Income Tax Calculation In Zerodha

To be clubbed with income for calculation of tax loss.

Income tax calculation in zerodha. We are following guidance note on tax audit under section 44ab. The process of calculating p l payment of taxes filing itr returns etc. Itr 4 also in case itr4 is being used by a salaried person because of equity intraday derivative trading short term equity gain loss has to be included as business income and. Income tax return filing for zerodha traders with income from equity mutual funds intraday and futures options trading in india.

Unsubscribe from amit jain. Update your mobile number e mail id with your stock broker depository participant and receive otp directly from depository on your email id and or mobile number to create pledge. Traders have a trading statement that consists of a list of transactions undertaken by the person in various segments during a specific period. Hindi income tax rules for stock market how to save money and carry forward losses.

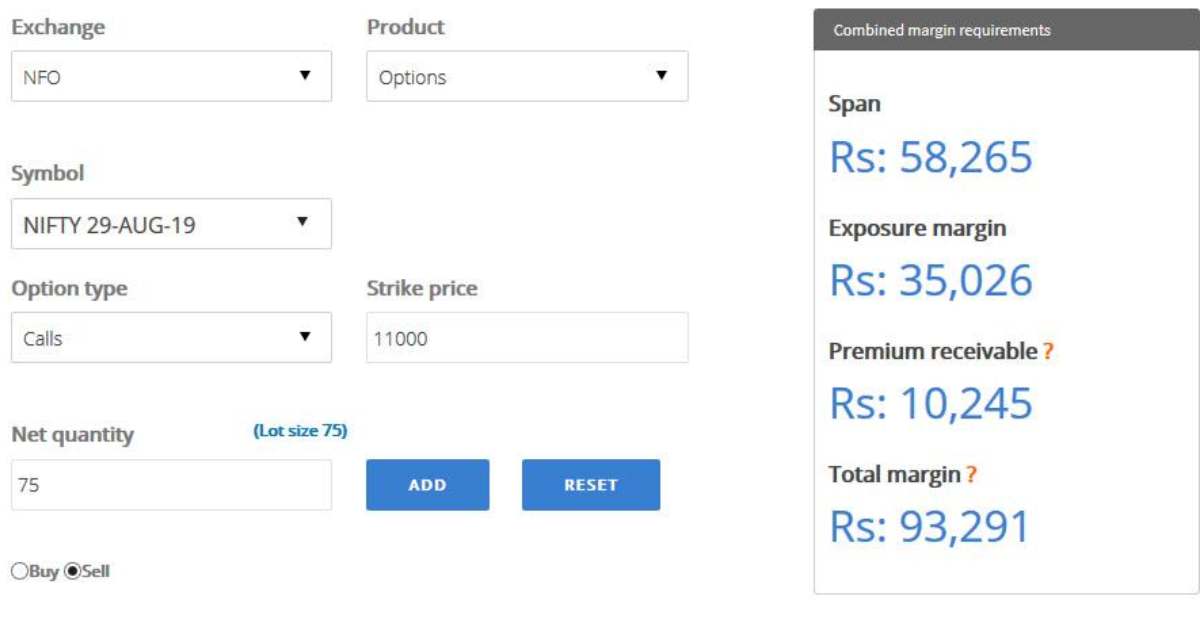

Using the tax p l report the trader can determine which itr form to file and also determine the applicability of the tax audit. 2 sir my primary income from salary i want to trade in zerodha intraday equity f o i want to pay 30 tax if i get any profit from trading in this case is it compullsurry to show this is busines income if yes which itr to file if not can i show it as other income and which itr to file please help. The module covers the taxation aspect of investing trading in the stock markets. The buy average calculation of your holdings will exclude intra day trades.

It is the same as a tax p l report and it is an essential document to calculate taxes on trading income. Can be set against business loss for next 8 years if declared in it return it form. Import tax pnl and file itr online. The turnover is being calculated in console just to determine if you need a tax audit or not.

D derivatives profit. You are required to consistently follow fifo to report the p l in your income tax returns. Stock brokers can accept securities as margin from clients only by way of pledge in the depository system w e f. Zerodha provides a tax p l report to all its traders aggregating the trading transactions done during the financial year.

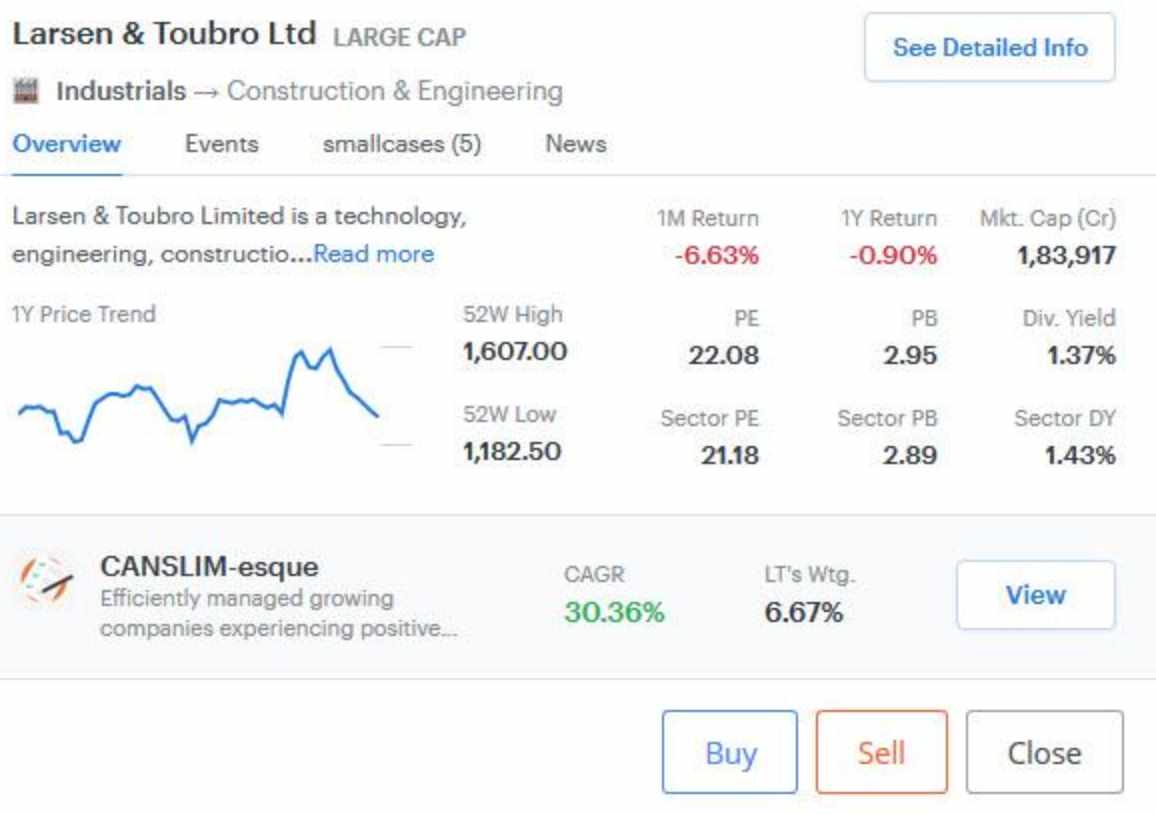

If you sell your holdings and then buy it back the same day the difference will be considered an intraday profit or loss and your holdings buy average will remain unaffected. A zerodha trader has to file itr based on the income they have from trading in equity mutual funds or derivatives. It consists of details.