Income Tax Calculator Sweden 2020

Uniform tax rebate up to 2 000 yr free per child to help with childcare costs.

Income tax calculator sweden 2020. Sweden 2019 income tax calculator. If you make kr 480 000 a year living in the region of skåne sweden you will be taxed kr 124 342 that means that your net pay will be kr 355 658 per year or kr 29 638 per month. Enter your salary and the sweden salary calculator will automatically produce a salary after tax illustration for you simple. Tax free childcare take home over 500 mth.

Check your tax code you may be owed 1 000s. Sweden income tax allowance sweden provides most taxpayers with an income tax allowance of kr12 500 which can be kept as a tax free personal allowance. A tax credit is a fixed amount of money that may be kept by taxpayers without paying any. Calculate your combined federal and provincial tax bill in each province and territory.

Free tax code calculator transfer unused allowance to your spouse. Marriage tax allowance reduce tax if you wear wore a uniform. The same rate applies when a pension is paid by a swedish source to a person not tax resident in sweden. 2020 income tax rates and thresholds.

The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. Follow these simple steps to calculate your salary after tax in sweden using the sweden salary calculator 2020 which is updated with the 2020 21 tax tables. More good calculators for sweden. Calculate the tax savings your rrsp contribution generates.

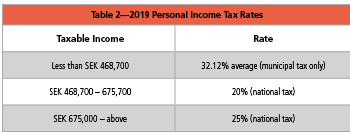

Canadian corporate tax rates for active business income. The sweden income tax calculator part of our suite of sweden payroll salary and tax calculators is updated for the 2020 tax year using the latest tax tables published by the government in sweden let s look at some of the key features of this tax calculator. Non residents working in sweden for a swedish employer or a foreign employer with a permanent establishment pe in sweden are taxed a flat rate of 25 at source. Sweden s tax credit is a basic fixed allowance available to all single taxpayers without dependents.

11 income tax and related need to knows. Sweden residents income tax tables in 2020. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. If you found this information about vat in sweden useful and liked our free online vat calculator for sweden then you will probably find the following calculators and supporting sweden tax tables useful.

Sweden income tax calculator key features. Employment income tax for non residents. 2020 includes all rate changes announced up to july 31 2020. How to calculate your salary after tax in sweden.