Income Tax Percentage Jamaica

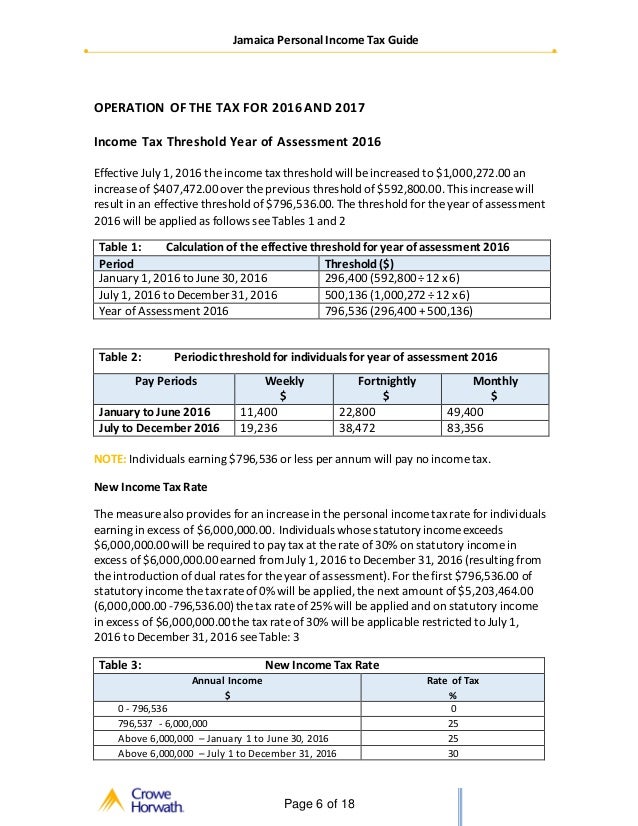

Income tax rate has increased 5 for persons earning over 6 million.

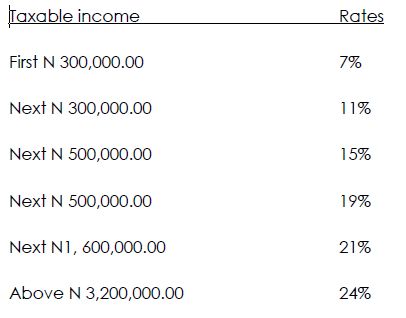

Income tax percentage jamaica. The corporate tax rate in jamaica stands at 25 percent. Tax is imposed on certain sources of income such as interest dividends royalties and fees by way of withholding at a rate of 33 for non resident corporations. Personal income tax rate in jamaica averaged 26 76 percent from 2004 until 2020 reaching an all time high of 35 percent in 2010 and a record low of 25 percent in 2005. Paye income tax rate 1 500 096 00.

Lower rates of withholding are possible provided that the recipient is resident in a country that has concluded a double taxation treaty dtt with jamaica. Updated for 2020 with nis nht and tax deductables. The personal income tax rate in jamaica stands at 30 percent. The jamaica tax calculator includes tax years from 2002 to 2020 with full salary deductions and tax calculations.

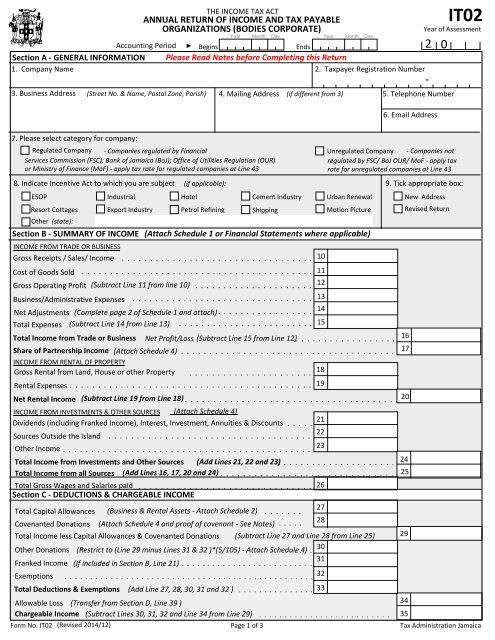

The salary tax calculator for jamaica income tax calculations. Individuals are generally liable to income tax at the rate of 25 on their chargeable income not exceeding 6 million jamaican dollars jmd per annum less an annual tax free threshold where applicable. Tax admministration of jamaica corporate tax rate in jamaica averaged 29 17 percent from 2005 until 2020 reaching an all time high of 33 33 percent in 2006 and a record low of 25 percent in 2013. Income tax rates thresholds and exemption 2003 2020 notes and instructions for completion of returns of income tax payable it01 it05 payroll taxes and contribution rates employee employer.

Over 65 allowance 0 00. Nis employee rate 1 500 000 00. Section 30 of the income tax act will has been amended to impose the tax rate of 30 per annum on income in excess of 6 000 000. Nis employer rate 37 500 00.

Paye income tax additional threshold 80 000 00. Paye income tax additional rate 6 000 000 00.