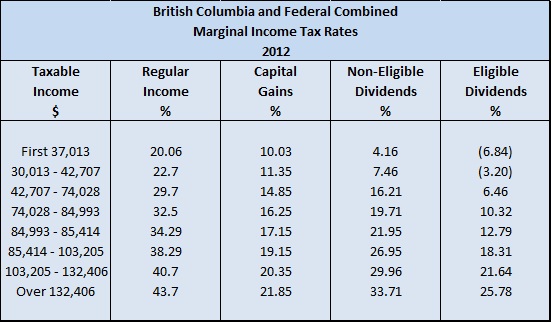

For example if your taxable income is more than 41 725 the first 41 725 of taxable income is taxed at 5 06 the next 41 726 of taxable income is taxed at 7 70 the next 12 361 of taxable income is taxed at 10 5 the next 20 532 of taxable income is. 8 20 the total of all sales taxes for an area including state county and local taxes income taxes. There are only seven states nationwide that din t collect a state income tax however when a state has no income tax it generally makes up for lost tax. 0 00 the total of all income taxes for an area including state county and local taxes federal income taxes are not included property tax rate.

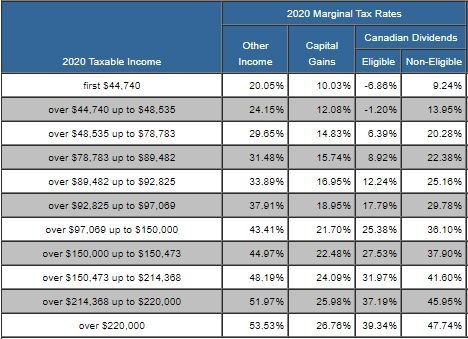

With each payslip your employer will deduct taxes from your income. This amount is considered a non refundable tax credit. 4 1 4 3 4 52 4 69. Budget 2020 proposes adding a new tax bracket for income above 220 000 at a rate of 20 5.

The lowest rate is 5 06 and the highest rate is 16 80. The tax threshold for the basic personal credit or amount is the portion of the wage that is entitled to a tax rate of 0. Provincial and territorial general corporate income tax rates range from 11 to 16. 12 03 the property tax rate shown here is the rate per 1 000 of home value.

What are tax rates in bc. British columbia s tax brackets for tax year 2019. British columbia tax rates current marginal tax rates bc personal income tax rates bc 2021 and 2020 personal marginal income tax rates bc income tax act s. The federal tax brackets and personal tax credit amounts are increased for 2021 by an indexation factor of 1 010.

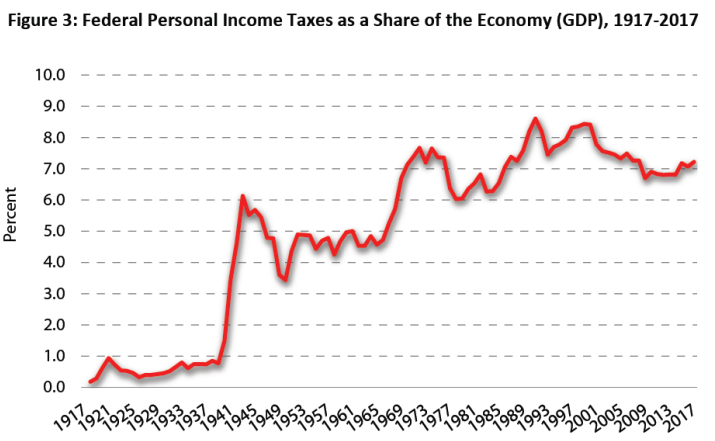

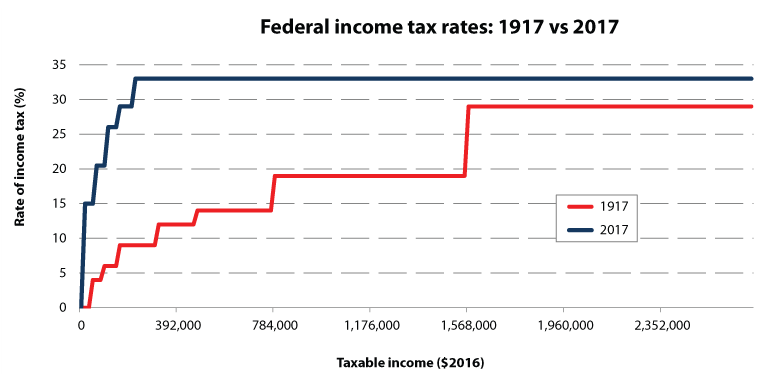

No but dividends received by corporate shareholders out of the exempt surplus of foreign affiliates are not taxable. There are 6 tax brackets in british columbia and 6 corresponding tax rates. Canadian tax rates are progressive meaning the more you earn over the tax free allowance the more tax you must pay. Tax rates for vancouver wa.

The highest provincial rate is applied above 157 749 however the federal rate is increased further after this income level. The personal income tax brackets and tax rates in british columbia are average compared to more heavily taxed provinces like manitoba and quebec.