Income Tax Rate Ya 2020

29 11 2019 tax rates for basis year 2020.

Income tax rate ya 2020. The individual needs to be a malaysian tax resident for each ya throughout the flat rate tax treatment. Filing for the year of assessment ya 2020 begins on 1 mar 2020. Withheld amount is called withholding tax. Personal income tax in singapore for resident taxpayers is progressive from zero to a maximum of 22 these means the higher the personal income the higher your tax bracket falls into.

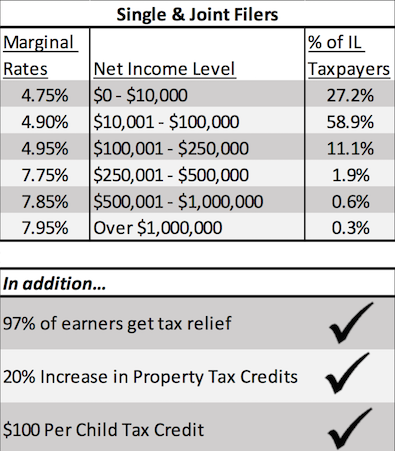

Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Nature of income tax rate interest commission fee or other payment in connection with any loan or.

Tax rates for new startup companies ya 2020 qualifying conditions for the tax exemption scheme for new start up companies sute. What are the individual income tax rates in 2020 according to iras. Green technology educational services. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

Companies will be granted a 20 corporate income tax rebate capped at 10 000. Companies will be granted a 50 corporate income tax rebate capped at 25 000. From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22. Companies will be granted a 25 corporate income tax rebate capped at 15 000.

Companies will be granted a 40 corporate income tax rebate capped at 15 000. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. If you need to submit an income tax return please do so by the following dates. Highlights on changes in tax matters in malaysia effective from the year of assessment ya 2020 based on finance act 2019.

18 apr 2020 extended to 31 may 2020 new paper filing. Taxes on director s fee consultation fees and all other income. Tax rates chargeable income.

.jpg)