Income Tax Calculator Dc

After a few seconds you will be provided with a full breakdown of the tax you are paying.

Income tax calculator dc. Income tax tables and other tax information is sourced from the district of columbia office of taxpayer revenue. Your household income location filing status and number of personal exemptions. If you make 55 000 a year living in the region of washington usa you will be taxed 9 482 that means that your net pay will be 45 518 per year or 3 793 per month. Withholding year to date if unknown enter 0 job 3.

Using our district of columbia salary tax calculator. This breakdown will include how much income tax you are. Both reduce your tax bill but in different ways. Also we separately calculate the federal income taxes you will owe in the 2019 2020 filing season based on the trump tax plan.

Your average tax rate is 17 24 and your marginal tax rate is 29 65 this marginal tax rate means that your immediate additional income will be taxed at this rate. Your household income location filing status and number of personal exemptions. Withholding year to date if unknown enter 0 job 2. Your family s jobs if married include spouse jobs job 1.

Expected yearly income. District of columbia s 2020 income tax ranges from 4 to 8 95. Number of dependents who do not qualify for child tax credit do not count yourself or spouse. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Also we separately calculate the federal income taxes you will owe in the 2019 2020 filing season based on the trump tax plan. A tax credit valued at 1 000 for instance lowers your tax bill by 1 000. 2020 2021 federal and state income tax salary calculator. This page has the latest district of columbia brackets and tax rates plus a district of columbia income tax calculator.

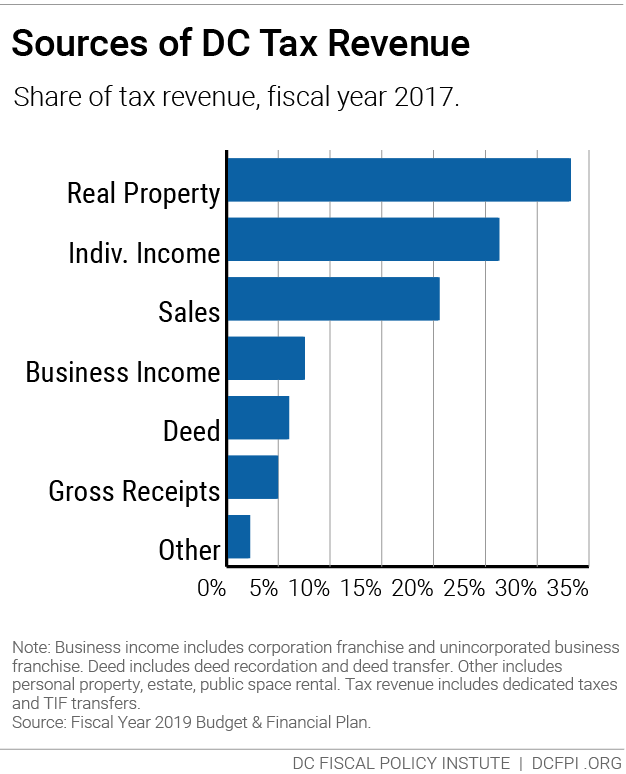

The results that the calculator give you are calculated with consideration to the most recent income tax and social security information available for the tax year 2020 21. Tax credits directly reduce the amount of tax you owe dollar for dollar. Income tax brackets are the same regardless of filing status. Overview of district of columbia taxes.

Capital has a progressive income tax rate with six tax brackets ranging from 4 00 to 8 95. Expected yearly income.